The Government of India has initiated a number of social security schemes to boost the financial stability of its citizens and to reinforce the economic development of the nation.

These statutory social security schemes have huge significance for the masses since it not only ensures a comfortable future but also a sense of security.

List of Social Security schemes by Government of India:-

1. Sukanya Samriddhi Yojana

It is a small-scale social security scheme for your daughter’s education and marriage. It’s a part of the government’s ‘Beti Bachao and Beti Padhao mission’.

The government through Sukanya Samriddhi Yojana wants to convey a message that if a parent could make a proper plan for their girl child, they can definitely improve and secure their daughter’s future.

Key points:

For whom– The scheme is suitable for every parent with a girl child with the aim of channelizing savings for their education and marriage.

Eligibility– Suitable for your daughter up to 10 years of age

Costs involved– Annual contribution ranges from a minimum of Rs 1000 to a maximum of Rs 150000.

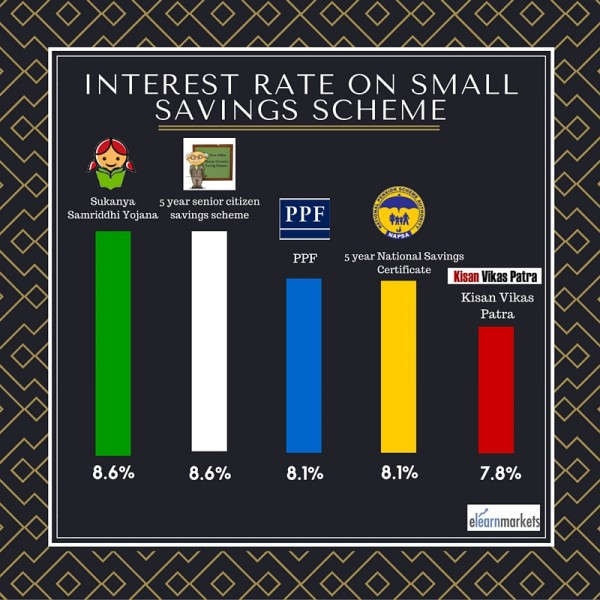

Benefits– Provides an annualized return of 8.1%

2. National Pension Scheme

It’s a voluntary pension scheme introduced with an aim of fulfilling retirement needs. It is regulated by the Pension Fund Regulatory & Development Authority (PFRDA) which provides the tax benefits for investment up to Rs 50,000 under section 80CCD in addition to Rs 150000 under section 80C. Hence, your total annual deduction comes to Rs 200000.

Also Read : Why to Invest in National Pension Scheme?

Key points:

For whom– It is ideal for individuals who do not have anyone to look after them post-retirement.

Eligibility– Suitable for individuals between 18 to 60 years of age

Costs involved– The minimum contribution is Rs 1000 while there is no cap on the maximum contribution.

Benefits– Fulfills your retirement need and also offer a tax benefit

3. Pradhan Mantri Jan Dhan Yojana

These social security schemes are suitable for the economically weaker sections of society who do not even have a bank account. Pradhan Mantri Jan Dhan Yojana offers basic financial services like a Savings Account, Deposit Account, Insurance, Pension, Remittances, etc.

Key points:

For whom- For individuals who do not have any access to basic financial services. It is suitable for individuals working in an unorganized sector.

Eligibility– Anyone belonging to the weaker section of the society.

The costs involved-There are no minimum and maximum contributions for this scheme.

Gain knowledge about various Government Financial Schemes for Free

Benefits– It provides zero balance savings account, debit card facility, and accident and life cover of Rs 100000 and Rs 30000 respectively.

4. Public Provident Fund (PPF)

It’s a government-backed long-term social security scheme that aims to benefit self-employed people to save for their retirement. It offers tax benefits under 80C of the Income-Tax Act and provides a tax-free return on maturity. You can also open a PPF account for your wife and children.

Key points:

For whom- Suitable for salaried class people and small business owners.

Eligibility– Any adult can open the account on his or her own name or on behalf of a minor.

Costs involved– Annual contribution ranges from a minimum contribution of Rs 500 to a maximum of Rs 1,50,000.

Benefits– Tax-free interest on maturity and provides an annualized return of 7.6%

5. National Savings Certificate (NSC)

National Savings Certificate is a small-scale social security scheme and tax savings investment in India. It is a government savings bond issued for a time period of five and ten years and is very popular among the rural masses

Know more: All you need to know about National Savings Certificate

You can purchase this bond from any Post Office in India and can be kept as collateral security to get a loan from banks.

Key points:

For whom- Suitable for Government employees, Businessmen, and other salaried classes who are Income Tax assesses.

Eligibility- Any adult can open the account in his or her own name or on behalf of the minor.

