Mr.K.Sharma is planning to move overseas for his job, however, there are many arrangements he needs to make before going for it. The prime ones being the management of his financial accounts. This is the case with most of us who wants to move to a foreign nation. There are certain arrangements you need to make, certainly making them is not very difficult/cumbersome if you are able to understand it well.

| Table of Contents |

|---|

| Implications on Financial accounts while going overseas |

| NRE account Vs NRO account |

| What to do will all your Financial accounts when moving overseas? |

| Bottom Line |

There are provisions according to which an Indian can still maintain the Indian Financial accounts when he moves to a foreign nation for employment.

Implications on Financial accounts while going overseas

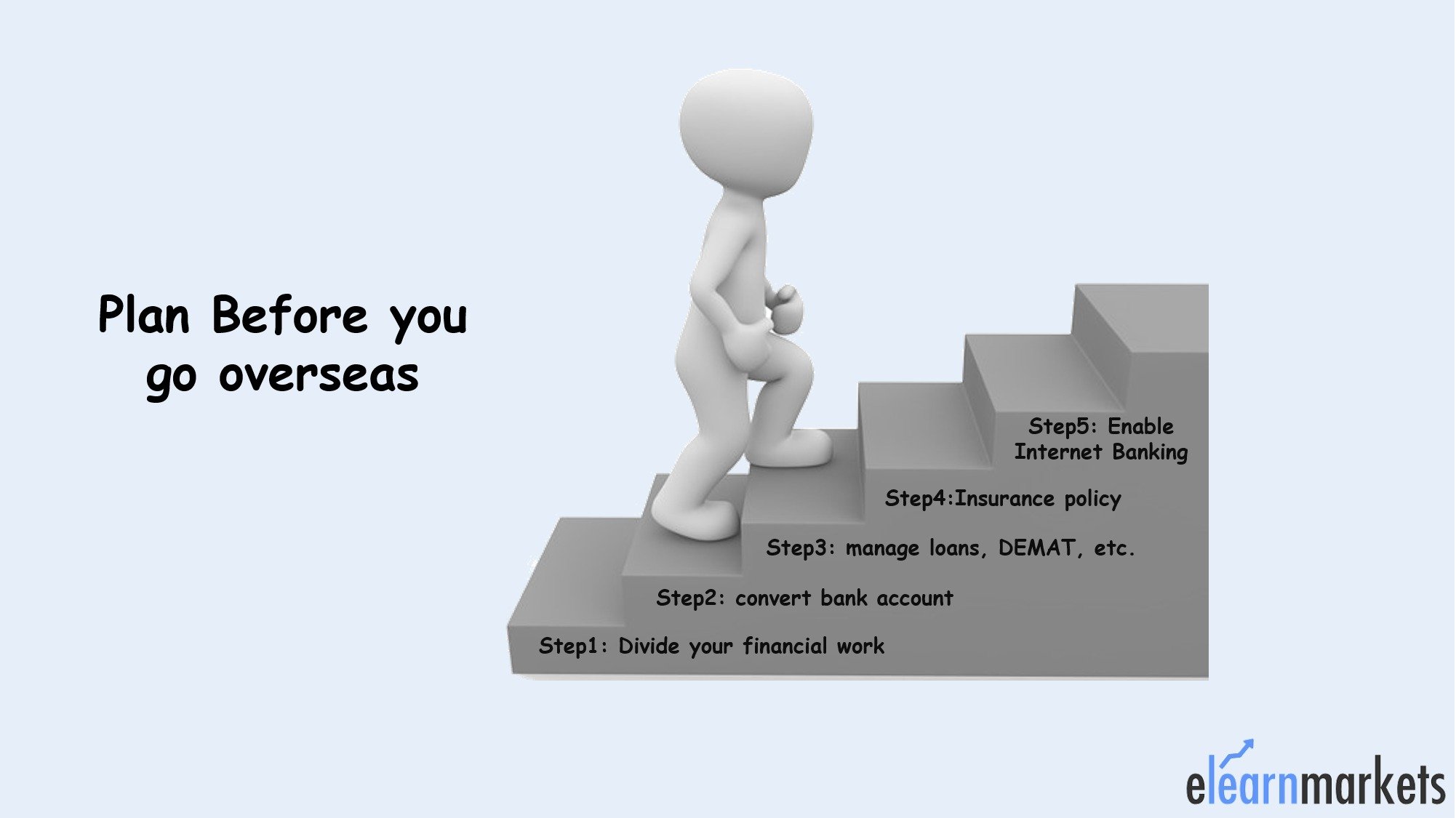

It is always good to plan before we do anything, and so here are some important things you need to know and ensure before shifting overseas:

Step1: It is recommendable to divide the financial work into two parts,

1) Tax-related work purpose 2)Foreign exchange purpose

For foreign exchange purpose as long as you intend to do your job overseas, you become a Non Residential Indian (NRI) from the day you reach the overseas shore. However, for tax-related things the process and rules are not the same.

