English: Click here to read this article in English.

सिस्टमैटिक इन्वेस्टमेंट प्लान (SIP) हाल के कुछ वर्षों में लोकप्रिय हो रहा है।

इसके लिए हम नोटबंदी को धन्यवाद देते हैं, जिसकी वजह से कई व्यक्तियों ने एसआईपी और म्यूचुअल फंड के फायदों को ढूंढ निकाला है।

हालांकि, अब भी कई इन्वेस्टर एसआईपी के बारे में कन्फ्यूज् हो जाते हैं।

कई इन्वेस्टर सोचते हैं कि एसआईपी सिर्फ एक इन्वेस्टमेंट प्रोडक्ट है।

SIP के बारे में आगे चर्चा करने से पहले यह महत्वपूर्ण है कि आपको फाइनेंशियल मार्केट का ज्ञान हो।यदि आपको इस विषय को विस्तार में पढ़ना है तो आप बेसिक ऑफ फाइनेंशियल मार्केट कोर्स को ज्वाइन कर सकते हैं ।

अब चलिए समझते हैं SIP के बारे में:

बहुत लोगों के मन में एक सामान्य पर महत्वपूर्ण प्रश्न अवश्य आता है कि –

क्या मैं अपना लक्ष्य प्राप्त करने के लिए एसआईपी में इन्वेस्ट कर सकता हूं?इस प्रश्न का उत्तर हम इस ब्लॉग में विस्तार से समझेंगे:

सिस्टमैटिक इन्वेस्टमेंट प्लान (SIP) क्या है?

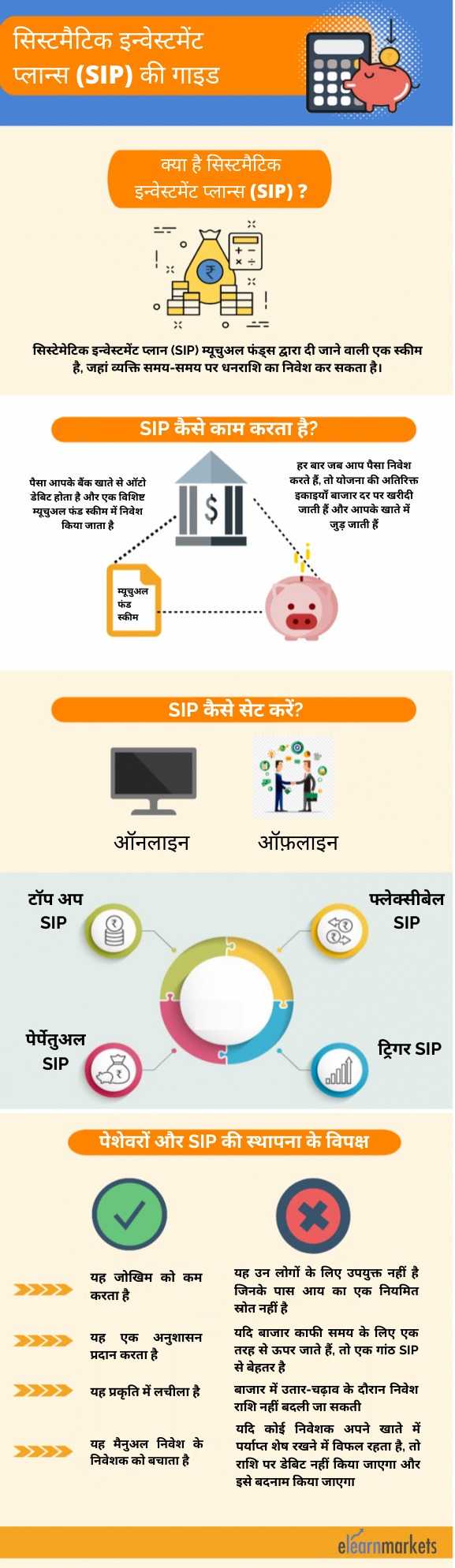

सिस्टेमेटिक इन्वेस्टमेंट प्लान (SIP) म्यूचुअल फंड द्वारा दी जाने वाली एक स्कीम है, जहां व्यक्ति समय-समय पर धनराशि को इन्वेस्ट कर सकता है।

यह इन्वेस्ट का एक सुविचारित और नियोजित तरीका है जो बचत की आदत को विकसित करने और धन सृजन के लक्ष्य को पूरा करने में मदद करता है।