Costs involved- Minimum investment can be Rs 100 and investment up to INR 1,00,000/- per annum qualifies for IT Rebate under section 80C

Benefits- Provides annualized return of 7.6% and qualifies for IT Rebate under 80C.

6. Atal Pension Yojana

Atal Pension Yojana, a government-backed social security scheme intended to provide pension benefits with a minimum contribution per month. This scheme is targeted at the unorganized sector and provides pension benefits with a minimum contribution per month.

Under this statutory social security scheme, for every contribution made to the pension fund, the Central Government would also co-contribute 50% of the total contribution or 1,000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years. But the subscriber has to contribute for a period of 20 years or more under this scheme.

It was introduced to help the low-income group of the society like maids, drivers or security guards. Upon the death of the contributor, the nominee of the Atal Pension Yojana can claim for the accumulated corpus or pension money.

Key points:

For whom- It’s for people under the low-income group or who’s not a part of the tax bracket

Eligibility- Suitable for all individuals between 18 to 40 years of age

Costs involved- For a monthly pension of Rs 1,000, an 18-year-old will have to contribute Rs 42 per month for 42 years while a 40-year-old subscriber will have to invest Rs 291 per month for 20 years

Benefits- Provides fixed monthly pension between Rs 1000 to Rs 5000 post-retirement

7. Pradhan Mantri Jeevan Jyoti Bima Yojana

It is a life insurance scheme backed by the Government of India. It was introduced in the 2015 budget by our finance minister, Arun Jaitley. Pradhan Mantri Jeevan Jyoti Bima Yojana, one of the best social security schemes aims to increase the number of insurers in India which is currently very low.

Key points:

For whom- It’s for an individual who is the sole earning member of the family and have dependents under him/her

Eligibility- Anybody who has a bank account and falls under the age group between 18 to 50 years can avail of the scheme

The cost involved- The premium is Rs 330 every year

Benefits- It ensures a term insurance cover of Rs 200000 to the dependants in case of the policyholder’s death.

Bottomline

All the options discussed above are widely known and ensure safety with reasonable returns. So you can choose to invest in one or more of the social security schemes according to your needs.

These statutory social security schemes cater to various strata of society and offer different returns. So think wisely before investing in any of the mentioned social security schemes to optimize your returns and tax benefits.

Take care and keep learning!

I am a employee of west Bengal govt.sponser school and I am salary holder. There is deduction monthly of G P F from my salary a.c. And I also have a P.P.F A.C IN S.B.I NOW can I open A ATAL PENSION YOJNA A.C AND I AM ELIGIBLE FOR THE SAME OR NOT??

Hello Sanjay,

Thank you for your comment.

As per the information provided in the official notification, any Indian citizen within the age bracket of : 18-40 years and having a savings bank account or post office savings account will be elligible for this scheme.

However we are not domain experts on this and we are simply providing the information as given in the official notification, therefore you should consult with your fianncial advisor who can guide you in a much better manner with regards to the above.

You can also read: National Pension Scheme- Retirement Scheme for all

Happy Reading!!

I should have more higer interest rate and compound interest rate are also benefit with scheme , have you any government scheme information?,please tell us!

Hello Solanki,

Thank you for your comment.

If you are looking for a higher interest rate and compound interest rate benefit government investment scheme, you can invest in National Savings Certificate(NSC).

To know more about NSC read here

Happy Reading!!

thanks for sharing this with us there are many scenes like above are the great initiatives.

make in India, Awas yojna, ujwala yojna,

Welcome Priyanshu

Hi, I am a Central Govt. employee and in new pension scheme. Whether, I am eligible for Atal Pension Yojana? during filling form it ask that whether i have taken any social security scheme, yes I have registered for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) for making clear about government contribution. Let me know, whether I should say Yes or No?

Hi Himanshu!

We are not expertise in it..so we will not be able to comment on this.

Happy Reading!

Please send to detail about those scheme.

Hi,

We have blogs written on these security schemes:

Sukanya Samriddhi Yojana

National Pension Scheme

Pradhan Mantri Jan Dhan Yojana

Public Provident Fund Scheme (PPF Account)

National Savings Certificate

Atal Pension Yojana

Pradhan Mantri Jeevan Jyoti Bima Yojana

Thank you for Reading!

Hello there! I could have sworn I’ve been to

your blog before but after browsing through many of the articles I realized it’s new to me.

Anyways, I’m certainly happy I came across it and I’ll be book-marking it and checking back often!

Very good article. I’m experiencing a few of these issues as well..

Can a tax payer opt for APY scheme? Also enroll for NPS??

Hi,

Those with taxable income are not eligible.

Thank you for Reading!!

Thanks for providing great information.

Hi,

Thank you for Reading!

Keep Reading