Key Takeaways

- Start with the basics first: Books like Getting Started in Technical Analysis help beginners understand trends, chart patterns, entries/exits, and market discipline.

- Learn candlesticks & chart patterns: Japanese Candlestick Charting Techniques and Encyclopedia of Chart Patterns offer deep insights into price behavior and pattern success rates.

- Volume validates price: A Complete Guide to Volume Price Analysis explains how volume confirms moves and signals market strength or weakness.

- Choose books based on your skill level: A single book can’t cover everything, so beginners, intermediates, and advanced traders should pick based on goals.

- Psychology and risk management matter: Tools and indicators help, but real success comes from discipline, position sizing, and emotional control.

- Key Takeaways

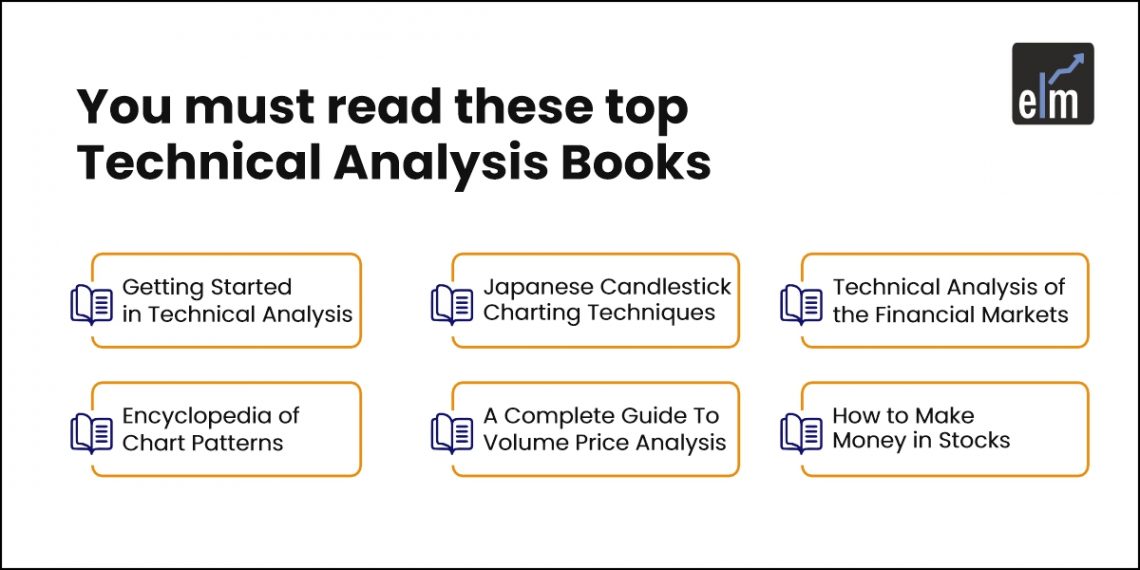

- Top 7 Technical Analysis Books

- 1. Getting Started in Technical Analysis by Jack D. Schwager

- 2. Japanese Candlestick Charting Techniques by Steve Nison

- 3. Technical Analysis of the Financial Markets by John J. Murphy

- 4. Encyclopedia of Chart Patterns by Thomas N. Bulkowski

- 5. A Complete Guide To Volume Price Analysis by Anna Coulling

- 6. How to Make Money in Stocks by William O'Neil

- 7. Technical Analysis from A to Z by Steven B. Achelis

- Frequently Asked Questions (FAQs)

Technical Analysis is the most effective and popular decision-making tool used by traders in the equity, commodity, and forex markets. Even the investor fraternity uses Technical Analysis, alongside conventional Fundamental Analysis, to time their market entry and exit. A serious trader, whether involved in intraday or short to medium-term trading, cannot overlook the importance of Technical Analysis. For those looking to sharpen their knowledge, exploring technical analysis books is essential to building this important skill.

It is the discipline that structures the price-volume data of a financial instrument over time. The structuring takes the shape of various candlestick patterns or classical price patterns and indicators which are derived from statistical formulas using the plain price volume data over time.

As one approaches the market with the tool of Technical Analysis, he or she learns that technical analysis is more of an art rather than being a rigid science. The importance of judgment while dealing with Technical Analysis indicators is very important, which comes with experience. Overall it can be described as a decision-making tool which has some amount of human judgment element built into it. Probability is the most important element in Technical Analysis as nothing works all the time, however, something that works with greater probability is an important element in it.

A new trader or investor can learn technical analysis through various methods, including attending classes, seminars, watching recorded videos, and reading some of the best technical analysis books. In our opinion, a good mix of all these resources is important to build a solid foundation of knowledge and enhance it over time.

Top 7 Technical Analysis Books

1. Getting Started in Technical Analysis by Jack D. Schwager

This book provides a solid foundation in technical analysis, making it an excellent choice among books on Technical Analysis. This book is filled with real examples, and it clearly explains essential topics like trends, trading ranges, and chart patterns in simple ways. Additionally, Jack D. Schwager talks about order management mechanics, including entry, exit, stops, and pyramiding techniques. It also describes various forms of charting in an easy-to-understand manner before delving deeper into trading signal generation methods. Getting Started in Technical Analysis helps traders to understand the emotional side of trading and provides valuable tips and strategies to avoid common mistakes. With the extensive real-world experience of Mr. Schwager as a trader, this book is an ideal starting point for anyone eager to learn technical analysis.

