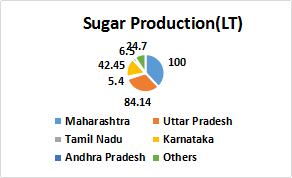

India is the largest consumer and the second largest producer of sugar, topped by Brazil. It is the second largest agro-based processing industry of the country, topped by cotton textile industry.

The Indian sugar industry is facing excess supply which has resulted in sugar price to go below the cost of production. The industry is worth more than Rs 80,000 crore with a total acreage of 50 lakh hectare of land under cultivation which is about 8% higher than 2017-18 sugar season’s.

Sector Overview:

- ISMA (Indian Sugar Mills Association) has lowered India’s 2018-19 sugar production estimate.

- The industry covers around 7.5% of country’s total rural population. It provides employment to 50 million rural people and about 4.5 crores farmers are engaged in its cultivation.

- There are total 732 sugar mills in the country: co-operative-327; private- 362; public- 43, with sufficient crushing capacity to produce around 340 lakh MT of sugar.

- The industry is highly regulated as the government decides upon the quantity to be sold and exported and also bails out the industry in bad times.

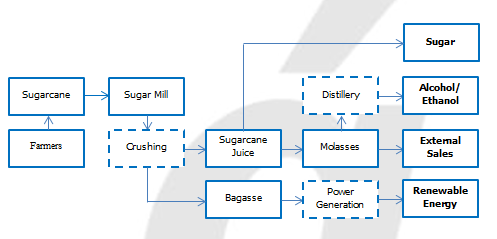

- The list of products includes Raw Sugar, White Sugar, Refined Sugar, Brown Sugar, Sugar Free Sucrose, Sugar Mills, Sugar Cane, Beetroot, Jaggery, Sugar Syrup, Molasses, Bagasse, Ethanol.

- Till15 March 2019, sugar production rose by 6%.

Production Process

- In global markets, 80% of sugar is extracted from sugarcane and 20% from sugar beet. However, in India sugarcane is the major source.

- On an average,1 tonne of sugarcane produce 95 kg of sugar and 10.8 litres of ethanol

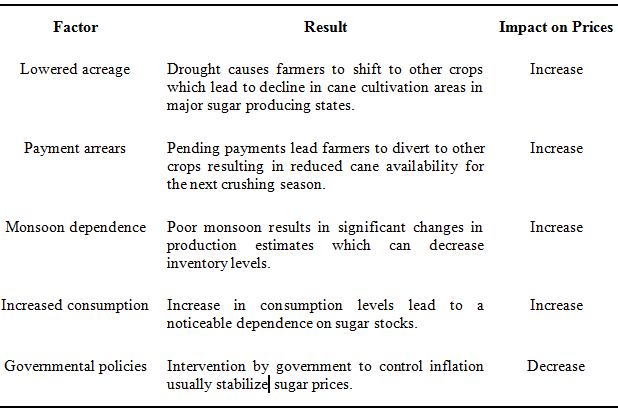

Factors affecting sugar realizations

Supply of sugar is more volatile and affects the prices. Thus, to predict the sugar realization, one needs to focus more on supply than on its demand. The supply of sugar depends on the following factors:

Government initiatives

The government introduced few schemes to liquidate surplus stocks and bail out the cash-starved sugar industry, which is facing a glut-like situation.

- The minimum selling price of the sweetener has been increased by 7%

- The import duty on sugar has been doubled to 100% and the 20% export duty has been scrapped off. Along with this a production assistance has been given which will help the sugar mills to clear their dues to sugarcane farmers.

- The government has made it compulsory for millers to export two million tonnes of sugar even as the global prices were low and is exploring possibilities to export raw sugar to other Asian countries. This export push initiative will enable the country to grab market share, dispose the surplus stock pile as well as narrow the trade deficit.

- The government announced a series of soft loans to boost the industry;

- Soft loan of Rs 12,900 crore for sugar mills for ethanol capacity.

- Separate soft loan of Rs 2,600 crore to molasses-based standalone distilleries to expand capacity and set up new units.

- Soft loan up to Rs 10,540 crore to help mills clear rising arrears to cane growers.

- Under the Ethanol Blended Petrol Programme (EBP Programme) the government has directed the oil marketers to target 10% blending of ethanol with petrol. Thus, increasing value addition in sugar industry. The procurement price of ethanol derived from 100 per cent sugarcane juice has been raised.

Recent developments

- India to hold first round of consultation in WTO over sugar subsidies on April 15-16, 2019.

- Countries like Australia, Brazil, Guatemala, Russia along with European Union have alleged that India distorted market policies on sugar by providing subsidies and assistance which far exceeded the norms set by WTO.

- Various subsidies and assistance have resulted in higher sugar production/exports which dampened international prices and also lead to global supply glut.

- Countries like Thailand and Australia are posing stiff competition in the export segment, especially on the back of low cost of production.

