Understanding the stock life cycle is an important element in interpreting the performance of a fund. Everything in nature goes through a cycle whether it is a living organism or weather. Like living organism passes through different phases of birth, growth, maturity, decline and lastly death or rebirth.

Weather also follows a cycle and there cannot be one season throughout. Summer season is an unavoidable part of the weather cycle and it’s going to stay with you for some time say around 4-4.5 months, whether you like it or not. Then it is followed by the monsoon.

In the same way, the stock market also follows a cycle. After a bear phase, there will be a bullish phase but however, no one knows how much time it’s going to take. If someone wants to enjoy the fruits when the situations are conducive, it’s important to adapt to the harsh phase by being adaptive to the environment. The key here is patience.

| Table of Contents |

|---|

| Different phases of the Stock Life Cycle |

| Where are we in the stock market cycle analysis? |

| Is the life cycle of business similar to the 4 stages of the stock market? |

| Bottomline |

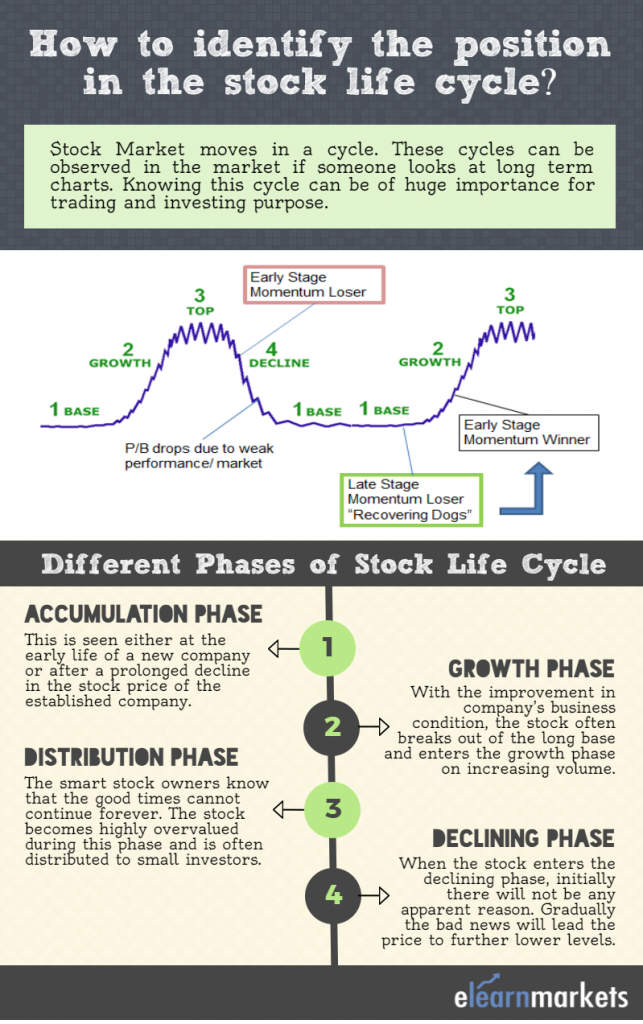

These cycles can be clearly observed in the market if someone looks at the long-term charts. Knowing this cycle can be of huge importance for trading and investing purpose. It may help you in identifying that where a stock is in its lifecycle. However, in real life, it’s very difficult to identify the actual position in its lifecycle.

Different phases of the Stock Life Cycle

Phase 1: Accumulation Phase

This phase is generally seen either in the early life of a new company or after a prolonged decline in the stock price of the established company. After a period of an adverse business condition, the company tries to reorganize during this period. This period may last from few months to many years. The stock here is largely held by the owners who don’t have any intention of selling until they realize a substantial profit.

Learn from Experts : Stock Market Course for Beginners

The stock may move in a range during this period and a strong resistance develops at the top of the base area. Any breakout from the base area signals the stock has entered the second phase.

Phase 2: Growth Phase

With the improvement in the business condition of the company, the stock often breaks out of the long base and enters the growth phase on increasing volume. The steady improvement in the business conditions and the entry of new investors who bid up the price to obtain stock reinforces the uptrend. The stock price remains above its 200 DMA in this phase and it’s better to remain invested in the stock until it holds its 200 DMA.

Also Read: How to trade using moving average on different timeframes?

Phase 3: Distribution Phase

The smart stock owners know that the good times cannot continue forever and the stock becomes highly overvalued during this phase. In the background of rosy earnings and good economic news, the stock is often distributed to small investors. The top may range from several months to few years and the price may move sideways during this period. An early warning sign can be in the form of price breaking below its 200 days moving average.

Also Read: Why Moving Average is important for your technical toolbox?

Phase 4: Declining Phase

When the stock enters the declining phase, initially there will not be any apparent reason for the same. Gradually the bad news and evidence of determination will lead the price to further lower levels. In between the fall, there may be some short-term false up-move and the investors may believe that the price has bottomed out. One should be careful during this period and rather as the stock price approaches to its 200 DMA, it may provide good shorting opportunity.

Where are we in the stock market cycle analysis?

Let’s take a practical example to analyze that what is the position of the stock in terms of stock life cycle.

This is a monthly chart of Reliance Capital. If we look at the monthly chart closely, we can see after a good accumulation in the stock back in the year 2000-2005, the stock entered the growth phase. It topped out in the year 2008 and entered the decline phase. Within 1 year time, it came back to the price where it started.

The stock has entered the accumulation phase since the year 2011. Currently, it’s facing resistance at around 680 levels and once it breaches this level with good volume, it will enter the growth phase.

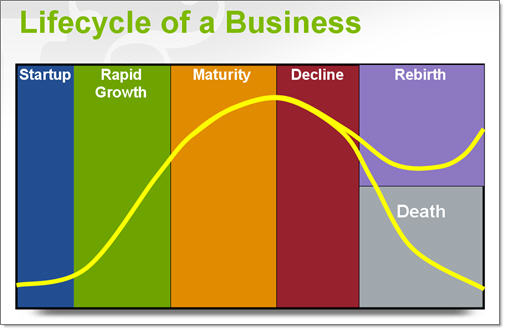

Is the life cycle of business similar to the 4 stages of the stock market?

The life cycle of business has a close connection with the 4 stages of the stock market as the stock market is a representation of the value of businesses.

The different phases of the business cycle: Embryonic stage, Growth stage, Shakeout stage, Maturity stage, and Decline stage is somewhat similar to the 4 stages of stock market cycle i.e. Accumulation, Growth, Maturity and Decline phase.

Bottomline

The investors often look at the solid fundamental reason before investing in a company. But one drawback of this approach is that by the time they have supportive evidence, it’s already priced in and accordingly the stock has already moved by 300-400% i.e. the market has already discounted the positive news.

Look to buy a stock when the stock is surrounded by bad news and nobody wants to buy it. The weak hands will try to exit their position on such news. On the other hand, after a good uptrend when the picture looks rosy, the smart investor exits their position and offloads their stake to weak and news-driven investors.

Excellent, what a webpage it is! This weblog presents valuable facts to us, keep it up.

Hi there! This blog post couldn’t be written much better! Looking through

this article reminds me of my previous roommate! He constantly kept preaching about this.

I am going to send this article to him. Pretty sure he’ll have a good read.

Thanks for sharing!

I have been browsing online greater than 3 hours nowadays, but I never

discovered any interesting article like yours. It is lovely

worth sufficient for me. In my view, if all webmasters and bloggers made just right content as you did, the internet will probably be much more useful than ever before.