Mutual Funds is like an organization which pools the money of investors and invest them on their behalf in a basket of different securities. The basket is divided into units called shares, these can be bought and sold in the market at a price called Net Asset Value(NAV). These funds are professionally managed.

In the present times a lot of emphasis is being put on Mutual Fund investment, like a lot of advertisements have come up promoting it. However, before investing in it you have complete knowledge about the pros and cons of Mutual Fund investment and Mutual Funds risk. It no doubt has a lot of advantages and variety but along with it also has some risks associated with each type, like volatility, liquidity, equity etc.

Debt Mutual Funds Risk:

Debt mutual fund investments are fixed income instrument. It generates monthly income for the investor. A lump sum (or SIP) amount is deposited into this asset class and it pays interest on that deposited amount to the investor.

Debt funds mean bonds, government bills, treasury bills, commercial papers etc.

Like all other asset classes Debt mutual funds also carries certain risk. Generally, there are two types of risk an investor should be aware of before investing in Debt mutual funds.

Learn from Experts: Basics of Investing in Mutual Funds

Interest Rate Risk:

This is a very common risk of debt Mutual Funds. As we know a change in interest rates leads to change in bond price. There is an inverse relationship between bond price and Interest rate. Whenever Interest rate falls Bond Price increases and Increase in Interest rate reduce the bond price.

The Interest Rate risk is associated with the fluctuation of Interest Rate which changes the price of a Bond that an Investor holding.

An investor should be aware, before investing in a Debt mutual funds schemes. The wrong prediction of Interest Rate fluctuation may lead to a loss.

For long-term investment, a falling interest rate will be very profitable for debt mutual fund holder. Similarly, increase in Interest rate will lead to a loss for a long-term investor.

Credit Risk:

It is a risk related to Debt mutual funds which measure the risk of the invested amount to be default.

High Credit rating instrument will have low chance of credit default risk and Instruments with low credit rating will carry high chance of credit default risk.

To choose in which type of mutual fund you should invest in, you can download Kredent Money App.

Generally, High credit rating instruments offer lower yields whether low credit rating instruments will offer high yields.

Bonds which have high credit risk will do well if the economy performs well similarly, their performance will be affected if the economy fails to perform well.

Balanced Mutual Funds risk:

The past two years’ market had been great for the mutual fund investors. Everyday market was making new highs and stocks were creating new highs. Mutual fund houses collected more than Rs.6000 cr in the last month of 2017.

Balance mutual funds gained a lot of popularity during this period. These funds were recommended to the first time investors and those investors who are very conservative about investing. There is no need to mention that the fund houses generated good return for the investors. But recently that scenario has been changed balanced fund is no longer balanced. Now they have also become riskier(suffering from Mutual Fund risk). Let’s discuss the reasons.

Higher exposure to equity:

We have witnessed more than 10 percent correction in Nifty index. Mutual funds’ performance was also affected due to this benchmark index’s fall. In percentage term, NAV (Net Asset Value) of some mutual funds fell more than the benchmark index.

If the funds are well balanced how they fell like this? Where did the fund managers fail? What actually happened?

Suggested Read: 10 mistakes people make while investing in mutual funds

In the last year, market had a great run, stocks were creating new highs, every single negative news was getting washed out by the bulls, despite higher valuation everyone started investing in equities. Here the problem started fund managers went too greedy to improve or better their performance. They continued adding stocks in their balanced portfolio. Some of the fund containing more than seventy percent equities including high-risk mid-cap stocks. As a result, the overall quality of the portfolio decreased and it no longer remains balanced.

Debt holdings:

Not only in equities, fund managers also had a bet on long-term bonds. Some fund houses invested in bonds ranging from ten to twenty years. It is true that interest rates are falling but who knows the future? It is very risky for a balanced fund to have such long-term bonds in their portfolio. Because when the market falls there is a chance of a rising interest rate so, the prices of the bonds also fall rapidly which affects the overall balanced portfolio performance.

A fund quality depends upon the securities it is containing and the quality of the fund manager. Before choosing a fund an investor should check back the overall performance of the fund manager. Not by only a bull market scenario, minimum three to five years’ performance should be reviewed by the investor.

Money Market Mutual Funds risk:

The money market is a market which is used to trade financial instruments. Financial instruments with high liquidity and short maturities are traded in the money market.

Participants in this market work as a short-term borrower or lender. Treasury bills, commercial papers, certificates of deposit etc. are the money market instruments.

Now let’s discuss the risk attached to the money market instruments which should be considered by an investor before investing in this segment.