एसआईपी के मामले मे, व्यक्ति अपनी सुविधा के अनुसार साप्ताहिक, मासिक या तिमाही आधार पर इन्वेस्ट कर सकता है।

एक निश्चित राश फोलियो धारक के बैंक खाते से काट ली जाती है और उसे म्यूचुअल फंड में इन्वेस्ट किया जाता है।

म्यूचुअल फंड में इन्वेस्टर को म्यूचुअल फंड के यूनिट्स मिलते हैं।

ये यूनिट्स हमें वर्तमान बाजार मूल्य अर्थात करेंट मार्केट प्राइस पर मिलते हैं। जो एनएवी द्वारा डिवाइडेड राशि के बराबर है।

SIP में इन्वेस्ट करने से पहले एक इन्वेस्टर को 4 महत्वपूर्ण चरणों का पालन करना चाहिए:

1) अपने वित्तीय लक्ष्य निर्धारित करें

2) तय करें कि आपको पैसे की आवश्यकता कब होगी

3) तय करें कि आपको कितना इन्वेस्ट करने की आवश्यकता है

4) एक चुनाव करें

पैसे का भुगतान पोस्ट-डेटेड चेक द्वारा या ईसीएस के माध्यम से किया जा सकता है, जिसमें हर महीने एक बैंक को आपके खाते से इन्वेस्ट राशि को ऑटो डेबिट करने के लिए एक स्थायी निर्देश दिया जाता है।

एसआईपीस्थायीया सीमित अवधि के लिए हो सकता है।

सिस्टमैटिक इन्वेस्टमेंट प्लान क्यों?

यहां विभिन्न रेटस पर यूनिटस खरीदी जाती हैं और इन्वेस्टरस को Rupee-Cost Averaging and the Power of Compounding से लाभ मिलता है।

एसआईपी के माध्यम से इन्वेस्ट करने का एक मुख्य लाभ Rupee-Cost Averaging है।

जब आपएक निश्चित समय के अंतरालमे इन्वेस्ट करते हैं, तो आपका पैसा अधिक यूनिटस को प्राप्त होता है, जब कीमत कम होती है और कीमत अधिक होने पर कम (यूनिटस) प्राप्त होती है।

वोलेटाइलपीरियड के दौरान, डिफरेंट NAV के आधार पर प्रतियूनिट कम एवरेज कॉस्ट प्राप्त की जाती है।

इसे एक छोटे से उदाहरण के साथ देखते हैं:

| DATE | NAV | AMOUNT (RS) | UNITS |

| 7-18 April | 15 | 1000 | 67 |

| 7-18 April | 13 | 1000 | 77 |

| Total | 2000 | 144 |

जिस रेट पर इन्वेस्टमेंट किया जाता है उसकी एवरेज कॉस्ट 14 रुपये है।

इसलिए बाजार के विभिन्न स्तरों पर यूनिटस एकत्रित हो जाती है।

यदि मई के अंत के दौरान NAV 17 रुपये है, तो 2000 रुपये के इन्वेस्टमेंट का मूल्य 2,448 रुपये (144 यूनिट * 17) होगा।

यदि कोई व्यक्ति 07 अप्रैल को बल्कइन्वेस्टमेंट करना चाहता था और उसने 2000 रुपये का इन्वेस्टमेंट किया था, तो इन्वेस्टमेंट केवल 2,266 रुपये (2000/15 * 17) के बराबर होगा।

शुरुआती पक्षी को कीट जंगल की लोककथाओं का हिस्सा नहीं लगता है।

यहां तक कि “शुरुआती इन्वेस्टर” को बाद में आने वाले इन्वेस्टर के इन्वेस्टमेंट बूटी का एक बडा हिस्सा मिलता है।

यह मुख्य रूप से the power of Compounding के कारण है।

कंपाउंडिंग के लिए नियम सरल है, जितनी जल्दी आप इन्वेस्ट करना शुरू करेंगे,आपके पैसे कोबढ़ने के लिएउतना ही अधिक समयमिलेगा।

उदाहरण के लिए,

यदि आपने अपने 40वें जन्मदिन पर प्रति माह 10,000 रुपये का इन्वेस्ट करना शुरू कर दिया, तो 20 वर्षों में आप 24 लाख रुपये प्राप्तकरेंगे।

यदि उस इन्वेस्ट में हर साल एवरेज 7% की वृद्धि हुई, तो यह 52.4 लाख रुपये होगा जब आप 60 तक पहुंचते है ।

