The world of Technical Analysis has always been filled with fancy terms and tools. With new indicators being developed every day, you often tend to forget the classic tools which actually formed the origin of Technical Analysis. One such tool is the technical indicator known as the Moving Average. It is a very powerful tool that can come in handy to every stock trader.

| Table of Contents |

|---|

| What is Moving Average? |

| Use of Moving Average |

| What Moving Average trend tell you? |

| Bottomline |

What is Moving Average?

Moving averages provide important information regarding the direction of the market.

They were created to provide the directional information of the market to smoothen out the zig-zags that form during a trend formation.

In the current generation of high speed computer calculations, its use has become much more relevant and simplified.

Learn about Magic of Moving Averages from Market Experts

Now they can be calculated and utilized up to the very minute and second of the price information when it appears in your computer screen.

Their applications along with the candlestick charts and pattern formations can provide trading signals for a very strong and profitable trading format.

As like all other technical indicators, Moving averages(MA) are utilized in correlation with other technical tools.

How they are followed and how they are utilized make a difference in moderate returns and highly profitable returns.

Trading techniques using the MA provide improved entries and exits into the markets.

Use of Moving Average

The most common use is when the relevant moving averages like the Simple Moving Average (SMA), Weighted Moving Average (WMA) and the Exponential Moving Average (EMA) cross each other and generate trading signals.

Read more: How to trade using moving average on different timeframes?

However, just observing and referring to the moving average isn’t gonna help you to make money. Applying candlestick patterns along with MA provide a higher function to the indicator.

Candlestick patterns and MA together form strategies with higher profitability with the formation of support and resistance levels with reference to MA.

This will help you identify the correct trend and execute trades with a better percentage of profits. The use of MA is very simple.

Once applied to candlestick charts, it makes the identification and analysis of supports and resistances very simple.

But the question always arises whether to use the Simple Moving Average (SMA), Weighted Moving Average (WMA) or the Exponential Moving Average (EMA).

Due to its technicality, the EMA has gained popularity over the years.

Money managers as well as the majority of technical investors use the EMA for their trading as well as investing decisions.

What Moving Average trend tell you ?

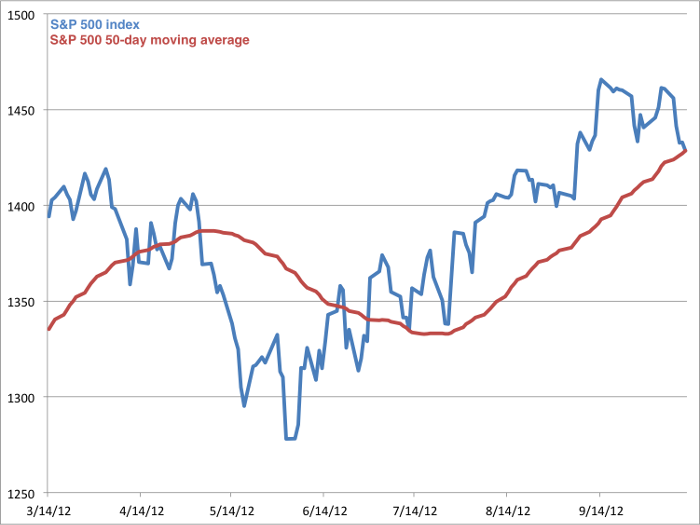

The MA provides a simple visual indication of a trend’s slope.

When the MA is rising, it indicates a trend’s slope on the upside.

When the MA is falling, it indicates a downtrend. When the MA is trending sideways, it indicates a sideways market.

Traders who follow moving indicators follow these basic rules for their entry and exits:

- If the EMA is trending up, trade the market on the long side. Buy when the prices pullback to, or slightly below, the MA. After a long position is established, use the recent low as your stop.

- If the EMA is trending down, trade the market to the short side. Short when prices rally to or slightly above the EMA. Once the short position is established, use the recent high as your stop loss.

- When the EMA is trading flat, or trending sideways, it signifies a sideways market. If you are an intelligent trader, utilize the MA to identify the sideways trend and avoid trading in this kind of market.

So, simply stated, traders who use EMA as a trend indicator go long when the prices are trading above the MA and go short when the prices are trading below the MA. If you are a candlestick trader, you will have an immense advantage over the average retail investors.

Watch this video to understand the magic of Moving Averages –

Bottomline:

As you are able to derive more information from the charts evaluations and your own chart studying, the relevance of these moving average start to appear more significant to you.

The point of using the MA along with other candlestick and technical signals is that historically these price points have been followed by the majority of technical traders.

So, due to crowd psychology, it becomes a self fulfilling prophecy.

In order to get the latest updates on Financial Markets visit stockedge.