Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

Rights Issue of shares is Corporate Action that is taken by a company to increase its capital by issuing new securities to its existing shareholder base.

Recently we all have heard about Reliance Industries Ltd.’s rights issue of Rs. 53,125 Crs, the biggest equity fundraising in the Indian capital markets.

As a first-time investor in the stock market, you would want to know about the rights issue of shares.

Well, your search ends here as we will be discussing the concept of the rights issue in detail.

What is the Rights Issue of Shares?

The rights issue of shares is basically a way through which a listed company on the stock exchange raises additional funds. It is an invitation to the existing shareholders to purchase additional new shares in the company.

In the right issue, the new shares are being issued and offered to the existing shareholders of the company at a discount to the current market price.

The shareholders have the right but not the obligation to subscribe to the newly issued share in proportion to their existing holdings.

They also have to check out the record date and ex-date for the subscription. Beyond this, the subscription becomes null and void.

For Example:

Reliance Industries Ltd. has proposed the rights issue of shares in the ratio of 1:15

It means Reliance Industries Ltd’s shareholders can subscribe to 1 equity share for every 15 equity shares held by eligible shareholders as on the record date. The right issue price is Rs. 1257. It is about a nearly 14% discount on the company stock’s price of Rs. 1466 as of April 30, 2020.

Let us suppose, investor A already owns 90 shares of Reliance Industries Ltd at Rs 1400.

The company set a conversion rate of 1:15, meaning that investor A can buy 1 discounted share for every 15 that he currently owns. As a result, the investor could buy 6 (90/15) more shares for Rs. 1257.

So now his cost for a total of 96 shares would be:

(90*Rs1400) + (6*Rs1257)

= Rs 1,33,452

So now one share would cost him 1,33,452/96

=Rs 1,391

So now his actual cost price for 90, as well as other shares, comes to Rs 1,391and the closing price is Rs 1,466.

Is it necessary to subscribe to rights issue?

There are 3 options that one can follow if one is holding shares of a company that has announced a rights issue of shares.

The first case – One can apply for the rights issue known as exercising rights in this case at Rs 1257 when the closing price was Rs 1466

Second Case – One does not want to apply for the rights issue so does not exercise

Third Case – One sells its rights issue to someone else also known as renouncing its rights.

So Renouncing means that you being a shareholder does not want to apply for rights so you sell the form of your right to someone whom you know for a discount and who does not own Reliance shares. So now he will get 6 shares at Rs 1,257.

So, in this case, the discount to market price is 14% and you sell your rights to another person who wants to apply for a rights issue of shares with 10% discount so you can earn 4% on the renounced rights share.

So you earn Rs 301.68 as a 4% commission on 6 shares applied at Rs 1257.

So now your holding cost for the 90 shares at Rs 1400 was Rs 1,26,000 so now your cost comes down to Rs 1396.65 per share. So had you applied your cost would have come down to Rs 1391 but since you wanted to renounce it came down only till Rs 1396.65.

So, in this case, you get more discounts by subscribing to the rights than renouncing them.

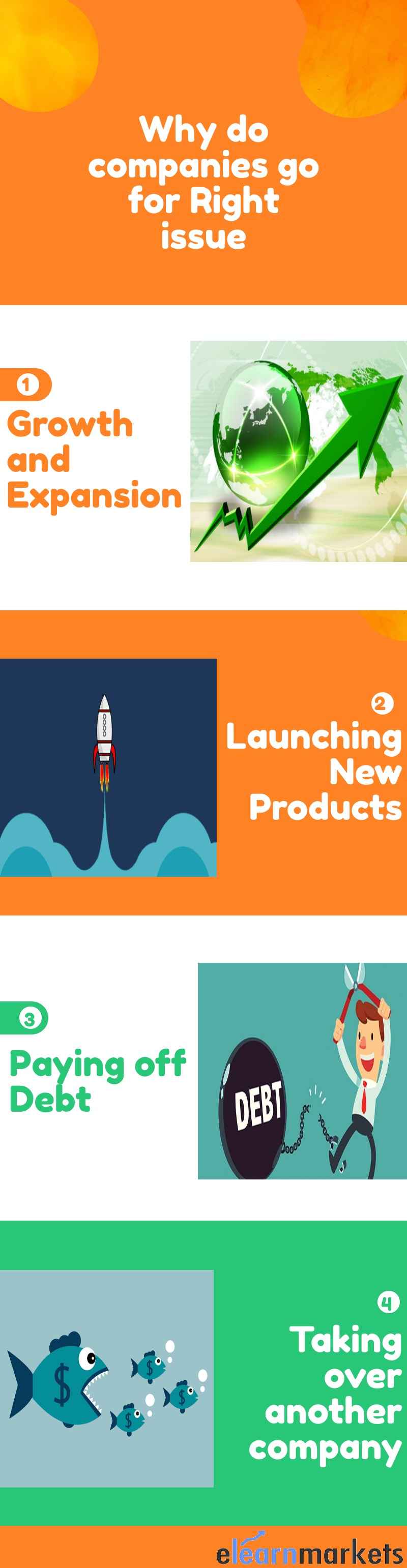

Why do companies go for Rights issue?

Companies go for the rights issue of shares to raise funds for:

- Growth and Expansion.

- Launching new products.

- Paying off debt.

- Taking over another company (Acquisition).

An investor should check out the reason for the rights issue before opting for it. He should also make sure the company has strong earning visibility and credible management.

Like in the case of Reliance Industries Ltd., the Company is raising capital for paying Debt i.e., Balance sheet Deleveraging.

Advantages and Disadvantages of right issue:

Advantages of right issue

- The shares are offered to the shareholders at a discounted price. So it is an opportunity for the existing shareholders to increase their stake in the company at a lower price thus decreasing their holding price average for the company.

- For the company, the Right issue is one of the best ways to raise capital without incurring additional debt from the banks on high-interest rates thus cutting on the Finance cost for a Company.

Disadvantages of right issue

- If the shareholder doesn’t subscribe to the rights issue then the company may fail to achieve its target.

- The promoters can raise more money from FPO etc than from rights as they can raise rights only in proportion to their existing Equity value.

- If a stronger Balance Sheet company is going for the right issue of shares, then it goes on to create a negative market sentiment for that particular company. It is assumed that the company is struggling to run its business operations smoothly.

- Due to rights issues dilution of Equity happens thus those who do not want to subscribe to the rights find their percentage of holding getting reduced due to the allotment of new shares.

- There is a time lag between rights shares issued and transferred to the holder account thus the same percentage of discount might not be availed while selling the rights shares.

How do you apply for the right issue?

There are two ways to apply for the right issue:

- If your bank supports ASBA (Application Supported by Blocked Amount), you can apply online just like an IPO.

- If your bank doesn’t support ASBA, then you would have received a courier of the Composite Application Form (CAF) from the RTA (Registrar and Transfer Agent) of the company.

Key Takeaways:

- The rights issue of shares is basically a way through which a listed company in the stock exchange raises additional funds.

- An investor should be able to look beyond the discount offered. He is paying money to get an additional share so, he should subscribe to it only if he is completely sure of the company’s performance and future potential.

- EPS, book value per-share metrics decline because of the higher number of shares.

- If the promoter is taking part in the Rights Issue of shares then it can be a positive sign.

Having understood about the Rights Issue of shares are you ready to apply in it? Let us know by commenting below:

Happy Learning!

good

Hi,

We really appreciated that you liked our blog.

Keep Reading!!