Martin Pring created the Know Sure Thing (KST indicator), a momentum oscillator that analyses the market’s pace of change over four distinct timeframes in order to forecast price movements.

The KST is a flexible tool that traders may use to help them spot market trends, time momentum shifts for when to enter and exit, and spot divergences that could be signs of impending reversals.

Because of its capacity to function over several timeframes, it offers a thorough picture of momentum, making it an invaluable tool for traders.

Nevertheless, the KST has drawbacks, including the ability to provide misleading signals, and its intricacy could be difficult for inexperienced traders to understand.

To improve trading decision-making, the KST should also be utilised in conjunction with other tools and analysis techniques, much like any technical indicators.

In today’s blog, let us discuss what this indicator is all about and how to trade with KST indicator:

What is the KST Indicator?

Martin Pring created the Know Sure Thing (KST), a momentum oscillator, to help traders better understand rate-of-change data.

Four distinct Rate of Change (ROC) indicators, each applied to a distinct era, make up the KST. The KST value is then created by combining these ROCs after they have been smoothed using a Simple Moving Average (SMA).

Calculation

The KST must be calculated in multiple phases. ROC values are first computed over four distinct time periods. After that, a SMA is used to smooth these ROCs.

A weighting factor is applied to the smoothed ROCs obtained, emphasising the longer durations. The KST value is the total of these weighted ROCs.

Lastly, the signal line is computed using the KST value’s 9-period SMA.

Interpretation of KST Indicator

Similar to many other momentum oscillators, including the widely recognised relative strength index (RSI), the KST indicator can be utilised in similar ways.

In addition to convergence and divergence with the price, overbought or oversold conditions, and crossovers of the centre line, traders may also watch for trading indications when the KST crosses over the signal line.

To increase their chances of success, many traders combine the KST indicator with additional techniques from technical analysis. To aid in their decision-making, traders can, for instance, examine other non-momentum indicators, chart patterns, or candlestick patterns.

Bullish momentum is indicated by a positive KST number, whilst bearish momentum is suggested by a negative value. When the KST crosses the zero line, traders frequently search for “crossings” since these can indicate possible buy or sell opportunities.

