You might find that while doing analysis before investing into any company investor’s use Operating Profit and Earnings before Interest & Tax (EBIT) interchangeably. It is necessary to understand the concept of Operating Profit vs EBIT.

Is this correct? Ask yourself.

Many times Operating Profit is confused with EBIT.

Between the two, helps you in understanding as to which is a better and reliable metric for the valuation of a company.

So let us understand the two.

What is Operating Profit?

It is basically the Gross Revenue which will finally become the Income for the Company. After subtracting cost of goods sold and operating expenses from gross revenue we get our operating income. Thus we need to know what all are included under operating expenses to configure operating income and what all are excluded and what all are included under Cost of Goods Sold (COGS).

What are included in operating expenses?

The expenses pertaining to operating expenses are cost of goods sold, employee expense, power and fuel expense, depreciation & amortization and any other expenses.

What are excluded from operating expenses?

Any one time adjustments like any one time gain or loss, if any is excluded. Interest expense, Tax and any other income which is directly not related to the ongoing business is also excluded.

Thus after deducting operating expenses from the gross revenue, we get our Operating Income.

What is Cost of Goods Sold (COGS)?

We also need to know what all are included under cost of goods sold which is the main component which differentiates between Gross Revenue and Net Revenue.

Thus cost of goods sold includes only those components which go directly into the making of products. Thus it comprises of raw materials and its components. Thus cost of goods sold when deducted from gross sales gives us the gross profit for the company.

Formula = Opening stock + Purchases during the year – Closing stock

Formula: Operating Profit = Revenue-Cost of Goods Sold (COGS) – depreciation or amortization – Operating expenses.

What is EBIT?

Earnings before deduction of Interest and taxes is known as EBIT. It takes into account Net revenue after deduction of cost of goods sold (COGS). It adds back Interest and tax expenses after deducting operating expenses and depreciation & amortization. It is the amount of profit derived from adding interest and tax with Net income. It even includes non operating income & expenses (like Profit / loss on assets, interest income, obsolete inventory charges, etc).

Formula: EBIT = Net income + Interest + Taxes

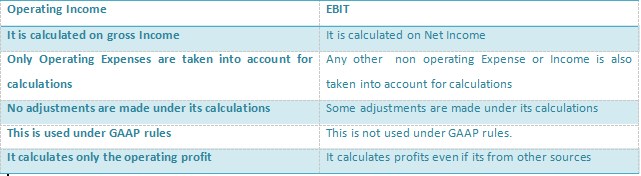

Differences between Operating Profit and EBIT:

Let us understand it practically from a case study to simplify the differences between the two.

This is the information we have of a Company XYZ Ltd:

| Fields | Amount in Rs (Crs) |

| Revenue | 200 Crs |

| Cost of goods sold (COGS) | 80 Crs |

| Operating Expenses | 10 Crs |

| Depreciation | 10 Crs |

| Gain from Fixed Assets (FA) | 20 Crs |

In this case Operating Profit would be Rs 200crs-Rs 80crs-Rs 10crs-Rs 10crs=Rs 100crs

Whereas’ EBIT would be Rs 200crs-Rs 80crs-Rs 10crs-Rs 10crs+Rs 20crs=Rs 120crs.

This example helps us to understand the practical difference between the two.

Key Takeaways

- Operating profit provides us an important metric about how much profit the company’s core business is actually generating.

- Under operating profit we ignore the gain or loss from fixed asset while calculating because it’s a non-recurring item that would give incorrect information about the company’s operation.

- When an investor invests in a company based on growth of EBIT then inconsistent growth due to onetime gain or loss will give incorrect information about the company’s core operations and thus may lead to wrong selection of stocks.

- Operating Profit provides the correct information about the working of any company.

- In the global research and analysis Operating Profit forms the main metric of any valuation.