हालांकि, अगर आपने 10 साल पहले इन्वेस्ट करना शुरू किया, तो हर महीने आपके 10,000 रुपये 30 साल में 36 लाख रुपये तक बढ़ जाएंगे।

हर साल एवरेज 7% की वृद्धि के अनुमान से, आपके 60वें जन्मदिन पर आपके पास 1.22 करोड़ रुपये होंगे – यदि आप दस साल बाद (इन्वेस्ट) शुरू किये थे, तो दोगुने से अधिक राशि आपके पास पहुंच जाएगी।

आप हमारे एसआईपी कैलकुलेटर का उपयोग करके एसआईपी इन्वेस्ट के रिटर्न की गणना भी कर सकते है।

SIP कैसे काम करता है?

आपका पैसा आपके बैंक खाते से ऑटो डेबिट हो जाता है और एक विशिष्ट म्यूचुअल फंड स्कीम में इन्वेस्ट किया जाता है।

आपको एक दिन में मार्केट रेट (NAV या शुद्ध संपत्ति मूल्य) के आधार पर कुछ निश्चित यूनिटस बाँटी जाती है ।

हर बार जब आप पैसा इन्वेस्ट करते हैं, तो योजना की अतिरिक्त यूनिटसमार्केट रेट पर खरीदी जाती हैं और आपके खाते में जुड़ जाती है।

SIP कैसे सेट करें?

SIP सेट करने के 2 तरीके हैं:-

a) ऑनलाइन

b) ऑफलाइन

a) ऑनलाइन:

ऑनलाइन के मामले में, देखने वाली पहली बात यह है कि इन्वेस्टरKYC compliant है। यदि नहीं है तो उसे आवश्यक दस्तावेजों जैसे पहचान प्रमाण, पता प्रमाण और एक तस्वीर के साथ करना होगा।

अब वह एक राशि चुन सकता है और इसे ऑनलाइन कर सकता है। उसे उस तिथि को चुनने की आवश्यकता है जिस पर एसआईपी काटा जाएगा और वह पीरियड चुनें जिसके लिए एसआईपी होगा।

इसे पोस्ट करें उसे अपने ऑनलाइन बैंक खाते में एक बिलर के रूप में फंड हाउस को रजिस्टर करना होगा।

हम निम्नलिखित उदाहरण लेते हैं: –

मान लीजिए कि इन्वेस्टर DSP Mutual fund चुनता है, तो वह https://invest.dspim.com/ पर जाता है

इसके बाद, एक ऑप्शन है जिसमें वह लॉगिन के बिना ट्रांसैट पर क्लिक कर सकता है। फिर वह खरीद पर क्लिक करेगा।

यहां अगर वह KYC compliant करता है, तो उसे अपना पैन नंबर और जन्मतिथि प्रस्तुत करनी होगी।

फिर उसे OTP भरने की जरूरत है जो उसे अपने मोबाइल और साथ ही साथ ईमेल आईडी पर मिलता है। इसके बाद, वह या तो एक मौजूदा पोर्टफोलियो का चयन करेगा या एक नया पोर्टफोलियो बनाएगा।

फिर सूची से, उसे योजना चुननी होगी। पोस्ट करेंकिआपकोSIP विकल्प चुनने की आवश्यकता है।

उसके बाद आपको राशि, एसआईपी की फ्रीक्वेंसी, पहली किस्त की तारीख और एसआईपी अवधिभरनी होगी ।

उसके पास हर साल एसआईपी की किस्त बढ़ाने का भी विकल्प है जिसे टॉप-अप एसआईपी के रूप में जाना जाता है।

यह करने के बाद आपको ट्रांजैक्शन को कंफर्म करना होगा।

b) ऑफलाइन:

एसआईपी ऑफ़लाइन होने की स्थिति में, आपको पूरी तरह से फॉर्म भरना होगा, अगर आपके पास मौजूदा फोलियो नहीं है।

ये नाम, पता, फंड का नाम, निवासी का प्रकार, बैंक डिटेल्स, आपके हस्ताक्षर आदि होंगे।

इसके साथ ही आपको एसआईपी की तारीख, फ्रीक्वेंसी आदि को भी मूल रूप से प्रस्तुत करना होगा। मूल रूप से, आपको सभी कागजी कार्रवाई करने की आवश्यकता है।

