Williams % R for Trading Strategies is a very simple but effective is a technical analysis oscillator described by Lary Williams in the year 1973.

It measures the capacity of bulls and bears to close prices each day near the edge of the recent range. Williams % R confirms the trend and gives us a warning of the upcoming reversal.

Williams % R gives us 3 types of trading signals. They are as follows-

| Table of Contents |

|---|

| Trading strategy using Williams% R and Moving Average |

| Taking early entry in reversal trades, based on multiple time frames |

| Bottomline |

1. It defines the overbought and oversold zone

2. It defines failure swings

3. It identifies bullish and bearish divergence

We will discuss two special strategies using Williams % R.

Trading strategies using Williams% R and Moving Average

This is a simple but very effective trading strategies using which we can get a good buy or sell signal. Here we just combine Williams % R and 100-period moving average to generate trading signals. This trading strategies works very well in case of volatile stocks.

Case 1:

When the price closes below the 100 DMA and the Williams % R is below the 50 line, a short signal is generated. We will remain in the trade until the Williams % R gives closing above 50 line and the price closes above 100 DMA.

Also Read – What could be the leading indicator in technical analysis?

In the first scenario, as we can see in the chart, that when the price closes below the 100 DMA and the Williams % R was also below the 50 line, we could have taken a short trade. However, when the Williams % R crossed back above the 50 line, we could book our trade, thus making a fair amount of profit in the process.

Case 2:

When the price closes above the 100-period moving average, from below, and the Williams % R is above the 50 line, a buy signal is generated. We will be there in the trade unless the Williams % R gives closing below 50 line or the price closes below the 100 DMA.

In the second scenario, we saw that as the price closed above the 100 DMA and as long the Williams % R is above the 50 line, we could remain in the trade. However, when the Williams % R closed below the 50 line, we could have exited the trade. This trade could give us very good profit.

Taking early entry in reversal trades, based on multiple time frames

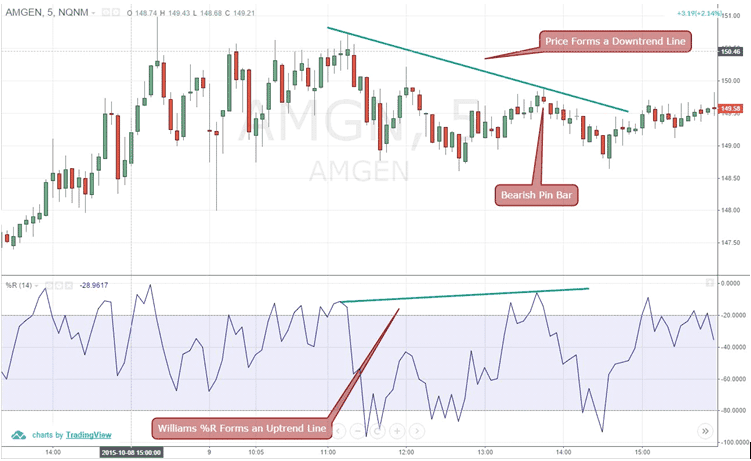

In the above chart, we have seen the indications in the daily time frame. In order to get an early signal, you may trade using multiple time frames. Say if you look into the daily chart to take your position, you may look into smaller time frame say hourly or 2-hourly chart to get a better entry. However, if you are a day trader, you may combine your hourly chart with that of the 5-minute chart. Let’s take an example to understand this in more detail-

For example, in the below chart you can see that there was an overbought condition (marked as a circle) in the daily chart of Havells India as on 16th May 2017. Next day (17th May) when the Williams % R came down from the upper reference line, it generated a sell signal. A trader who takes a trade based on daily chart would have entered in the trade either on 17th May (when Williams % R turned down) or 18th May (due to the formation of a bearish engulfing pattern on the daily chart).

Now let’s have a look at the smaller time frame (2-hourly chart in our example) to have more clarity on our trade. According to this chart, a trader would have made his/her position as on 16th May 2017 at around 12 pm. This gives us a much early signal as compared to the daily chart where the sell signal was received either on 16th or 17th May.

BOTTOMLINE

Like other technical indicators, Williams %R should also be used in conjunction with other technical analysis tools like chart patterns, volume, and breakouts, which can be used to get confirmed signals produced by Williams %R.

Check Stockedge to get all the combinations of technical and fundamental scans of Financial Markets.

Thanks so much for the w%r with 100DMA strategy which your shared, my questions are (1) What are the settings for the DMA indicator like dma period, dmaperiod shift, isRay, sample point (2) Can any other moving be used, if yes what settings do you recommend?

Regrads

DMA period settings depend upon trading scale. Short term 5,20 dma, Mid term 20 ,50, and 100 dma, long term 50,100 and 200 dma.

DMA shift period 6 because assuming that in the one month is 30 days, it means that one week trading is 5 days so 30 divided by 5 is 6.

There are many moving averages but we recommend HULL, ADAPTIVE, ZERO LAG EXPONENTIAL, and WILDER SMOOTHENING depending upon trading strategies.

ELDER RAY indicator is a combination of bull power, bear power and a 13 period exponential moving average. To capture big move, it can be used by 20, 30 or 50 period.

To know more about Technical Analysis you can go through our course :NSE Academy Certified Technical Analysis

I?¦ve been exploring for a little for any high-quality articles or blog posts on this sort of space . Exploring in Yahoo I finally stumbled upon this website. Studying this information So i?¦m happy to show that I’ve a very good uncanny feeling I came upon exactly what I needed. I most without a doubt will make certain to do not disregard this website and provides it a look on a constant basis.