If analyzed with good care Indian stocks can provide good returns. However, given the quantum of available options, most investors find it difficult to pick up the right stock. Also, small investors are not able to create a diversified portfolio in investment across different sectors and asset classes.

To make a diversified portfolio in investment, you can take assistance of Kredent Money App

Here is a point where Mutual Fund comes to the rescue. Mutual Fund can be understood as an organization which pools the money of investors and invest them on their behalf in a portfolio containing different securities. If you are interested in knowing more details on mutual funds, you may join NSE Academy Certified Personal Financial Management.

This portfolio is divided into units called shares. The price at which these shares can be bought or sold in the market is called Net Asset Value (NAV).

Why are Indians Considering Mutual Funds?

Many Indians have savings that they want to invest to gain returns, also may want to save for future with the help of investment. A difficulty faced by either type of investors is to decide where to invest.

In recent past the Indian stock market experienced a bullish phase, the returns it provided attracted many investors, but some problems the faced were:

- Lack of knowledge about the market in general and this industry in particular.

- The risk associated with the investment in stocks.

- Large sum needed to create a diversified portfolio etc.

With the increase in the awareness regarding Mutual Fund, Indians are considering Mutual Fund investment.

The major advantages it provides are:

- Mutual Fund is professionally managed.

- They have different schemes for people with different requirements (risk, investment horizon etc.).

- Mutual Fund investment can be started with a very minimum amount.

- Provides a diversified portfolio etc.

Due to the above advantages and the increase in awareness regarding Mutual Fund Indians are considering Mutual Fund investment.

