Pitchfork developed by Alan Andrews is a trend channel tool consisting of three lines- a center median line and a pair of lines above and below the median line which basically specified the number of standard deviations away from the median.

Also Read: How to trade the Price Channel Continuation pattern

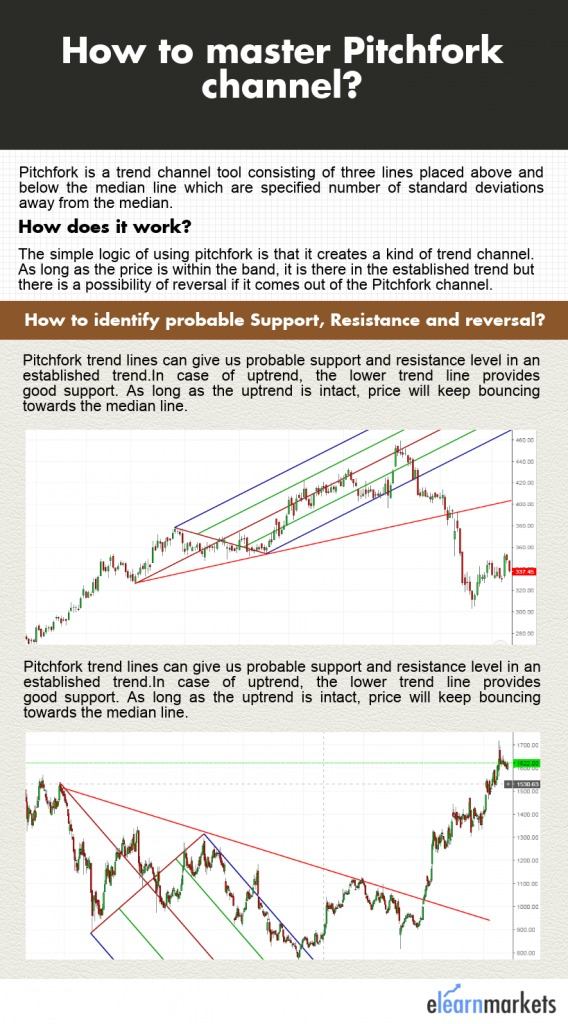

The simple logic of using pitchfork is that it creates a kind of trend channel.

As long as the price is within the band, it is there in the established trend but there is a possibility of reversal if it comes out of the Pitchfork channel.

How to draw the Pitchfork lines?

We start by drawing three points which are drawn based on reaction highs and lows.

The first point is basically the starting point of the median line which is based on two points i.e. point 1 and the midpoint between points 2 and 3.

This controls the steepness of the slope of the median line.

The above is a daily chart of Reliance Capital where point 1 is the starting point of the median line, followed by point 2 which is basically the reaction high and then we simply join the reaction low to complete the pitchfork pattern.

You can see in the chart that there have been so many instances when the price has respected the pitchfork lines which are highlighted using squares.

Learn Technical Analysis by joining: NSE Academy Certified Technical Analysis course on Elearnmarkets.

How to identify probable Support, Resistance and reversal?

Pitchfork trend lines can give us probable support and resistance level in an established trend.

In case of a downtrend, the upper trend line acts as a good support and as long as the downtrend is intact, the price will keep on going to the median line.

Failure to touch the line shows weakness and chances of upcoming reversal.

The final reversal signal comes when the trigger line is breached.

Below is the daily chart of Jubilant food work and as you can see that the stock was in a downtrend but was unable to touch the median lines suggesting weakness in trend.

Soon after coming out of the upper trend line, the stock faced some resistance at the trigger line (red line) and once it breached the trigger line, the stock rallied and gave about 60-70% return in a matter of just 3 months.

On the other hand, in case of a downtrend, the lower trend line provides good support.

As long as the uptrend is intact, the price will keep bouncing towards the median line.

Similarly in an uptrend, reversal signal comes when the trigger line is breached.

Read More: Triple screen trading system: the Alexander Elder way of trading

This is the weekly chart of Havells India which was in a good uptrend and it was continuously going towards the median line.

But once it breached the lower trend line, the stock saw the heavy correction.

However, the correction deepened after it went below the trigger line.

How to do real-time trading using Pitchfork?

Trading simply on the basis of Pitchfork is not a good idea rather you may combine your study with other indicators and price patterns to generate more confirm signals.

Let’s look at an example to understand this in more detail.

This is the daily chart of Havells India and if you can see that there was a beautiful symmetrical triangle pattern in the weekly chart and the stock made a retest after the breakout.

There was a beautiful confluence of the retest area and the Pitchfork support line.

At the same time, RSI also took support from the mid 50 line suggesting that uptrend is very much intact and the stock saw good bounce back from that area.

Bottomline

The placement of point 1 i.e. the starting point of the median line decides the slope or the steepness of the Pitchfork channel.

Even though the placement of point one is usually done at the reaction high or low but you may adjust it to display more realistic picture since there is no hard and fast rule to draw the same.

This is totally subjective in nature and depends totally upon experience once you start using it.

Thanks for sharing with us.. Keep up the great work…………….