- Associate company, means a company in which another company has a Significant Influence, but which is not a subsidiary company of the company and includes a joint venture company.

- Inter-company investments play an important role in business activities and the Associate company is one of the forms of such investment.

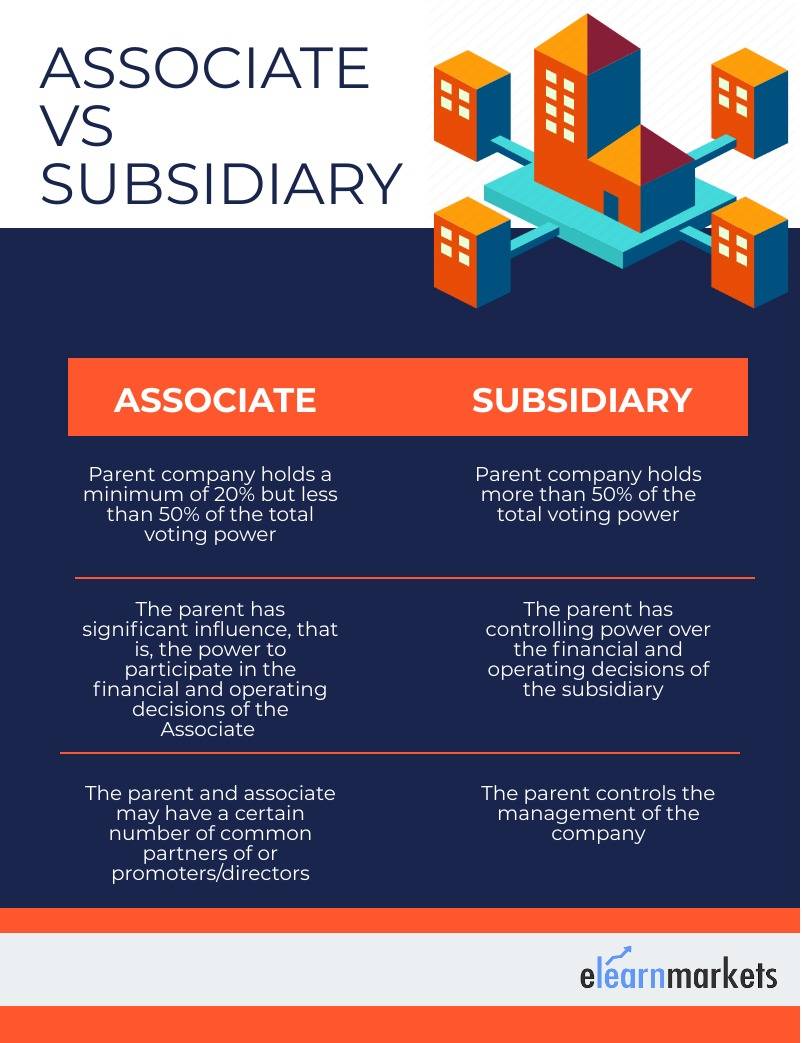

- The parent does not have controlling power but has a significant influence on the business activities of the Associate. The parent needs to have a minimum of 20% and a maximum of 50% of total voting rights in the associate.

- The investments in the associate company should be classified as long-term investments and disclosed in the consolidated balance sheet of the parent. Additionally, the parent’s share of the profits or losses of such investments should also be disclosed separately in the consolidated statement of profit and loss.

- An associate allows businesses to pursue swift growth strategies and enter into otherwise restricted markets and/or business segments. It also contributes to the parent’s bottom-line performance.

| Table of Contents |

|---|

| Understanding Associate Company |

| Benefits of investing in an Associate Company |

| Live Example |

| Investors Concern Surrounding Associate Company |

The global business environment is becoming more and more dynamic. This requires companies to diversify their asset base, enter new markets and geographies to achieve technological advancement. Have access to adequate liquidity to obtain competitive advantage and sustain growth for a longer period.

This compels companies to make inter-corporate investments (i.e., investments in other companies), which could be through the purchase of shares or may involve buying the debt of another company or acquiring any company for technological advancement.

