| Table of Contents |

|---|

| Why checking your credit score matters ? |

| The Future of Credit Scores |

| Personal Afterthought |

| Conclusion |

The premise behind check your credit score is simple; a number as a tool, that is able to determine with relative accuracy whether any given individual will default on their loan.Since the advent of such formal credit scoring systems in the early 1900s.

The use of this tool, has been fairly limited to financial institutions to determine any individual customer’s risk profile. But over the past two decades, as Credit Information Companies (CICs) have established themselves around the world, and as their presence has become more so ever present in the public consciousness, credit scores are slowly playing larger roles in our lives, especially in India, a country with lax data regulations.

What is a Credit Score?

To check your credit score seems like an arbitrary number, but it is simply attempting to quantify, what humans have been doing since the advent of marketplaces: establishing an individual’s ability to pay, and more importantly the trust/morality of the person, when it comes to actually paying back debts.

You can see this in the plethora of articles, and publications that list the major factors that CICs use when developing the credit score. Bank accounts, assets, liabilities, payment history, amount owed, length of history, new credit, types of credit used; these are some obvious factor that need you to go and check your credit score.

Moreover, what is more interesting is the greater number and value placed on ones past ability to pay, preparedness, and utility of credit higher is the credit score. It becomes negative if you have delayed payments in past. Moreover, it acts as a tool to understand if any financial institution should give you loan in future or not.

Why checking your credit score matters ?

The large focus on one’s past payment history, is a logical basis to measure trust, and credit worthiness. This very logic often allows people to conflate an individual’s credit score, with their trustworthiness, chances of success, and moral character. Large corporations and businesses in India check your credit score in soften any individual who is applying for a job, has their credit score reviewed by their potential employers.

In India where there is no strict legislation on data storage and sharing, TU Cibil(India’s biggest CIC), has created a formal program where it will share with employers the credit scores and reports of employees and potential employees, in order to make “better”, and “efficient” the screen process.

Learn from Market Experts – Credit Appraisal Process for Bankers

Credit Scores have also been begun to be used at ecommerce sites, to offer various payment plans and or deals. Flipkart in India has started allowing a select group of its customers to purchase products on its sites through the use of Debit Card EMIs. This option from Flipkart is currently available for a selected group of customers who are pre-approved by the bank partners

Flipkart team who use a combination of credit reports and credit scores to determine eligibility. Also E-commerce sites around the world, especially those that receive payment post-delivery, use credit scores, to determine whether they should sell to a customer.

The Future of Credit Scores

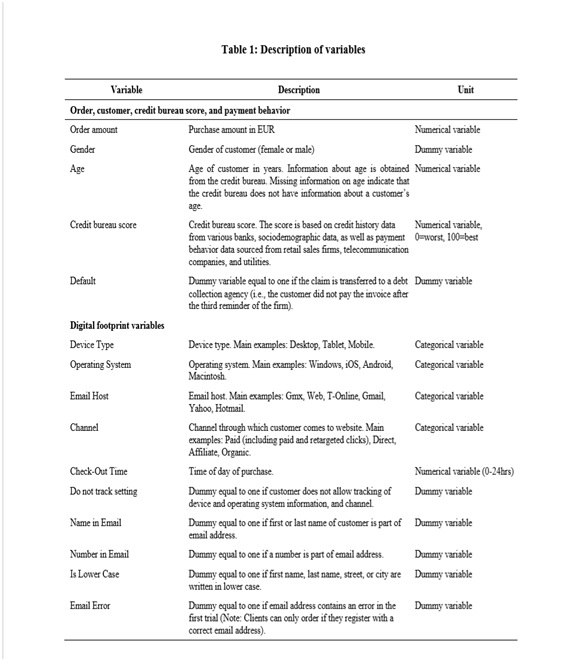

Individual companies are developing their own algorithms to measure a client’s character to determine payment ability, with easily measured digital factors. A National Bureau of Economic Research Paper partnered with a furniture German E-Commerce site(whose products are paid for post-delivery), compared the use of common, easily available digital footprints, to develop a tool analogous to the credit score.

