The Insurance Regulatory and Development Authority (IRDA) has proposed new major changes in IRDA Regulation 2018 for better need-based usage of the products and increased benefits for the end consumers. The main reason was that from the past few years the industry executives imparted various suggestions to improve the current product regulations in order to be in line with the dynamic needs of the present insurance market environment which invariably excludes global insurance market dynamics.

Changes and Benefits of the Drafted Proposals of IRDA Regulation 2018:

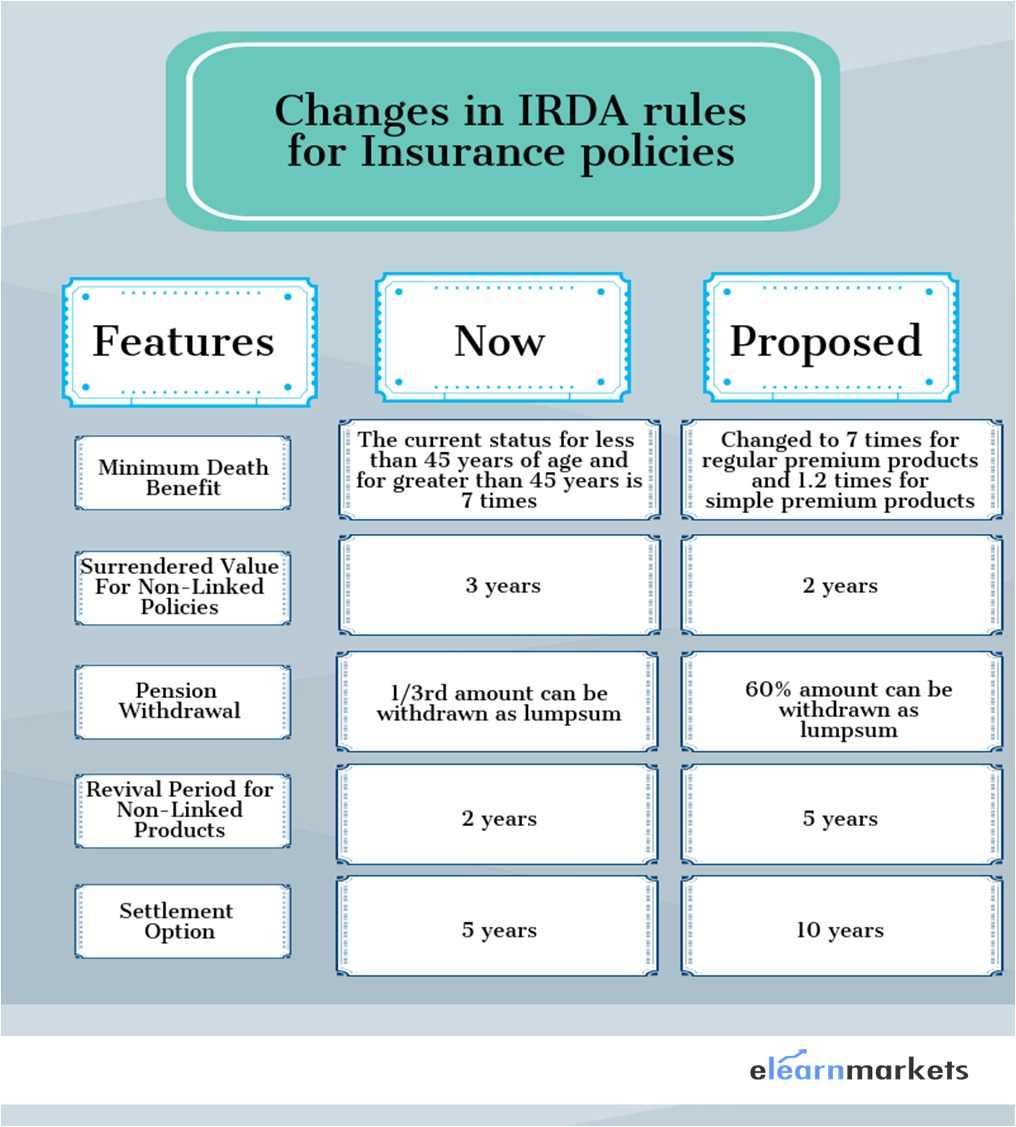

1. The Minimum Death Benefit has been changed to 7 times for Regular Premium Products and 1.5 times for Single Premium Products for all age groups:

The present status of minimum death benefit for age less than 45 years is 10 times and for more than 45 years is 7 times. But now in the drafted proposals, it has been reduced from 10 times to 7 times for Regular Premium Products and 1.5 times for Single Premium Products. The main reason behind this change is that the amount invested by the policyholder could be invested in markets which in turn will help in building higher corpus rather than getting deducted for the mortality charges.

2. The Non-Linked Policies will acquire guaranteed surrender value after 2 years:

Earlier the surrender value could be opted for after 3 years of policy in force but now it has been reduced to 2 years which will help the customers to take quick investment change decisions. The customer can withdraw the amount after holding it for 2 years.

Also Read : 5 Ways to Evaluate Life Insurance Companies

3. In respect of Non-Linked Policies, the revival period has been extended to 5 years from the present 2 years:

The restoration period of the discontinued policy with all the benefits covered is made unavailable after 2 years if the policy is discontinued due to the non-payment of the premium for the period of two years. But now it has been increased to 5 years. If the policyholder’s financial ability is sorted, they have now 5 years to revive the policy.

4. The option of computation upto 60% pension is allowed in respect of pension products:

Presently one can withdraw 1/3rd as the lump sum amount and 2/3rd of the amount is annuitized. But now one can withdraw upto 60% of the corpus. This is a good change for the policy holders as it will provide more flexibility and this will make the policy at par with National Pension Scheme.

5. For Linked pension products, facility for partial withdrawal is allowed:

Now the policyholder can partially withdraw the lumpsum from their linked pension products. Earlier it was not allowed.

6. Open market options are allowed in respect of annuities:

Now the IRDA has opened annuity products to all insurance companies. Earlier policyholders had to buy annuity only from the pension product provider.

7. The settlement option period has been extended to 10 years or original policy term, whichever is lower:

The period of settlement which is available to the policyholder to receive the maturity or death is 5 years. But now it has been extended to 10 years from the date of maturity or the original policy term whichever is lower. Therefore the policyholder will get more years for settlement in case of a mishap.

8. During Settlement period switches are now allowed:

Earlier switches in the settlement period were not allowed but now IRDA has proposed switches during the settlement period which will help Unit Linked policies’ customers to manage their funds better in a volatile market.

Know more : Future of Life Insurance

9. Insurers are now allowed to design individual term, group term, credit, and micro insurance products:

The policyholders are now allowed to design individual term, group term, and micro and credit insurance products which will give many benefits to the policyholders.

10. Group products governed by provisions are modified to allow a wider range of products based on the requirement of customer:

IRDA has introduced provisions for governing group products which are allowed in order to allow a wider range of products based on consumer demands.

11. Linked Variable Products is removed as Linked Product Structure

The category of linked variable products will be removed as linked product structure will address the requirements of the policyholder in a better way. It will provide more transparency and flexibility by giving an opportunity to the policyholders to invest in these insurance plans.

Watch the video below to know more about Changes in IRDA Policies:

Bottomline

All the proposals as drafted in IRDA Regulation 2018 are designed to provide benefits to the policyholders as discussed above.

In order to get the latest updates on Financial Markets visit Stockedge

revival period must increase to 5year

My I revive that policies which have already laps for not payment between two years grace period ?. table no- 814, 815, like that

Hi,

This is just an informative blog.

Thank you for reading!

Keep Reading!

Very useful

Hi Palak,

Thank you for reading!

Keep Reading!

Hi,

Thank you for Reading!

Keep Reading

I got information running rules & regulations of irda

Hi,

Thank you for reading!

Keep Reading!

How to revive lic policy. Plan no. 820

Hi Runu,

This is an informative blog on the Proposed changes in rules of insurance policies.

Thank you for Reading!

Keep Reading!