Sometimes companies may prefer partial ownership and may opt to own a minority stake along with significant influence, but not control, over the investee’s business.

`

Thus, the parent acts as a Minority Active investor. That is, it limits its ownership to more than 20% however less than 50%. The concept of “Associate Company” comes into play when such an ownership pattern is followed by the parent company.

Understanding Associate Company

- Associate company [Sec 2(6) of Companies Amendment , 2017] concerning another company, means a company in which another company has a Significant Influence, but which is not a subsidiary company of the company and includes a joint venture company.

- Under this, the term “significant influence” means control of a minimum of 20% but less than 50% of total voting power by the investor company or control of or participation in business decisions under an Agreement.

- Thus, in the broadest sense, an associate company is one over which the parent company has significant influence, having the power to participate in the financial and operating policy decisions of such company, to obtain benefits from its activities.

- The financials of Associate Company, whether Indian or Foreign, will be covered under the Consolidated Financial Statement (CFS) of the parent. The parent company should also disclose the proportion of ownership interest and, if different, the proportion of voting power held by it.

- Associate Company is accounted for in the consolidated Income Statement as a share of profit of associate (net of tax) and also accounted in Cash Flow Statement under the cash from operations section.

- Unlike minority interest, the value of an associate company is not included in the calculation of Enterprise Value. This is because it reflects the claim on assets consolidated into other firms, and not actively being part of the investor company’s core business operations.

Benefits of investing in an Associate Company:

- Investment in an associate company acts as a simple means of entry for companies seeking to enter into newer markets and trying to make foreign direct investments, which otherwise may not be possible.

- At times, it may not be feasible for a company to acquire a controlling stake in another company, especially in a competitor. In such a situation, an Associate makes a prudent investment option. Moreover, the investor company also has the opportunity to increase the shareholding up to a controlling interest in the future.

- The companies can have the shared benefit of improved production capabilities, technological and research advancement, financial support and others.

- Thus, an associate company contributes to the profitability of its parent company and also helps to create value for such a company.

Live Example:

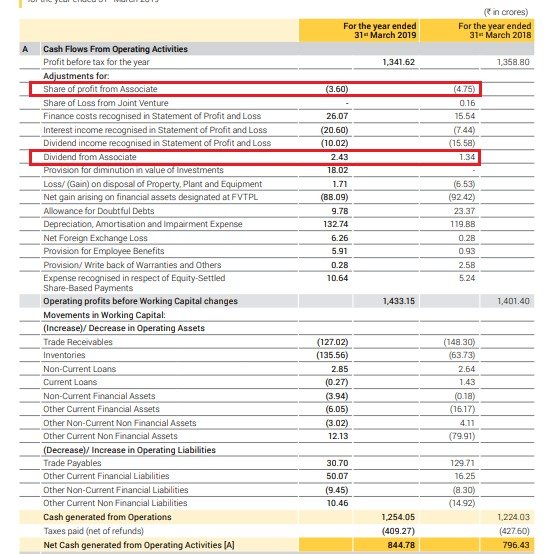

The consolidated financial statement includes the share of profit/loss of an Associate Company, in the proportion held.

The notes forming part of such statements (in annual report) provide detailed information regarding the Associate Companies and their contribution to the financial performance of the Investor company.

