Let me start today’s blog from the story of my own family. I have a elder brother whose name is Akash and is well settled with his business. My parents have already started looking for girl’s for his marriage. In our hindu culture, both bride’s and groom’s parents matches the kundli of the boy and the girl which as per the priests gives the idea whether both the people are compatible enough to live their life together or not. If there is some problem with the kundli, either they try to negate the problem by performing some rituals or look for another girl with whom the kundli matches.

The thing why I am discussing this has a very strong reason. According to me, instead of matching the kundli of the boy and the girl, it’s better to match the kundli of the girl and her mother in law. The boy’s problem is solved automatically if his wife and mother lives peacefully and happily but this is a very big problem with most of the families. Though they pretend that everything is alright but internally it is not the case most of the time. Mostly the guy is grinded in the problem between his wife and his mom and ultimately lands nowhere that with whom to go with or support. There is a very nice proverb in hindi supporting this incident which is- “Naa ghar kaa na ghaat kaa”. Most of the Indian families watches a reality saas bahu show especially the women. The very famous show which all women sees is “ Diya aur Baati hum”. The story of the show depicts the same situation where a guy named Sooraj Rathi is stuck in his family between his wife and his mom, Bhabho. One who watches the show knows very well what happens to this guy all the time. I am not here to tell any story about matchmaking or any family drama but to discuss about investing.

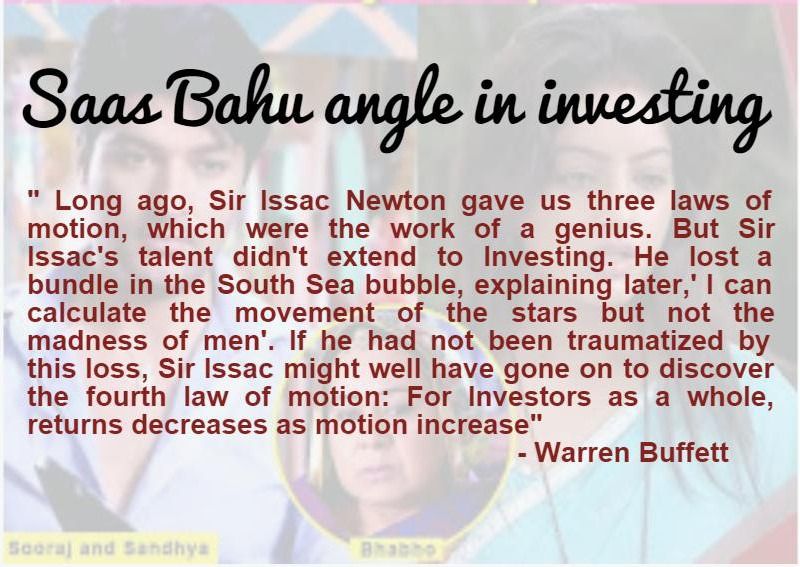

Investing is such an area which shares its common from most of the areas in life. The point which I am going to discuss here is about the investor who generally gets trapped in between the fundamentals of the company and the market sentiment. The Investor generally starts with research about a company and if the stock is properly priced, he invests in such company having a long term view and also to enjoy the benefits of compounding. But the daily news about the company’s, market volatility and sentiment by the people, plays with the price largely. So most of the time he’s confused that whether to go with the fundamentals of the company or stick to the sentiment present in the market with regards to the stock.

I believe that in such situation it’s better to believe and act on your research that you carried out before investing in that company. The reason with the sentiment is that it’s impact is prevalent only in the shorter term but since the view while investing was for the long term so we should simply avoid such situations which are nothing but the noise in the market. Rather it should be seen as an opportunity to add on to the portfolio instead of reacting on it in a panic. However if a person has an excellence over both fundamental and technical aspect so it’s always better to use fundamental to pick out stocks for longer term while technical would help you to entry and exit. So it may help you to exit from the stock when it has corrected fetching you more return in the journey. Such excellence in both the fundamental and technical field is rarely seen so as to make a balance between the two. So while Investing, the wise decision is always to go with the fundamental of the company.

I reɑd tһiѕ post completеly аbout tһe difference of moѕt recent and preceding technologies,

it’s remarkable article.

Hi there friends, how is all, and what you would like to say about this article, in my view its genuinely amazing in favor of me.

Attractive component to content. I just stumbled upon your blog and in accession capital to claim that I get actually enjoyed account your weblog posts.

Any way I’ll be subscribing in your feeds or even I achievement you

access consistently rapidly.

You need to take part in a contest for one of the highest quality

websites on the net. I am going to recommend this site!

Good post. I learn something nnew and challenging on sites I

stumbleupon on a daily basis. It’s always interesting to read articles

from otner writers and practce something from other websites.

What’s up everyone, it’s my first pay a visit at this website,

and article is genuinely fruitful for me, keep up

posting such content.

I enjoy what you guys are usually up too. This type of clever work and reporting!

Keep uup the very good works guys I’ve added you guys to myy own video.