Donald Trump’s excoriation towards the high pricing of drugs by the pharmaceutical industry anticipated quite a few challenges for the industry.

When he officially became the 45th President of America, these anticipations were converted into a downfall of major pharma stocks.

Read More: Analysis of FII and DII relative to NIFTY price movement

Assumptions were that the industry would be a target to be included in the Border Adjustment Tax that the Republican lawmakers were trying to impose on imports.

For most pharmaceutical manufacturers, more than 40% of their US sales come from exports.

The downward trend of Nifty Pharma stocks is fully justified as a large portion of the total revenue of the index’s constituent companies is derived from direct exports to the US.

Thus, the expectations of implementation of this import tax made investors wary.

Major Reasons of the 3-Year Low of NIFTY Pharma at 8757.8

- Compliance hurdles and import reduction were further heightened by deteriorating price environment in the United States.

- This was a direct impact of greater competition, triggered when the US Food and Drug Association increased its pace of approvals in America, granting approval to 800 drug applications in 2016, a number known to be the highest for a single year.

- The USFDA’s enhanced suspicion towards the Indian pharma companies’ quality control in manufacturing further aggravated their woes. Finding a number of observations in an investigation relating to quality check, the USFDA issued Form 483 to a few Indian pharma majors.

- They were also affected by channel consolidation hitting their profit margins. Consolidation i.e. vertical integration of suppliers(medical clinics, pharmacy benefit managers, retail pharmacies) increased the suppliers’ bargaining power with drug manufacturers.

These are the major reasons which resulted in the sector trading at a 3-year low of 8757.8 on May 29, 2017.

Learn technical analysis from scratch by joining: NSE Academy Certified Technical Analysis course on Elearnmarkets.

Recent slight Increase in Indian Pharma Stocks:

On June 22, 2017, the Business Standard reported a number of patent expiries of drugs.

This seems to be a boon to Indian companies, most being manufacturers of generic drugs.

The opportunity of a sales gain of an equivalent amount exists for generic drugs on account of branded drugs going off-patent.

As of now, the Trump administration is yet to put up an executive order regarding drug costs.

But, a draft order has been put up suggesting an easing of regulations which is contrary to his campaign promises.

The president’s criticism has not been translated into policies impeding the monopoly of the pharma majors, rather the administration has done the exact opposite by rolling back some of the regulations.

As per the draft order, drug companies are expected to get more power to charge higher monopoly prices overseas and give even fewer discounts to hospitals with poor patients resulting in a positive, rather than negative impact on the companies’ profitability.

The existing regulatory and administrative rules cause beneficiaries of Medicare in US to pay the list price, while pharmacy benefit managers (third-party administrators that run the drug plans) get a lower price from drug makers.

The draft order appears to stress on reducing the burden of such regulation.

It is less likely that such regulatory and administrative changes will help in significant reduction of healthcare costs of the citizens.

On account of this draft executive, the woes of the pharmaceutical companies and its investors stand negated and the hope of the stock prices rising is once again instilled.

The Only Fear of Pharma Sector- Value-Based Pricing

Only one policy, known as value-based pricing, if implemented could be detrimental to drug companies, which manufacture very expensive drugs to cure rare diseases.

The idea refers to paying drug companies for the value that a drug brings and refunding money if a drug fails to prevent a critical health condition.

This will benefit drug manufacturers only if their drug is successful in terms of treating a rare disease.

Thus, the companies’ focus will have to shift from expenditure in marketing the drugs to expenditure in research and development.

Yet, there lies Uncertainty…

A certainty about the increase in profitability of the pharma industry cannot be forecasted because of the recent notification by the Indian government regarding prescribing generic names of drugs and the impact of GST( Goods and Service Tax).

In general, for the past few years, Indian government seems to be more inclined towards reducing the burden of healthcare costs on its citizens.

In May 2016, it banned 344 Fixed Drug Combinations (This ban was however lifted by the Delhi High Court, in December) and subsequently, amended the Drug and Cosmetic Rules, 1945.

The amendment made it mandatory for doctors to prescribe generic name two font larger than a trade name.

However, these notifications do not restrict doctors from prescribing branded drug name along with generic name, though it is optional.