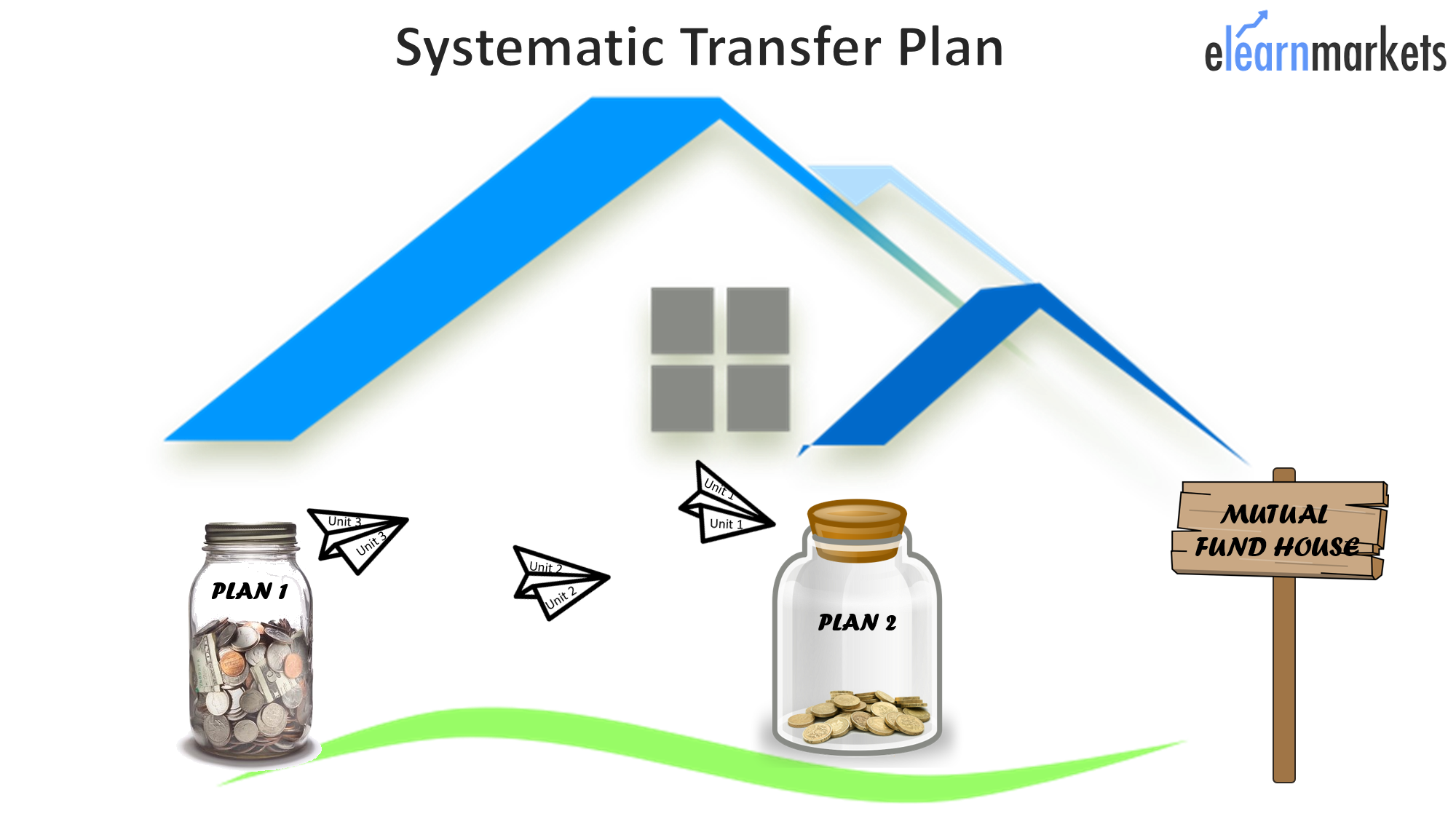

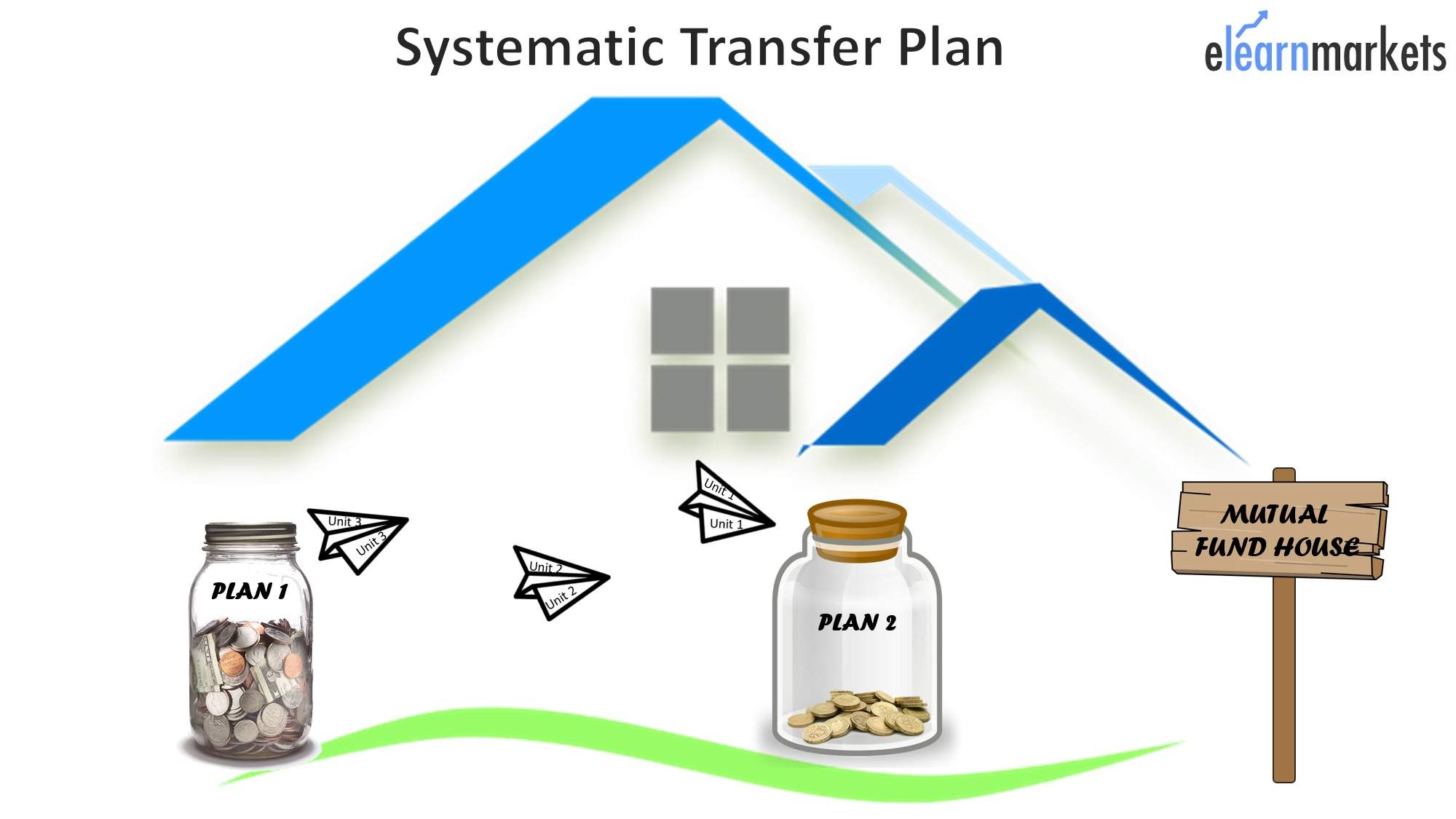

What is Systematic Transfer Plan (STP) in Mutual Fund?

