Narrow Range 4 and Narrow Range 7 (NR4 and NR7) help to find the calm so that we can prepare and profit from the impending storm. The market goes through a regular contraction and expansion cycle.

“The quiet period before the next explosive market move is like the calm before the storm”

In this trade setup, you should wait patiently for the market in order to enter contraction which means for range of the bars to reduced. Once we spot NR4 or NR7, a bigger price movement and direction is expected. It is a breakout and reversal pattern which helps to generate profit after a range.

In this blog, let us discuss what Narrow Range 4 and Narrow Range 7 mean and how to trade with them:

Table of Contents

NR4 and NR7 Trading Strategy

Narrow Range Trading Strategy is a breakout-based method that assumes that the price of the security trends up or down after consolidation in a narrow range.

For NR7 the default period is 7 days which means that if the price range of any particular day is lowest as compared to the last 7 days then that day is NR 7 days. Similarly, For NR4 the default period is 4 days which means that if the price range of any particular day is the lowest as compared to the last 4 days then that day is NR 4 days.

The range is calculated as the difference between the High and Low of the particular day. The day after the NR 7 or NR 4 day acts as the confirming day on where the price will move further. If the breakout happens at the high of the NR 7 candle then indicates bullishness whereas If the breakout happens at the low of the NR 4 candle then indicates bearishness.

The philosophy behind this pattern is the same as the Bollinger Band Squeeze, a volatility contraction followed by a volatility expansion.

How to find NR7 day?

Following are steps to identify NR7 day:

- Get the high and low data of the last few days

- Calculate the range for every day (high-low)

- Compare the range of today and the previous 6-day range.

- If today’s range is the smallest of all the 7 days then it is NR 7 days else not.

How to find NR4 day?

Following are steps to identify NR4 day:

- Get the high and low data of the last few days

- Calculate the range for every day (high-low)

- Compare the range of today and the previous 3-day range.

- If today’s range is the smallest of all the 4 days then it is NR 4 days else not.

The NR 4 day can be seen from the chart below:

NR4 and NR7 Trading Example

The trading example shows Reliance with 4 signal signs in less than 2 months. We have also used the Average True Range indicator which shows the range of the candles. We can see at the NR4 and NR 7 candles the ATR has decreased which means that the range of the candle is the lowest in the last 4 or 7 days.

A next-day move above the high is bullish whereas below the low is bearish. One can notice that NR 4 is formed back to back on three different occasions. The first NR 4 gave the bearish signal and we can see that the next day there is a gap down opening which confirms the signal. Next NR 4 signal is a bullish reversal signal confirmed by the volume and bullish candle on the next day.

We can see back-to-back NR 4 candles that generated a bearish candlestick pattern. One should sell when the price crosses the low of the NR 4 candle or may incur a loss if the signal does not work out. At this candle, we can also see that ATR has declined.

Finally, we can notice NR 7 giving a bearish breakout, confirmed by the volume and next-day candle.

Narrow-range stocks provide you with an opportunity to be ahead of trade followers/indicators who may only enter the trend after you. One of the simplest strategies to trade these setups is to go long above the day’s high of NR7 or NR4 while setting a stop at the day’s low of the same.

You can go short below the Day’s low of NR7 or NR4 with a stop at the day’s high of NR7 or NR4 day. This pattern gives a trader a distinct edge to trade at least the next 2-3 days. In many situations, NR 7 breakout is found near the beginning of the new wave.

How to trade using Narrow Range Scans in StockEdge?