एक एसआईपी टॉप-अप विकल्प भी है जिसमें हर 6 महीने या 1 साल में वह एसआईपी की मात्रा बढ़ा सकता है।

एसआईपी के प्रकार

अब जब हमने SIP की मूल बातें समझ ली हैं, तो SIP के विभिन्न प्रकार हैं,जैसे-

1) फ्लेक्सिबल एसआईपी:

यह एसआईपी किसी व्यक्ति के कैश फ्लो के अनुसार इन्वेस्ट की मात्रा को बढ़ाने या घटाने की अनुमति देता है। यदि कोई बोनस या अतिरिक्त आय प्राप्त करता है, तो वह किसी की SIP राशि में बड़ा योगदान दे सकता है। लिक्विडिटी क्रंच की स्थिति में, व्यक्ति एक या अधिक भुगतान छोड़ सकता है।

2) टॉप अप एसआईपी:

यह एसआईपी समय-समय पर अपने पीरियाडिक कॉन्ट्रिब्यूशन को बढ़ाने की अनुमति देता है। व्यक्ति अपनी आय में वृद्धि के अनुसार इन्वेस्ट राशि को बढ़ा सकता है।

3) स्थायी एसआईपी:

यह एक एसआईपी है जहां कोई अंतिम तिथि नहीं है और एसआईपी तब तक जारी रहता है जब तक इसे रोका नहीं जाता है।

4) ट्रिगर एसआईपी:

यह एक एसआईपी है जो NAV या किसी विशेष स्तर के इंडेक्स के आधार पर ट्रिगर हो जाएगा।

एसआईपी सेट करने के गुण और दोष

एक एसआईपी सेट करने के लाभ इस प्रकार हैं:

- यह रिस्क को कम करता है- एसआईपी के मामले में, लंबी अवधि में पीरियाडिकइंटरवल पर इन्वेस्ट किया जाता है जो बाजार की अस्थिरता को बीट करने में मदद करता है। अधिक यूनिटस तब खरीदी जाती हैं जब मार्केटडाउन होते हैं और जब मार्केटअप होते हैं तो कम यूनिटसखरीदी जाती है।

- यह एक अनुशासन प्रदान करता है क्योंकि एक ही राशि का साप्ताहिक, पाक्षिक, मासिक या तिमाही इन्वेस्टमेंट होता है।

- यह नेचर में फ्लेक्सिबल है क्योंकि एक इन्वेस्टर अपनी आय के फ्लो के अनुसार अपने इन्वेस्टमेंट को समय दे सकता है ।

- यह मैनुअल इन्वेस्टमेंट के इन्वेस्टर को बचाता है क्योंकि इन्वेस्टमेंट ऑटोपायलट मोड में होता है।

एक एसआईपी की हानियां इस प्रकार हैं:

- यह उन लोगों के लिए उपयुक्त नहीं है जिनके पास आय का नियमित स्रोत नहीं है।

- यदि मार्केट काफी समय के लिए एक तरह से अप हो जाती हैं, तो लम्प सम एक एसआईपी से बेहतर है।

- मार्केट में उतार-चढ़ाव के दौरान इन्वेस्टमेंटराशि को नहीं बदला जा सकता है।

- यदि कोई इन्वेस्टर अपने खाते में पर्याप्त बैलंस रखने में फेल रहता है, तो राशि को डेबिट नहीं किया जाएगा और इसे अस्वीकृत किया जाएगा। इसका मतलब यह है कि उस अवधि के लिए इन्वेस्टमेंट नहीं होगा।

महत्वपूर्ण उपलब्दियां:

- सिस्टेमेटिक इन्वेस्टमेंट प्लान (SIP) म्यूचुअल फंड द्वारा दी जाने वाली एक स्कीम है, जहां व्यक्ति समय-समय पर धनराशि का इन्वेस्ट कर सकता है।

- एक एसआईपी स्थायी या सीमित अवधि के लिए हो सकता है एसआईपी मुख्य रूप से 4 प्रकार के होते हैं: फ्लेक्सिबल एसआईपी, टॉप-अप एसआईपी, स्थायी एसआईपी और ट्रिगर एसआईपी ।

- एसआईपी के मामले में, लंबी अवधि में पीरियाडिकइंटरवल पर इन्वेस्ट किया जाता है जो बाजार की अस्थिरता को बीट करने में मदद करता है।

- यह उन लोगों के लिए उपयुक्त नहीं है जिनके पास आय का नियमित स्रोत नहीं है।