The effect of this compulsory prescribing of generic name of drugs has shifted the influencing power from doctors to pharmacists to some extent, while the consumer is the prime beneficiary.

It is obvious that the pharma firms’ promotional budgets will now get more directed towards pharmacists in the form of a volume of discounts as compared to the existing promotions being primarily doctor-centric.

Profit margins of pharmaceuticals are going to diminish because generic drugs with the same constituents as branded drugs are much cheaper than the latter.

The other issue is relating to GST whose implementation has led to unprepared stockists in the supply chain refusing to stock medicines due to the uncertainties of the outcome of this destination-based tax. This issue has been highlighted by Biocon Chairman and Managing Director, Kiran Mazumdar-Shaw herself when she cautioned every one of the possible drug shortage.

As per The Economic Times, dated June 30, 2017, she is said to have claimed that the pharmaceutical companies have taken a huge hit on their margins due to this new taxation policy.

Specific headwinds:

Some particular pharma companies have headwinds of their own.

On June 27, 2017, US FDA announced a new measure which is likely to adversely impact Indian companies like Sun Pharmaceutical, Glenmark Pharmaceuticals, and Dr. Reddy’s Laboratories.

The new regulations involve expediting the review of drug applications where there were fewer than three generics in the market.

The above-mentioned companies face a higher risk because they have a high contribution from drugs with less than three generic approvals and are likely to suffer a major loss of market share due to the increased competition.

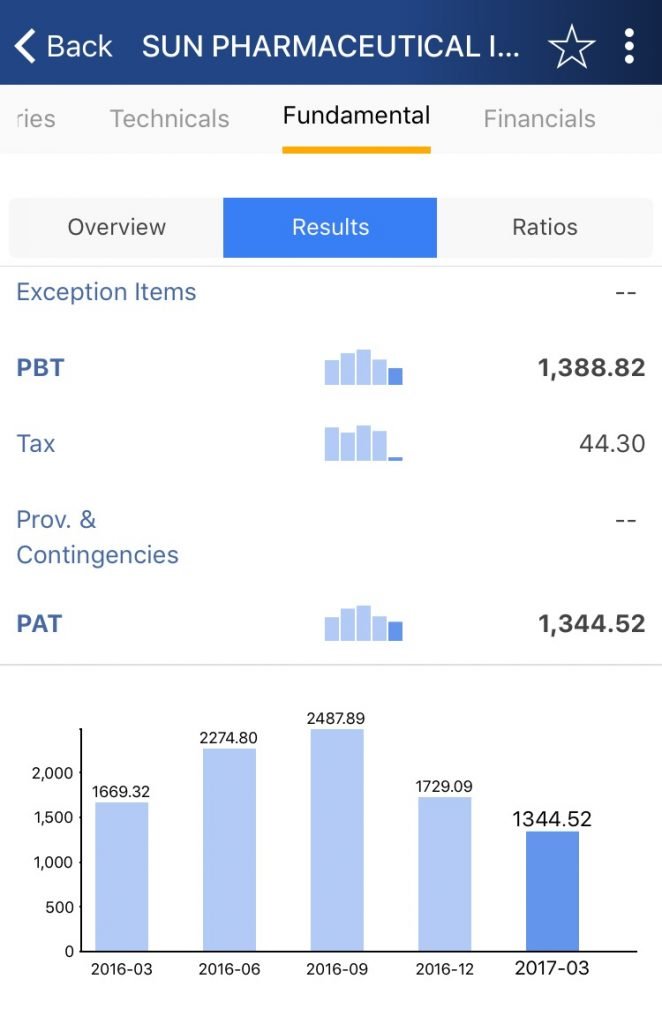

In the chart below, it is clear that Sun Pharma has been showing a continuous decline in its Profit After Tax since last year.

Source: StockEdge

The Future- Positive, Negative or Uncertain?

The fate of a few specific Indian pharmaceutical majors looks to be uncertain at the moment, given the regulatory headwinds.

However, the overall Indian pharma sector seems to have a brighter future with all the negative anticipations being negated

As time progresses, more clarity will emerge on the policies of the American and the Indian government and we will revisit the landscape to assess the future.