They succeeded in creating a tool slightly better than the credit score alone, and when combined with the original credit score, the new scoring system was significantly better than each on its own. They were able to do this using simple digital footprints like –

Each of these variables, are easy to collect, for any person or organization that runs any website.

If such simple digital footprints, hold such predictive qualities, imagine the effects when intimate and detailed data points from social networks and smart devices are analyzed and used to develop credit scores. Peer to Peer lending Companies in India, perhaps, best represent this shift and move to using nontraditional data to determine a person’s credit worthiness.

Lendbox, an upcoming P2P platform, claims to use over 300 data points other than an individual’s credit score to determine their credit risk. “ These data points are a mix of personal, financial, social and psychometric indicators. Their unique selling point is based on the whole fact, that by using these extra social, personal, and psychometric indicators they are able to better judge a person’s credit worthiness in order to check your credit score.

To know more about credit scores, watch the video below:

This is only the tip of the iceberg. Credit scores can become even more embedded in our personal lives. It would not be too far-fetched to think that matrimonial sites, start requiring credit scores to be made visible.

Infact CICs like Experian, have already published information on credit scores and marriages, and the Federal Reserve Bank has published a research report showing the predictive qualities of credit scores with ‘success’ of marriages.

They are already used in western countries to judge tenants and renters. They could be used to determine success of your child in a particular school. At the end of the day there are endless studies linking credit scores, to various aspects of life and therefore endless potential ways for your credit score to affect your life in unseen ways.

Personal Afterthought

There are pros and cons to the potential future I have described in this report/essay. On one side, the use of alternative data sources creates potential for those outside of the current financial system to gain access to financial products and loans, in order to improve their lives. But on the other side of the coin, is the question of whether giving up such personal information will end up in more freedom or less. Already China has in work a Social Credit Score to use a national reputation score. Such systems would most likely increase inequality and allow central authorities to limit our thoughts and actions.

Developed Nations have already seen the risks of how using certain information like gender, ethnicity, and religion could lead to discrimination and a vicious cycle of rejection and further degradation in those communities. They have also developed strict data protection and regulation laws that limit companies in regards to what data they can collect and how they can use and sell the data. Countries like India and China are, however, moving in the opposite direction, implementing lax data regulation if any at all. They are creating central government controlled databases that have already been used to judge, limit and restrict lives in China, with the very same potential in India with the recent implementation and mandation of the Aadhar system.

Ultimately, the future of such technological implementation, will be determined not by individuals or companies, but governments. Individuals who know they will be affected negatively, will always be loud minority. Individuals who know they fit within the defined roles will be a silent majority, seeing and understanding the threats of the system, but truly feeling apathy or maybe even derision towards the rest.

Companies, at the end of the data, are profit seeking; vast data and its analysis allows them to increase profit margins, and reduce risk. The majority will always favor lax regulation, in the same manner many were against labor unions, minimum wage, etc. The final responsibility is the Government’s, who will need to take upon themselves to decide whether such a future is/would be constitution or even Moral.

The truly scary part in all of this is, not that such a scoring system would reveal an individual’s perceived flaws and characteristics, but rather the fact, that credit scoring systems ultimately work under the assumption that that such flaws and characteristics cannot change and to instill such belief and logic in society, will create a society stuck in time, unable to progress as a whole, removing the spirit of entrepreneurship, removing the hope of success, it could very well lead to a system of the past — analogous to a Caste System, where status, job, success all are seemingly predetermined.

Conclusion

Credit Scores have always been a useful tool for financial institutions. But as they slowly permeate our lives, we must consider whether it is appropriate for them to be used as measures of character, and perhaps more importantly whether they should be allowed to make use of personal and intimate information. The implications could be widespread, so, in the meanwhile, be sure to maintain your credit score. You never know how it could affect you.