2. Japanese Candlestick Charting Techniques by Steve Nison

Candlestick Charting Technique is an important technical analysis book for analyzing any market. In this book, Steve Nison covers a wide range of themes, including the history of candlestick patterns, their types, and how to utilize them in any market in any time frame. The language of the book is very easy to read, and there are numerous examples to help a learner understand the patterns and gain command so that they can apply these in the real-time market.

Learn Technical Analysis skills with the Technical Analysis Made Easy course by Market Experts

3. Technical Analysis of the Financial Markets by John J. Murphy

Technical Analysis of the Financial Markets was published in 1999, and it is a very comprehensive guide to the subject of Technical Analysis and has helped thousands of traders all across the world in their journey of trading. The newer edition covers almost all possible aspects of beginner to intermediate level technical analysis, with inter-market relationships and stock rotation being two important additional features. This book has got good reviews, and most of the readers agree that it is a thorough and dependable guide for technical analysis

4. Encyclopedia of Chart Patterns by Thomas N. Bulkowski

As the name suggests, the book, Encyclopedia of Chart Patterns, comprehensively covers chart patterns that provide distinct opportunities in the market. This book not only describes patterns but also gives clear descriptions of preconditions and confirmation signals of each chart pattern. Different chart patterns have different probabilities of success and failure. This book gives an approximate success-failure ratio of each pattern from a vast number of examples from markets. Thomas N. Bulkowski has provided a thorough analysis of various chart patterns, including bullish and bearish patterns, as well as details on their performance and trading implications.

Download the Technical Analysis PDF for free to get started with the basics of Technical Analysis!

5. A Complete Guide To Volume Price Analysis by Anna Coulling

In this technical analysis book, price-volume analysis is considered the most important part of technical analysis. Volume, especially delivery volume with a significant price move, reinforces confidence in the trend direction. The book aims to help traders and investors understand how to use volume price analysis (VPA) to identify market trends, reversals, and potential trading opportunities. The book is particularly valuable because it breaks down complex concepts in a simple way that is easy to understand for all readers. By focusing on the interaction between volume and price, the author provides a different perspective that complements other forms of technical analysis.

6. How to Make Money in Stocks by William O’Neil

How To Make Money in Stocks, written by William O’Neil, was published in the year 1988 with research of stock market data of more than 100 years. The celebrated ‘CANSLIM’ method introduced in this book became a successful method for trading and investing for many traders, investors, and fund managers. This method basically focuses on how to pick companies with strong fundamentals, such as earnings growth and market dominance, and purchase equities at the perfect time. All topics are exemplified with charts and notes beside them.

7. Technical Analysis from A to Z by Steven B. Achelis

This is another comprehensive technical analysis book that covers a wide range of technical analysis concepts. It is well known for its clarity and accessibility, making it suitable for both beginners and experienced traders. This book is divided into two parts. The first part covers basic concepts which are useful for beginners, while the second part contains advanced topics like chart patterns and elaborates on more than 100 technical indicators.

Overall, the above list of technical analysis books is very comprehensive and gives readers a fairly strong foundation of technical scanning. However, we should understand that technical analysis is only part of trading. Equally important are money management skills and psychological aspects of handling a trade.

Also Read: Top 9 Must-Read Fundamental Analysis Books

Frequently Asked Questions (FAQs)

1. Who should read technical analysis books?

Technical analysis isn’t exclusive to technical traders. Anyone who wants to understand markets better should read technical analysis books. Many fundamental traders rely on fundamental analysis to decide whether to enter a market, but once they’ve made that decision, they turn to technical analysis to identify optimal, low-risk entry points for buying.

2. How to learn technical analysis?

You can start learning technical analysis through free online resources and beginner courses to understand basics like charts, trends, and indicators. Once you’re confident, move to advanced topics with structured learning. Elearnmarkets offers both free and paid technical analysis courses. You can also begin with our free Technical Analysis PDF for a solid foundation.

3. How to choose the best technical analysis books?

To choose the best technical analysis book, check reviews and the author’s expertise, ensuring the content aligns with your learning goals. Focus on specific topics like chart patterns or risk management, and prioritize recent publications for up-to-date insights.

I am glad to see you list two books already in my library. I am looking for updated book on order placement for etf use.

Hi,

Thank you for Reading!

Keep Reading!

It is truly a great and helpful piece of info. I’m satisfied that you just shared this helpful information with us. Please stay us informed like this. Thanks for sharing.

It is really a nice and helpful piece of info. I¦m happy that you simply shared this helpful information with us. Please keep us up to date like this. Thanks for sharing.

I am very happy to read this. This is the kind of manual that needs to be given and not the accidental misinformation that is at the other blogs. Appreciate your sharing this greatest doc.

Very interesting topic, appreciate it for posting.

Thanks for every other informative website. The place else may just I get that type of info written in such an ideal means? I have a venture that I am just now operating on, and I have been at the look out for such info.

A very good set of books. Useful

I’ll just get “Technical Analysis from A to Z by Steven B. Achelis” thanks for the post very useful 🙂

Hi,

Thank you for Reading!

Keep Reading

I was searching for indicators for swing trading. Thanks, admin, for sharing such wonderful content on this topic.

Hi,

We really appreciated that you liked our blog. You can read our blog Swing Trading Indicators from here.

Keep Reading!

I would like to thank you for the efforts you’ve put in writing this web site. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has encouraged me to get my own site now. Really the blogging is spreading its wings quickly. Your write up is a great example of it.

Hi,

We really appreciated that you liked our blog.

Keep Reading!