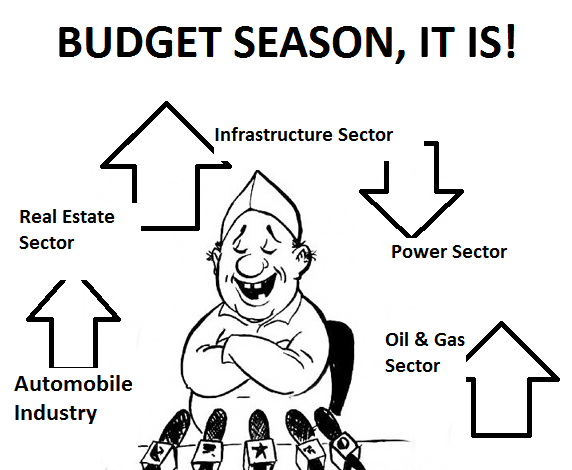

The Budget season, it is! This is the time when our Government will give the reason as whether our decision to choose them was fair enough.

Apart from the Government’s expenditure and revenue statement, we will also come know as to what Government has in store for us in the form of policies and the tax proposals for the upcoming assessment year.

Year to year, there are certain sectors that are majorly affected by the Finance Minister’s endeavours.

In this article, we will be discussing on the major sectors that are always part of our budget menu and how are they affected through Government’s policies.

Sectors Affected by The Union Budget

Infrastructure Sector:

We often complain “roads ki haalat toh dekho”, “metros are overcrowded these days”, “Government ye nahi karta, wo nahi karta”. But let me tell you, that Government does put in efforts.

Though the process is slow, yet it’s ongoing.

This sector is one of the most expensive affairs in the Government’s lists of spending. Every year the Government needs to put aside a large amount of funds to be pooled in for the rural and urban infrastructural development.

We are privileged to enjoy the benefits of smooth roads, bridges, transportation facilities, airports, railways and alike.

If we look back to the times, definitely we have made a progressive step towards the infrastructure development as a whole. However, there is a long way to go. We are yet to see a balanced development in the rural and the urban infrastructure development.

Let’s see what does the Government has in store for the infrastructure sector this time.

Automobile Industry:

How is this sector affected by the budget?

For instance, let us consider a car manufacturing company. The Government provides a subsidized the rate chart of excise duty on the manufacture of cars. In this case the costs per car will decrease and the ultimate consumer will be benefited thereon.

In case of high-end vehicles, the parts of the vehicles are imported from outside India. In that case, the cost per car/vehicle depends on the rate of custom duty levied thereon.

So the buy sell pattern of the industry depends on the tax policies laid down by the Government in this regard.

Power Sector:

We all are aware of the rising demand of fuel for the purpose of power generation. It depends on the Government as to what extent it levies taxes on fuel, which indirectly affects the power generation in the economy.

Our manufacturing sector such as iron and steel plants, oil plants are heavily depended on the power generation equipments. The duty levied on such power equipments determines the level of manufacture or import of such equipments.

Oil and Gas Sector:

Quite often do we discuss on our favourite petrol prices. The petrol subsidy plays a major role in the downward shift of the petrol prices.

Further, the Government’s initiative on “Har ghar mei LPG cylinder ho” is commendable. The Government has always provided LPG subsidy plans.

Now, it targets the LPG’s to reach those rural houses which are still going through the hardships of make-shift hearth.

Real Estate Sector:

The low and affordable housing agenda is a well established issue.

“Housing for all by 2020” is the most famous campaign that has come up so far. The idea of “Smart Cities” is also being materialist with the list of smart cities released lately. The Government is all set to bring in its objective to conclusion in this regard.

Apart from the public financial institutions, the Government is also provided opportunities to the private sector by grant certificate of registration to the prospective housing finance companies.

Every year Government brings new schemes for promoting affordable housing.

We may have a wide range of expectations at the micro-level. But our economy is growing. We need much more than a shopping complex in every housing society or a 7 star hotel in every possible location.

The idea is to fulfil the necessity before serving the luxury.

The above-mentioned five sectors have always been priority sectors in the Government’s lists of spending. Let’s see what does the Finance Minister has stored in for all of these sectors in this year’s budget.

Read more articles on budget in our Budgeting & Savings section.

Happy Learning