Step2: You should inform your bank accordingly so that the bank can convert your account into Non-Resident Ordinary Rupee (NRO) account. You can subsequently open Non-Resident Rupee (NRE) account and/or Foreign Currency Non-Resident (FCNR) account.

NRE account Vs NRO account

Both NRO account and NRE account can be opened as either savings account or current account.

Differences:

- Repatriation (the sending of money back to one’s own country)-

NRE- This financial account is Freely Repatriable.

NRO- This financial account has certain restrictions like remittance is allowed up-to USD 1 million net of taxes applicable in the financial year.

- Tax-treatment-

NRE: It is tax-free

NRO: Interest earned and credit balances are subject to respective tax brackets.

- Funds generated in India in INR-

NRE: An NRI is not allowed to deposit such funds in the NRE account.

NRO: Such funds can be deposited in NRO account.

- Jointly held accounts-

NRE: This account can be jointly held as a joint account by an NRI with another NRI but not with a resident of India.

NRO: Under Section 6 of the companies act 1956 NRO account can be jointly held as a joint account By an NRI with another NRI or with a resident of India.

Looking at personal and professional requirements an individual should take a call in order to maintain which type of an account.

Step3: Shares, debentures in India can be owned, but the company should be informed regarding the change in Residential status. The individual can still invest in IPO and shares, but the rules may differ for an NRI. The same applies in case of properties. However, if there are any loan obligations, payments must be in accordance with the original agreement.

You can also read: IPO- Value or Trap?

Step4: The insurance policies held can be continued, the premiums can be paid with the help of NRO accounts.

Step5: Ensure that your bank accounts are enabled with internet banking facility, this will help in making payments in India like Loan payments, Premiums etc.

What to do will all your Financial accounts when moving overseas?

There are various accounts that need to be taken care of before a person sets sail for abroad for employment purpose. Some of them are as follows:

- Savings Account – You have to convert saving’s account into NRO account. You can deposit rent, dividend, interest earned in India.

This NRO account can be opened after submitting all the documents that state that taxes have been filed.

- DEMAT account – An NRI cannot invest more than 5% of the paid up capital of an Indian Company. You have to close the existing DEMAT account and transfer the shares to the NRO account.

After transferring the shares when you sell them the proceeds will be credited in the NRO account( it is an NRO DEMAT account under PNIS).

- Mutual Fund – Existing Mutual Fund account will no longer be available, however, there are some Mutual Funds that are available to NRI’s living in US and Canada such as L&T Mutual fund and Sundaram Mutual Fund.

To learn,plan and invest in mutual effectively, you can download Kredent Money App.

- Public Provident Fund(PPF) – An NRI can use the funds available in the NRE account or NRO account to make investments in the Public Provident Fund (PPF) account. When the deposits mature the NRI needs to withdraw the balance. However, he is not eligible for an extension on the PPF account.

There are two stages of Tax implications: One is in India and the other is in the country in which the NRI is staying.

In India PPF is available for deduction under section 80C, you can reduce your tax payout in India by investing in PPF. In countries like the U.S., the interest earned in PPF is taxable.

- Employee Provident Fund (EPF) – Under normal circumstances you can get EPF maturity amount after the age of 55, but when you want to settle abroad, you can get the EPF corpus before retirement.

There is no waiting period, you can get the EPF corpus immediately.

(You can collect the EPF withdrawal form online, and apply for EPF withdrawal online. Attachment on documents can also be done online)

Bottom Line

It seems a very cumbersome task to make all the arrangements, but once known properly regarding what do the tasks become much easier. It is advisable to take the help of a Chartered Accounted in order to file tax returns appropriately since the tax norms differ largely for NRIs. Opening the NRO and NRE is easy, your bank will be able to provide you full support regarding the same. Most of the banks have such options.

Thanks Freda

Welcome

Great info, thanks for sharing this!

Hi,

Thank you for Reading!

Keep Reading

Great article. Thanks for the detailed information. Your blog is by far the best source I’ve found.

Magnificent goods from you, man. I’ve understand your stuff previous to and you’re just too excellent. I actually like what you have acquired here, certainly like what you are saying and the way in which you say it. You make it enjoyable and you still take care of to keep it wise. I can’t wait to read far more from you. This is really a terrific web site.