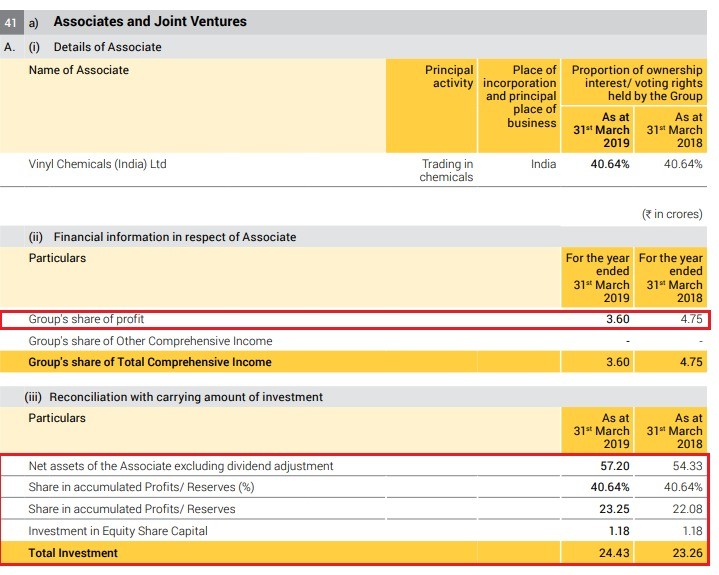

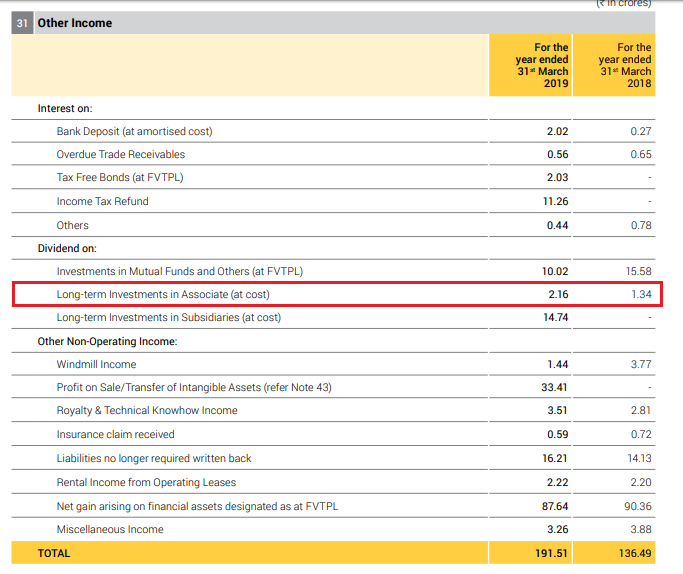

Here we have taken the example of Pidilite Industries Limited which has Vinyl Chemicals (India) Limited as its Associate Company. The calculation and explanation surrounding the same can be well understood through the excerpts taken from the company’s Annual Report.

The proportion of ownership interest/voting rights held by Pidilite Industries in Vinyl Chemical (India) is 40.64%.

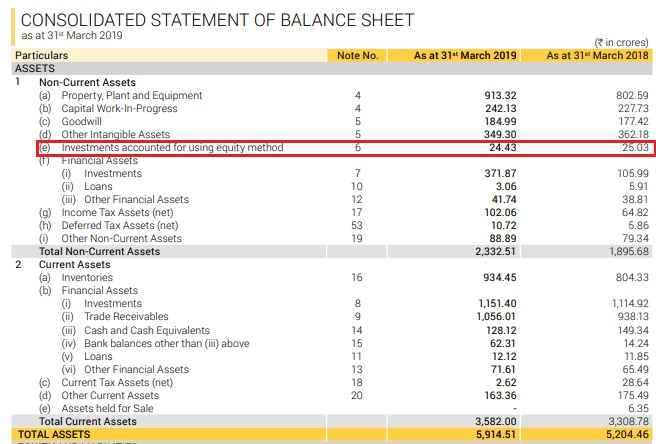

1. Impact on Consolidated Balance Sheet:

Here, we see that the investments made in Vinyl Chemical (India) forms part of “Investment accounted for using equity method” under Non-Current Assets.

