It’s important to acknowledge the need for retirement planning, but many a time, people find excuses to avoid doing the same. Thus, in spite of having a successful career, they die poor. By 2031, the population of people more than 65 years old is expected to grow the fastest (75%) among all age groups, yet only 23% (approximately) were saving or planning to save for retirement in 2016.

Before we get to the excuses and the reasons, it’s essential to know what we mean from retirement planning. It refers to the allocation of savings for retirement, as it is one of the most significant life events. The goal of retirement planning is to achieve financial independence and the reason why you need to save is that it’s your life and you deserve to live it the way you desire.

Also read: Why is Retirement Planning Important?

In most of the cases we avoid to go for any retirement plan. Find out

The possible reasons for avoiding retirement planning

1. “It’s too selfish”

Retirement does demand you to think about yourself, for it is the most expensive and a long-lasting financial goal. It does not provide relief immediately, but for years to come.

In America, the idea is for each generation to make it on its own. So, old people think they are quite within their rights to spend all their money themselves, leaving little for their heirs. They do not see themselves as selfish. Many even think they are doing the next generation a favor – protecting them from sloth and dependence.

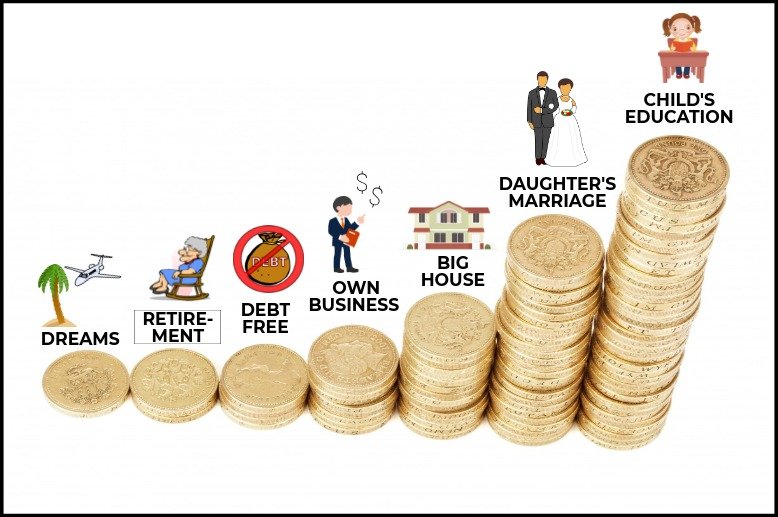

But, Indians are brought up in a society where we are taught to first provide for others and then think of ourselves. Doing the opposite is a taboo and would be termed as “self-centered” and “rude.” It is odd to consider and accept retirement planning at this stage; not until the other goals (eg: child’s marriage, kid’s education etc.) are already planned for.

Fortunately, this trend of prioritizing events is slowly changing. People are giving more preference to their dreams and desires by making retirement planning a priority. It is not wise to plan for others at the cost of their own retirement and future.

One spends a majority of his/her life doing things for others. If there’s just one thing to do for yourself, one selfish thing that’s all yours, it’s retirement planning. The passive income from your retirement plan buys you the opportunity to appreciate all life has to offer, and it gives you a chance to treat yourself.

2. “It’s too early”

Many people have adopted the idea that you don’t have to start retirement planning until you’re nearly there. The truth is, the earlier you start saving, the better your chance of having the kind of retirement you want. Most millennials tend to never get out of the “I am too young” phase for years and procrastinate because the thought of growing old is unappealing. And soon, when they reach 40-45, they regret their actions, when it is too late. It is reasonable to not give high priority to old age in your savings portfolio at the beginning, as long as you take one step forward in retirement planning.

“Waiting until you’re 30 to start putting aside money when you could have started at age 25, could mean 20% less in savings due to compounding interest and value appreciation” – Walter Updegrave, editor of RealDealRetirement.com.

Saving has become a necessity especially for millennials because of:

- Ridiculous housing prices,

- Accumulating college debt,

- Unnecessary expenses,

- Increasing standard of living, etc.