Inflation Risk:

One of the major risks of money market instruments is inflation risk. In India, money market instruments return has no huge difference with bank saving schemes. But investing in this market or money market related mutual fund depends upon the investor. Money market’s return should be more than the inflation rate otherwise an investor will lose its purchasing power.

Suppose, inflation is 5.5 percent and money market return is 5 percent, then the investor’s return will be -0.5 percent.

Opportunity loss:

Opportunity loss is when an investor missed a better opportunity by staying invested in money market instruments. It has been seen that mutual funds who invest in capital market’s instruments have better growth potential or can generate better returns for an investor. Investors who missed those opportunities in the name of less risky investments may face opportunity loss. Because they are losing the ability or opportunity of creating wealth.

Equity Mutual Funds risk:

Among all the asset classes like Fixed income securities, Real estate, Equities etc. equity is considered the riskiest, except for the dividends (which is a rare case) there is no guarantee that it provides. However, risk and expected return from an investment are directly proportional, and so the expected return from equity is the highest among all. By investing in Equity Mutual fund the biggest advantage an investor gets is that it is professionally managed and so can study the equity markets better.

Also read: Know before you invest in Mutual Fund

Volatility Risk :

Volatility refers to the fluctuations in the share prices. It is a very important factor that has to be considered while investing in equities. Among equity funds, Balanced Equity funds are least risky as they try to mitigate the volatility and fluctuation risk by diversifying the portfolio. Large-cap funds are less risky( as they can withstand economic downturn) than mid-cap and small-cap as they are less volatile, however being more volatile small-cap and mid-cap funds provide great returns( since in growing economy there growth prospects are high) at times. Returns on Equity Mutual funds generally depend on the conditions of equity stocks in the market. So, if an investor wants to mitigate volatility risk he/she must invest in a Mutual Fund which invests in a diversified portfolio.

Performance Risk:

Investors want to invest in Mutual Fund since it is professionally managed they expect its returns to be better than savings schemes like Fixed Deposits, Savings account etc. However, the returns on Equity Mutual funds largely depends on the equity market performance and the timings at which the sum is being invested, for example when the sum is invested at a time when the markets are low at present but will soon be at a bull phase, the returns would be very good and vice-versa. Hence, investing in the perfect time is of immense importance. Also, the performance of an Equity mutual fund should not always be judged on the basis of recent performance only, as it may be inconsistent based on the market movement.

Concentration Risk:

In case of equity mutual funds, it can be very risky if all the portfolio is very concentrated toward a single sector or market cap. For example, if the fund only invests in FMCG sector the returns on the portfolio will solely depend on the FMCG sector, in case it performs well the returns will be good and vice-versa. In order to mitigate concentration risk is important to invest in a fund that diversifies across various sectors or between various market cap firms, so that if one underperforms the other will be able to balance it. In a case where a portfolio is not diversified the risk is very high but at the same time, the expected return is also very high.

Risks of closed-end Mutual Funds:

Closed-ended funds are actively managed Mutual Funds that raise a definite sum by Initial Public Offering (IPO), after which no one can invest directly into them (they are traded like stocks in a listed exchange). They typically concentrate on one industry, geographic market or sector. Every Mutual fund has its own management and manager, objectives, and strategy, so any two funds could have significant differences in their risks, price volatility, and fees.

Liquidity Risk:

In case of closed-ended Mutual Funds when it invests in equity, investing for long-term provides a better chance of greater returns. However, if we invest in for a longer time frame liquidity becomes an issue. Since close ended Mutual Funds are actively managed it will work when the stocks have enough liquidity. Even though they are listed there is no guarantee that the stocks will be liquid and so Funds need to be very careful while selecting the stocks. Also, in case of close-ended Mutual Funds, an investor can redeem their units only at the maturity date but can sell it through the exchange if required.

Risk-Free Mutual Funds:

The risk involved in investing in a Mutual Fund totally depends on the underlying asset the Mutual Fund is investing or aiming to invest in, investment objective etc. There are various Mutual Funds which invest in various asset classes with different levels of risk. For example, a fund which invests in Fixed Income securities like stocks, bonds, etc. will be relatively safer than the ones investing in the equity market (shares). A type of risk-free Mutual Fund may be Arbitrage Mutual Funds, this fund takes the advantage of price differences, they buy from one market and invest in the other, So they are almost risk-free or have a very minimum amount of risk involved. Short term Mutual Funds are also relatively less risky.