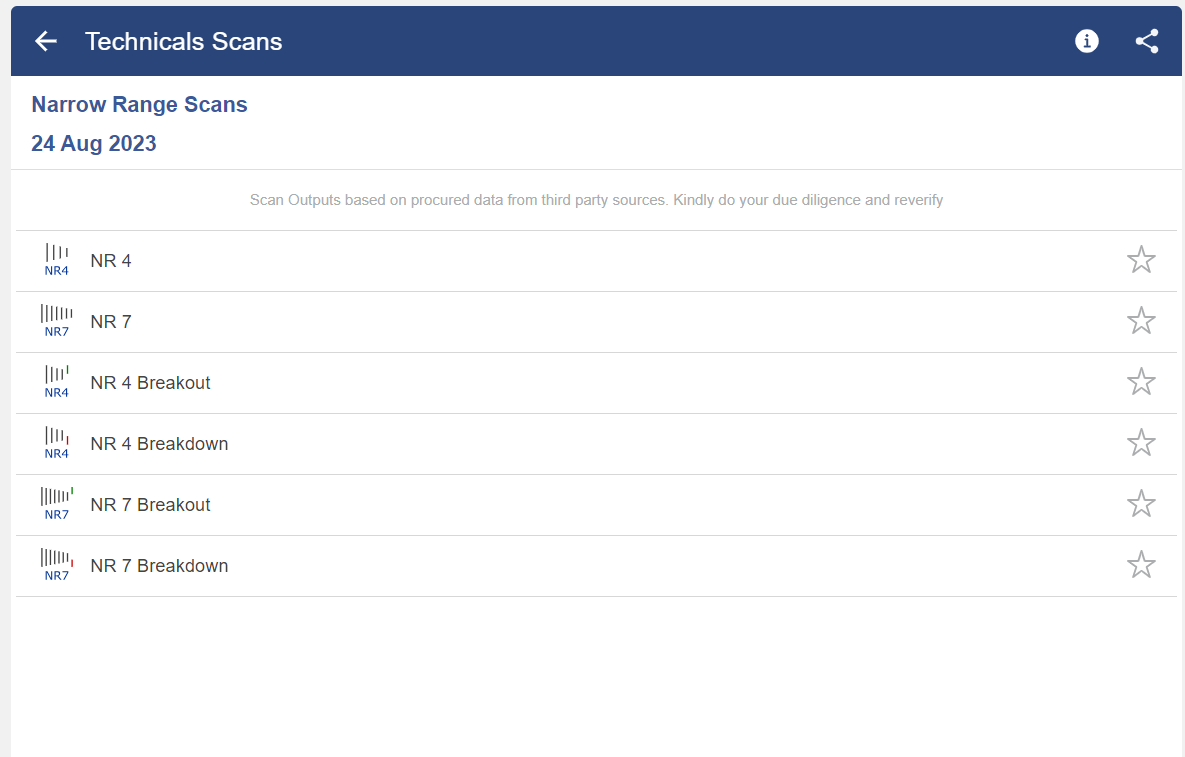

We can use Narrow Range Scans available in StockEdge for filtering out stocks and trading accordingly. Below is the list of Narrow Range Scans:

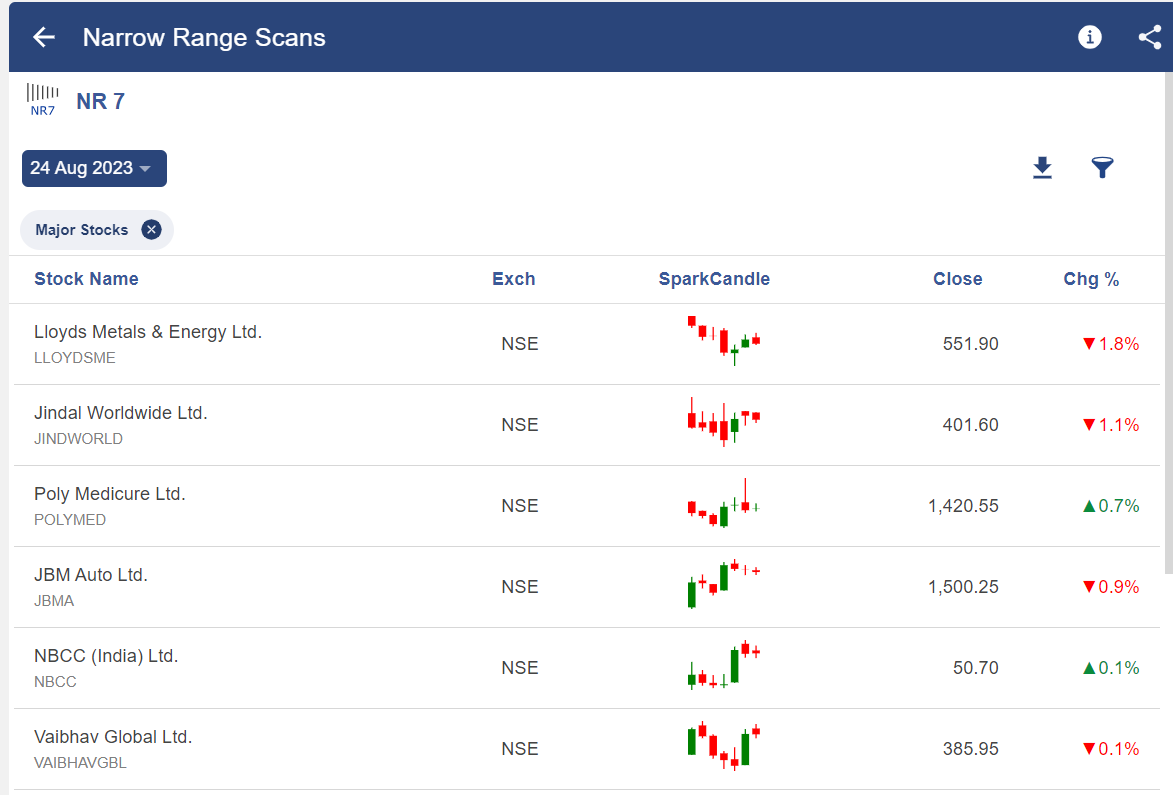

After clicking on any of the above scans, we will get a list of stocks fulfilling that criteria as shown below-

Learn more about Technical Analysis Strategies through our Technical Analysis Made Easy Course

Bottomline

For NR7 stocks the default period is 7 days, if the price range of any particular day is lowest as compared to the last 7 days then that day is NR 7 days. For NR4 the default period is 4 days, if the price range of any particular day is lowest as compared to the last 4 days then that day is NR 4 day. One should buy only when the previous candle is an NR7 candle, and the current candle has a Gap-Up opening. One should sell only when the previous candle is an NR7 candle, and the current candle has a Gap-Down opening.

You can learn more about the concepts through our share trading courses online.

in the chart shown above of reliance industries the NR4/NR7 strategy does not match with “key takeaway” points 3 and 4

Hi Anand,

This is just one of the technical strategies which you can use on the charts.

Thank you for Reading!

Keep Reading!

When you say gap up or gap down. How much in term of percentage one should consider minimum for the same.

Hi,

Gaps are areas on a chart where the price of a stock (or another financial instrument) moves sharply up or down, with little or no trading in between. As a result, the asset’s chart shows a gap in the normal price pattern. There is no fixed percentage for it.

Thank you for reading!!

i appreciate your work. thank you.

Hi,

Thank you for Reading!

Keep Reading!

Very good strategy 👍

Hi,

We are glad that you liked our post.

Thank you for Reading!

good one

Hi,

We really appreciated that you liked our blog.

Keep Reading!