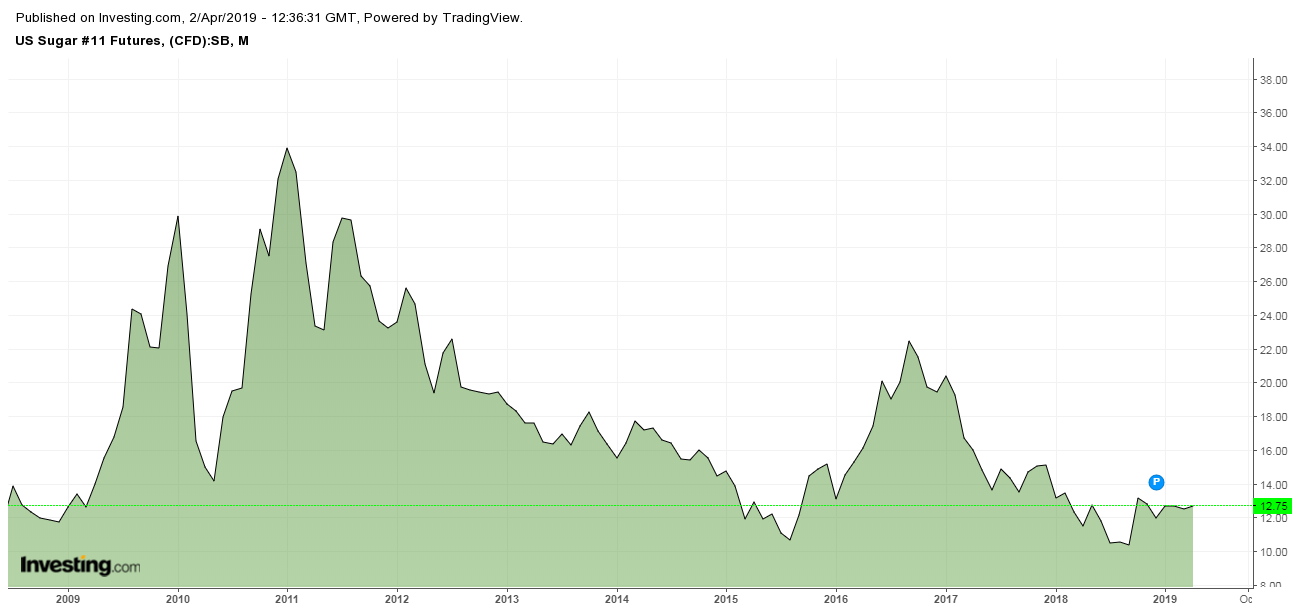

- Global sugar prices fell more than 20% in 2018, mainly due to rise in Indian sugar output.

Advantages of Sugar sector

- The Indian sugar sector is amongst the largest tax payers to the Central exchequer as well as to the to the State exchequer.

- The sector plays a significant role in accelerating industrialization process and has been instrumental in resource mobilization, employment generation, income generation and creating social infrastructure in rural areas.

- GOI’s impetus to ethanol (major by-product of sugar) under EBP programme will help the country to reduce its dependence on crude and narrow its deficit.

- The sector makes surplus exportable power through cogeneration and has potential to export 7500 MW power. Cogeneration will help to fill the gap between power demand and supply.

- Total installed cogeneration capacity in all sugar mills is about 4200 MW, of which about 3200 MW is being exported to the grid.

Disadvantages of Sugar sector

- Rising sugarcane FRP (fair and remunerative price)-The government has raised FRP despite rising sugarcane production. This has resulted in rise in raw material cost for the sugar mills impacting their operating margins.

- Excess supply of sugar-The sugar output has been consistently high for the past eight years. India has been producing far more sugar than it consumes. Sugar surplus lowers the prices below the cost of production and affects the cash flow of the mills.

- Sugarcane arrears –Sugar cane arrears to farmers have crossed Rs 20,000 crore. The rise in arrears is due to increase in fair and remunerative price/state advisory prices along with higher acreage and production. This has stressed the working capital of the sugar mills.

- Fall in global sugar prices-The international market price of sugar is on decline due to global supply glut. This has resulted in lower export shipments from the country and could add to the woes of increasing stockpiles.

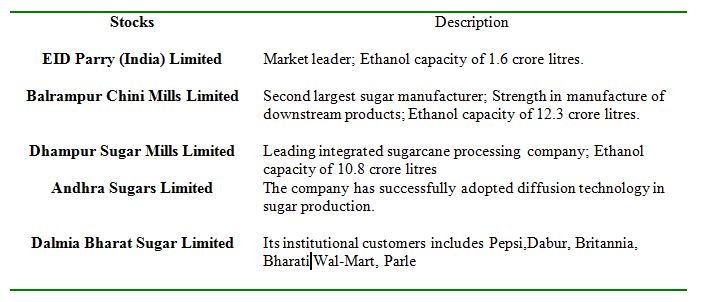

Key Stocks in the sector

Key Takeaways

- The Indian sugar sector has grown slower rate and horizontally as compared to its global competitors.

- Oversupply, cash constrain, fall in global prices, lower export due to price mismatch and higher cost of production has slumped the sector.

- Strong intervention by the government has further added to the woes and has failed to balance the interests of sugar millers and sugarcane producers. This has also made the Indian sugar sector noncompetitive in the global markets.

- Transition from only sugar producing units to integrated plants producing chemicals, sugar complexes, distillery to produce ethyl alcohol along with cogeneration is expected to alleviate the sector.