The risk in Mutual Fund SIP:

Systematic Investment Plan(SIP) in an investment plan where an investor can make payments in a scheme systematically every month (or a pre-defined time period). Mostly returns in SIP majorly depends on the investment horizon, that is the time frame from which you hold the plan, generally higher the time frame is compensated with higher returns. But with a higher time frame, liquidity is hurt. Another Mutual Fund risk is the credit risk or the default risk in case of instruments like bonds. One major Mutual Fund risk involved in investment through SIP is Fund Manager performance risk.

What about Fund Manager Risk?

The performance of a Fund largely depends on the Fund Manager’s ability to manage and balance risk. Fund Manager risk is the risk associated with Fund Manager not being able to perform up to the expectations of the investors, that is lower than expected returns. This risk is mainly prevalent in the funds which are actively managed, for example, closed-ended Mutual funds.

Mutual Fund risk factors:

As discussed above there are a variety of risks an investor faces when investing in Mutual Fund, some of them are as follows:

- Credit Risk: It is the risk associated with the credibility of the company, Bonds, stock being invested in. It is good to invest in companies or stocks with good credit ratings in order to mitigate credit risk.

- Interest Rate risk: While investing in Debt Mutual Funds interest rate fluctuation risk becomes an important point of analysis.

- Liquidity risk: This is the risk of being unable to see your assets or shares of the Mutual Fund at a desired price.

- Market Risk: These are the volatility, fluctuation risk etc.

- Fund manager risk: This is the risk of Fund manager underperforming, mostly in case of actively managed Mutual Funds, etc.

Measurement of Mutual Funds risk

There are some measures of risk that can be used to analyze an investment,

- Alpha: this measures the risk in relation to the market or any particular index.

- Beta: Beta is a measure volatility or systematic risk. This can be mitigated with the help of diversification.

- Standard Deviation: This is a measure which measures the returns from the mean value or mean returns over the years.

- Sharpe Ratio: it is a measure of excess return per unit of risk taken.

These are some measures that can be used in order to analyze the returns of the Mutual Fund or any other investment.

SEBI Riskometer:

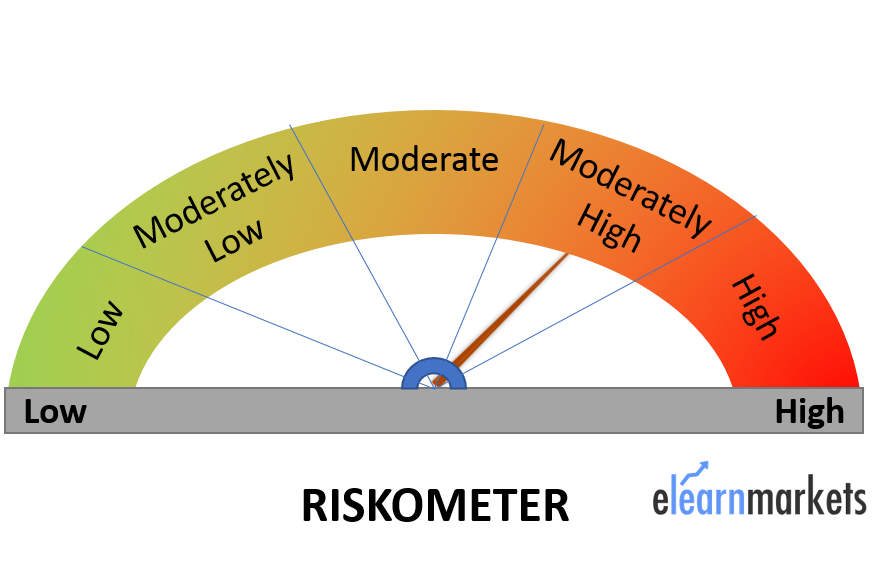

The regulator for Indian Security market SEBI (Securities Exchange Board of India) has introduced a ‘Riskometer”, this has five scales Low, Moderately Low, Moderate, Moderately High, High. Each of these scales depicts different risk profiles, For example, Low has the lowest level of risk and so mostly having asset classes like Fixed Income securities etc. On the other hand, High depicts the profile with the highest risk, with a major portion invested in equities.

Know more about SEBI: How Does SEBI Play An Important Role In Our Economy?

Bottom Line:

The risk is a very important factor that needs to be considered while investing in Mutual Fund or for any other investment for that matter. There are different types of risks, some can be mitigated like systematic risk, some cannot. Therefore we should know about the ways to analyze it. Generally, the conventions say that returns are directly related to risk so, higher the risk, higher the returns. It is very essential to know your appropriate risk profile and manage it, by investing in the right Mutual Fund and the right Plan.

Thanks for sharing valuable information about low-risk high return and mutual funds risk.

Hi,

Thank you for reading!

You can read more blogs on Financial Planning here.

Keep Reading!