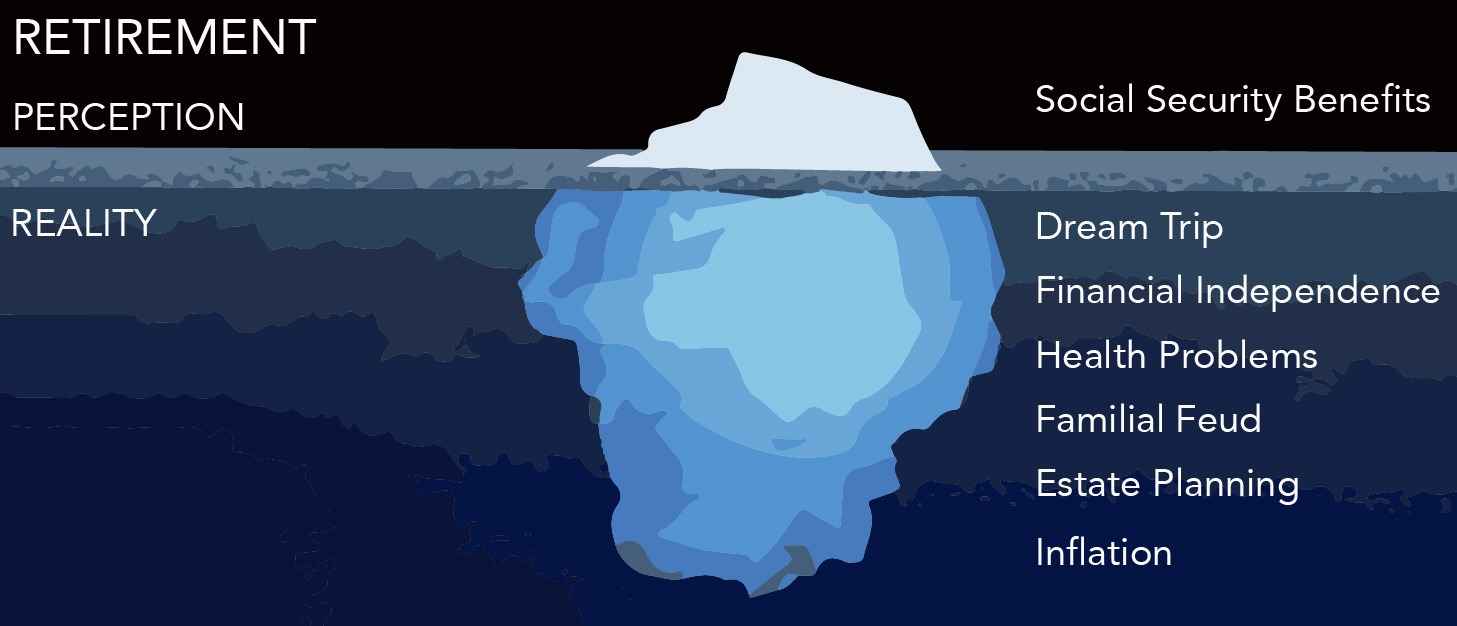

They are up against issues that the older generation may not have encountered. Not only that, retirement planning has become of urgent need due to transforming social security measures, as they may not receive it in the same form, but with cuts here and there.

3. “I can’t even see it coming”

For some people, it’s often difficult to clearly picture how life will turn out 5-10 years hence. Opportunities and events that we never even dreamed of can present themselves out of the blue, and completely change the course we’re treading on. So it’s challenging to predict how good or bad the future will be.

With that being said, it can seem downright pointless to start retirement planning as it’s far off, and for some, it seems decades away. They are unable to visualize the seriousness of retirement planning and the challenges that lay ahead. When it comes to retirement planning, you have to be strategic. It’s not easy to look far ahead in future and visualize it especially when you have a very active income right now.

But, once their 5-digit salary stops crediting to their bank account, it will be too late and they will then realize they still have another 30 odd years to live. Their health will start giving in; their kids may not be able to take care of them as they’re expecting the kids to and it will all be downhill from there.

4. “I don’t have enough to save”

People find themselves unable to save for retirement planning simply due to lack of any excess left at month-end. It seems marginal but bears truth.

Expenses are on the rise whereas people’s incomes are stagnating. It’s getting almost impossible to save in today’s times especially if your salary is sustaining a family of 6.

Even though the struggle is real, it does not make a good enough excuse to hide behind. Step by step, something needs to be done about it. Just because you were unable to save for the future, no one will be ready to give money to you at your retirement. It’s all on you to take charge and act on it. Starting small is better than not starting at all, and if you plan well, you may eventually have more to work with. With as little as Rs.1000 a month initially moving up eventually, a dependable retirement corpus can be generated.

5. “My kids will take care of me”

Today, 77% (approximately) Indians are not into retirement planning; most depend on their kids to take care of them. In big, fast-moving cities, older people are becoming more aware and independent of their kids and expect nothing in return for bringing them up. Whereas in small towns, it is a crime to think like that. It is impossible for some parents to factor in the thought of their children not being their “Budhape ka Sahara”. Indian parents often feel that by investing in their children to be financially independent, they will grow up to take care of them.

But with changing scenarios, it is important to take care of your own, for you never know if your children will be able to sustain them, let alone you. It’s time to stop limiting retirement planning to your children.

Closing Thoughts

Retirement planning is an important step to sustain yourself and it needs to stop being a “selfish” move. One needs to make oneself the priority, for life at 60 is not going to be all rainbows and butterflies. It is laid with challenges and difficulties of another paradigm. There is no right age to start retirement planning, the earlier the better. It all depends on the kind of life after retirement one desires. One may not understand the gravity of retirement planning, but it cannot be avoided forever. Saving does not mean a lump sum amount each month, but a single drop makes the ocean. Your children will always be there for you, financially and otherwise, but financial freedom will give you many more opportunities, rather than being dependent. And what is better than always being in control of your life, no matter how old you are?

These are just some of the reasons why people don’t get into retirement planning…but these are reasons and not excuses.

With retirement planning, you’re prepared – and once your plan is ready, you’re halfway there to making your retirement dream into a reality.

To delve deep into the financial planning and learn how to plan your retirement perfectly, you can enroll for NSE Academy Certified Financial Planning & Wealth Management course.