“Investment accounted for using equity method” includes:

(i) Amount of investment in associate = Rs 1.18 crore

(ii) The proportionate share in Vinyl Chemical’s net asset = 40.64% of Rs 57.20 crore

= Rs 23.24 l

Suggested Read: Consolidated financial statements: How to better analyse a company

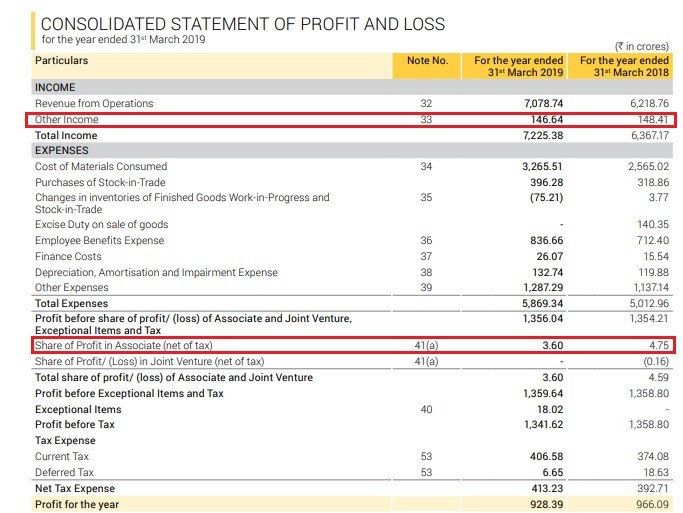

2. Impact on Consolidated Profit and Loss Statement:

The dividend income received from the associate, ie., Rs 2.16 crore is added to the other income. Thus, aiding the Total Income of the company.

The profit made by the associate is reported on a proportionate basis and contributes to the investor company’s bottom line growth. That is, 40.64% of Rs 8.86 crore = Rs 3.60 crore.

Thus, the associate company contributed to an extent of Rs 5.76 crore to the company’s overall performance.

Suggested Read: Major loops between Standalone v/s Consolidated Financial Statements

3. Impact on Consolidated Cash Flow Statement:

The profit of the associate, on a proportional basis, is treated as a non-cash item and therefore it is deducted in the cash from operations. However, the dividend income from such an entity is added to the cash from the operations of the company.

Investors Concern Surrounding Associate Company:

Over the years, one of the major concerns surrounding the financials of a company is its multi-layered company structures, one being an Associate company.

There have been instances of money laundering or fund diversion by building complex structures using an associate company. This is mainly done through loans and investments made by the parent in the associate company.

Some companies invest in foreign associates, especially in countries like Mauritius, Panama, and Singapore. Mostly such foreign associate is either dubious or lacks independence. The parent enjoys tax benefits and may also divert funds through the foreign associates by giving loans to them and then writing off such loans as non-recoverable.

Sometimes the parent may not provide a true and fair view of the associate company’s financials, thus misrepresenting its group’s financial situation.

This impacts the interest of all stakeholders, especially retail investors.

A few examples can be used to understand how a lack of checks and balances in corporate governance, has led some companies to misuse the concept of Associates to divert or siphon off the funds.

(i) DHFL– The housing finance company’s promoters and its associate companies have siphoned off money through bank loans of Rs 97,000 crore. The parent transferred money to the Associate as capital advance from 2009-10 to 2010-11. However, during the said tenure these companies failed to show expenditure or revenue or any execution of work in their financial statement with the associate.

(ii) Bhushan Steel– The company transferred funds of about Rs 1770 crore of the total scam amount to its associate companies as capital advance. The parent then transferred amount from the head, Capital Advance to the head Capital Work In Progress in their books of accounts, thus ‘adjusting’ the receivables from 32 associate companies.

However, from 2009-10 to 2014-15, these companies showed no expenditure or revenue or any execution of work in their financial statement.

Moreover, the company directors, who had signed the balance sheet of the companies, were unaware of the business activities.

To avoid investing in such fraudulent companies the investors should:

- Review and analyze the related party transactions that are published by the company from time to time. This clearly states the financial transaction (operational) made between the parent and the associate.

- Review the parent’s exposure in terms of its net worth, to its associate. This includes exposure to share capital (equity and preference), corporate guarantee to bank facilities and loans and advances made to such entities.

To know more about how to prepare financial statements of a company you can take our online course: Certification in Online Equity Research Analysis and for offline course you can click here: Certification in Equity Research Analysis.

Great content! Super high-quality! Keep it up! 🙂

Hi,

Thank you for reading!

Keep Reading!

Keep functioning ,fantastic job!