Systematic Transfer Plan is a plan which enables the investor to permit the Mutual Fund house to transfer a certain part of the Mutual Fund scheme to another scheme of the same Mutual Fund house.

Suppose an investor has Rs. 200,000 and he wants to invest it, but not all at once. In such a case the investor may invest this sum in a liquid fund of a Mutual Fund house and then allow the Mutual Fund house to transfer a certain amount to another scheme every month (or a particular and defined time period e.g. weekly, quarterly etc.). This will enable the investor to curtail certain volatility related risk in Mutual Fund investment.

Lump Sum Vs Systematic Transfer Plan(STP)

An investor can go about Mutual Fund investment by either investing a lump sum at a time, Systematic Investment Plan (SIP), Systematic Transfer Plan (SIP), etc.

In case of Lump sum investment when the market is bullish an investor can book large profits together but the case is not the same when the market is at low. In such a case Systematic Transfer Plan (STP) would be a better way out.

The central idea behind gaining from Systematic Transfer Plan is that when the markets are at high with the help of Systematic Transfer Plan you can buy more units at different prices.

However, this idea or rather this expectation lies on the fact the markets movements are high, and that since it is volatile it will move down at some point of time, and so we would be able to buy more units at the same amount of investment.

While analyzing and forecasting such things we fail to realize that markets do not move according to anyone, making it extremely difficult to predict its future movement.

It is seen from past experience that many times Systematic Transfer Plan has failed to generate extra returns. To the contrary, it has led to decrease in returns.

Can I expect better return from Systematic Transfer Plan(STP) than the lump sum?

As we have mentioned earlier it totally depends on the market whether Systematic Transfer Plan will provide better returns or lump sum investment in Mutual Fund.

If the market is at high i.e. it is experiencing a bullish phase, the lump sum will provide higher returns. This is because all the investment will be done in the initial phase and so the cumulated returns will be the maximum.

If the market is very volatile Systematic Transfer Plan will be a better route to Mutual Fund investment. This is because more units can be bought with the same sum when the market is down.

Therefore, it totally depends on how well can a person recognize the market movement and extrapolate it to predict the future movement.

Mutual Fund Systematic Transfer Plan(STP) Tax?

Every transfer in a Systematic Transfer Plan (STP) is considered a redemption of one plan and purchase of another plan.

Systematic Transfer Plan from liquid/debt fund if is less than three years is taxable for Short Term Capital Gain (STGC) tax according to the tax slab of the investor.

If Systematic Transfer Plan is done from dividend re-investing option, Systematic Transfer Plan will be tax-free, but for the dividend, the Dividend Distribution Tax of around 28% has to be paid. It is still a better way for people who fall in the tax slab of 30%. But for investors who fall in the lower tax bracket, the other way that is paying STCG will be more profitable.

Difference between Systematic Transfer Plan & Systematic Investment Plan?

Systematic Investment Plan (SIP) is a plan in which an investor pays every month (or any other defined time period like quarterly, weekly etc.) a sum to the Mutual Fund instead of a lump sum investment at once.

On the other hand, Systematic Transfer Plan (STP) is a plan in which an investor invests a sum in a scheme of a Mutual Fund house and permits the Mutual Fund house to transfer a certain part of it every month (or any other defined time period like quarterly, weekly etc.) to another scheme of the same Mutual Fund house.

The major objective of Systematic Investment Plan (SIP) is to allocate the money in a systematic way as it comes irrespective of whether the market is running low or high. Whereas the major objective of Systematic Transfer Plan (STP) is to transfer funds systematically from one scheme to another.

Which type to choose depends on the market and the investor, for example, 2015 and the beginning of 2016 has not been particularly good for those who did Systematic Investment Plans (SIP) as the markets have kept on falling. On the other hand, in 2017 the market was at a bullish phase.

For investors who do not want to pay in the lump sum may go for Systematic Investment Plan (SIP) or if the case is opposite then they can go for Systematic Transfer Plan (STP)

The Bottom Line:

Along with offering various types of portfolios (schemes) Mutual Funds also provide various options for the way we want to invest. Some of them are Lump sum investment for investors who want to invest a lump sum at a time, Systematic Investment Plan(SIP) to invest some amounts periodically, Systematic Transfer Plan(STP) to transfer certain amount periodically from one scheme to another.

The decision about which way to go depends on the market movements and personal factors. However, before choosing any plan or type it is of immense importance to know about Mutual Fund properly and the investment type. The investor also can take the help of financial advisor before taking any financial decisions.