| Get success in your trading with our ROC Stock Indicator Course |

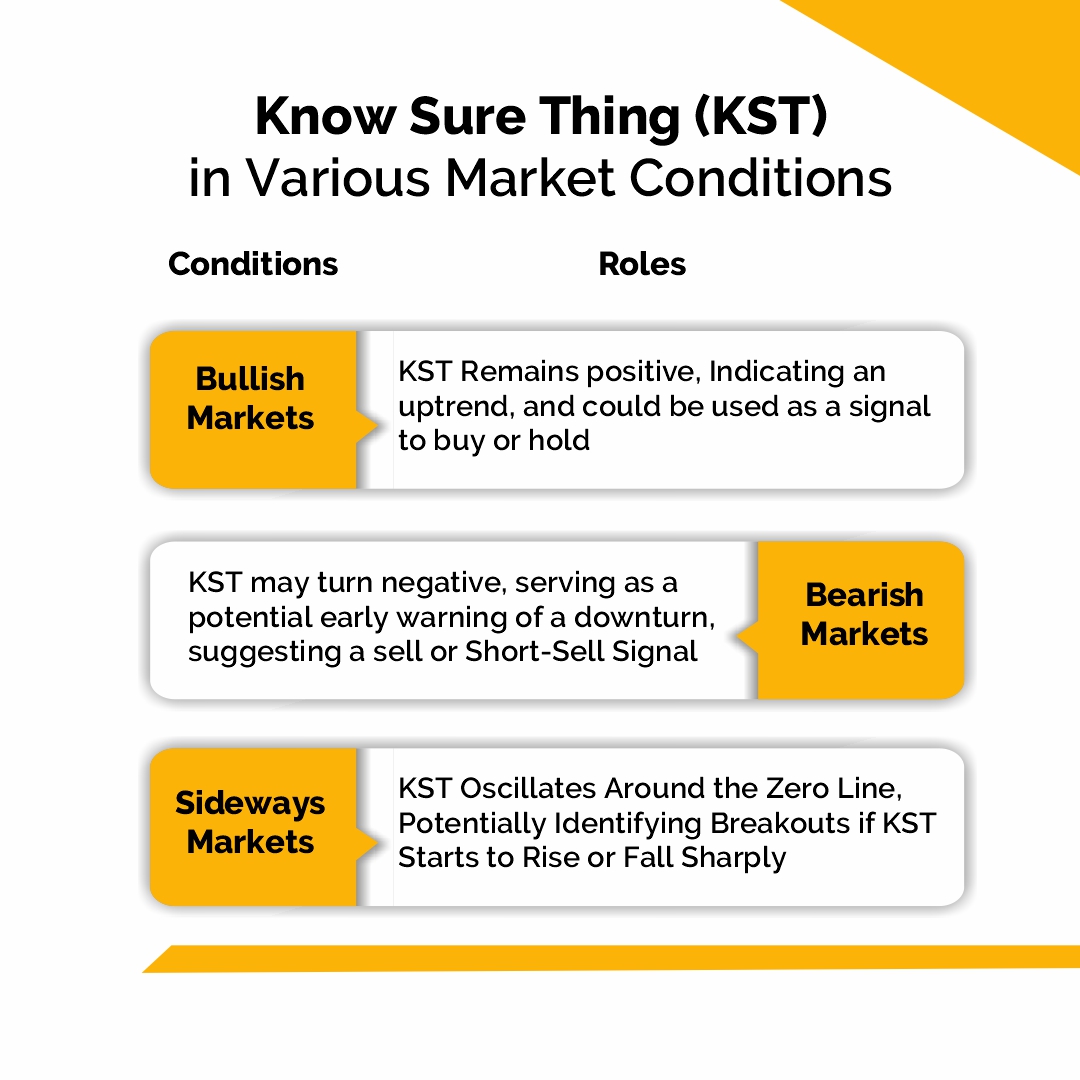

The KST is likely to stay positive in optimistic markets and frequently rises before the price does. This can serve as a hint for traders to buy or hold onto their position.

The KST may enter negative territory in bearish markets, which could serve as an early warning indicator of a market decline. This can be a clue for traders to short-sell or sell the asset altogether.

The KST may oscillate around the zero line in sideways markets. It can be used by traders to identify potential breakouts if the KST begins to rise or fall sharply.

Trading with KST Indicator

The KST Indicator can be used in the following ways when trading:

1. Momentum Trading

The KST can be used by momentum traders to determine possible entry and exit positions. Upon rising over the zero line, the KST may indicate a chance to buy. It can indicate that it’s time to sell when it drops below the zero line.

2. Trend Identification

An asset’s underlying trend can be discovered using the KST. An upward trend is shown when the KST is positive and rising. On the other hand, a declining KST in negative territory may point to a downward tendency.

3. Divergence

Price and KST divergences have the ability to predict future reversals. The KST making a lower high while the price reaches a higher high could indicate an impending decline, a bearish divergence.

On the other hand, a bullish divergence—where the price hits a lower low while the KST hits a higher low—might suggest an approaching upswing.

Benefits

The KST has a number of advantages, such as early signal production and adaptability. Compared to many other indicators, it offers a more thorough perspective of market momentum because it incorporates many timeframes.

Additionally, it can offer early entry and exit signals by seeing changes in momentum prior to price changes.

Risks

The KST has some drawbacks despite its benefits. It is not perfect and might give false signals, just like any other technical indicator. Furthermore, it can be difficult for inexperienced traders to use it efficiently due to its complexity.

Bottomline

Martin Pring created the Know Sure Thing (KST), a momentum oscillator that can detect changes in market momentum over a variety of time periods.

KST is used in trading under a variety of market circumstances, helping with trend recognition, momentum trading, and divergence detection. It gives traders important information that affects their decisions to purchase, sell, or hold.

KST has benefits and drawbacks, just like any other technical indicator. Because it provides a more comprehensive perspective of market momentum than many momentum indicators, its multi-timeframe methodology gives it an advantage.

| Learn profitable investing through our webinar on Profitable Investing Through the Indicator System! |

Frequently Asked Questions

What is the KST indicator?

A momentum oscillator called the Know Sure Thing (KST) is used to analyse rate-of-change pricing data. In addition to looking for overbought or oversold conditions, traders also generate trading signals when the KST crosses over the signal line.

How do you use the KST indicator?

It is not advisable to utilise the KST indicator in a range market as it is mainly intended for trading trends. Signals are generated when the nine-month simple moving average of KST passes its signal line.

What is the difference between MACD and KST?

The KST is obtained from four ROC indicators, whereas the MACD is based on the relationship between two exponential moving averages. Therefore, compared to the MACD, the KST might be more responsive to changes in momentum.

What is the KST indicator in intraday?

The zero line is where the KST varies. An indicator that is bullish is the KST above the line. It demonstrates that prices are in a strong upswing and that the weighted smoothed ROC trends are positive. A bearish trend is indicated by a KST rating less than zero.