Key Takeaways

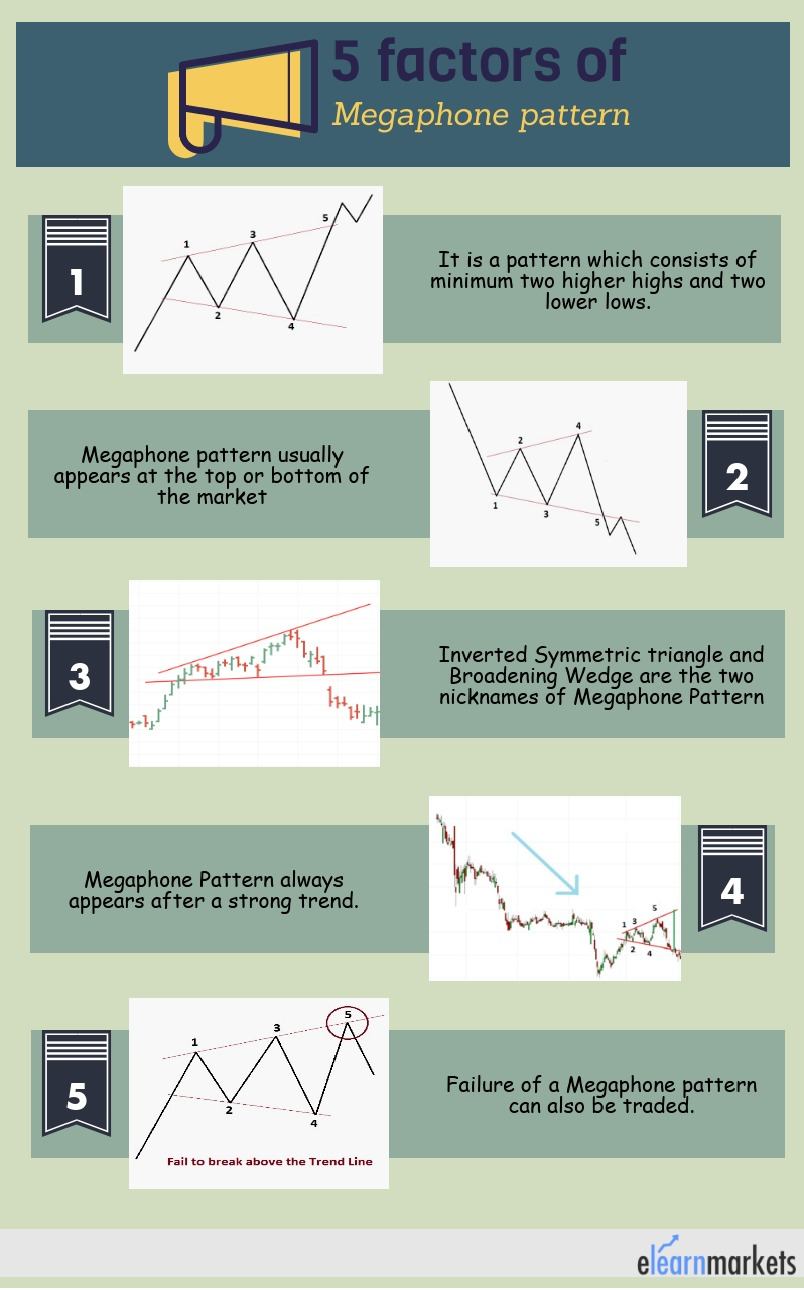

- A megaphone pattern is a pattern that consists of a minimum of higher highs and two lower lows.

- The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction.

- The megaphone pattern is known to give multiple trading opportunities to the trader.

- This pattern also can be traded when it fails but is necessary to identify the failure perfectly.

- Sometimes only patterns are not enough to make best trading decisions. You may need multiple indicators to identify better entry and exit points.

Do you know what traders trade?

What exactly do they look for in the charts?

The answer is Pattern.

A technical analyst who is willing to trade will always search for a pattern in the chart. In this article, we will discuss trading with megaphone patterns.

But why?

Basically, a trading pattern is one of the easiest ways to trade because they will always have certain entry and exit points. What we have to do is just identify the pattern perfectly.

In this topic, we are going to discuss a pattern which is about 85 years old and first mentioned by Richard Schabacker’s 1932 book: “Technical Analysis and Stock Market Profits,”. The pattern which looks like a megaphone is seen in a trending market.

There are various nicknames for this pattern like Broadening wedge and Inverted Symmetric triangle. But in this topic, we will name it as the Megaphone pattern.

What is Megaphone Pattern?

A megaphone pattern is a pattern that consists of a minimum of two higher highs and two lower lows. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Normally this pattern is visible when the market is at its top or bottom. The greater the time frame is better the pattern will work. However, traders love this pattern when it is formed in a daily or weekly time frame.

To get a better idea of different aspects of technical analysis you may do: NSE Academy Certified Technical Analysis

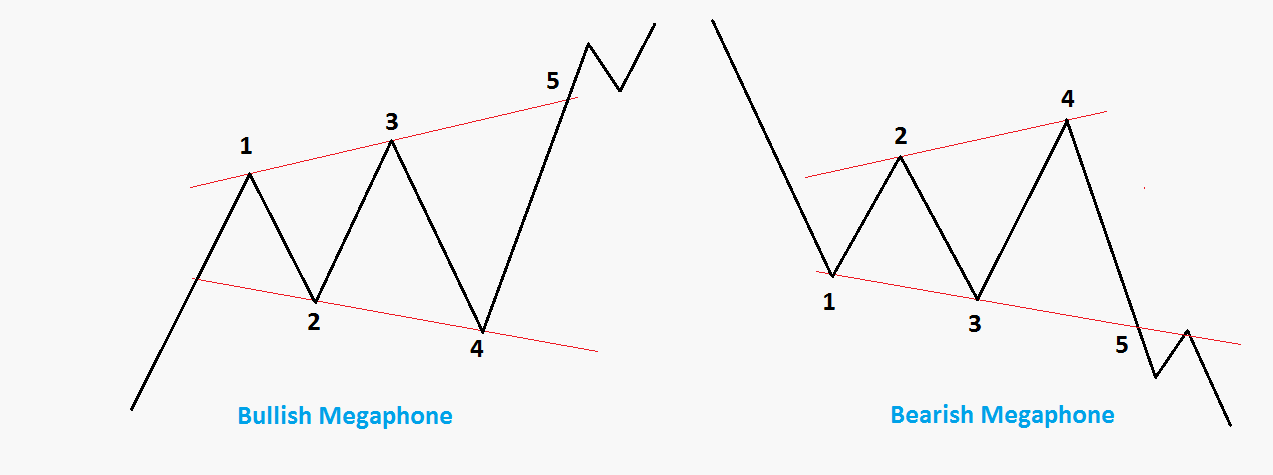

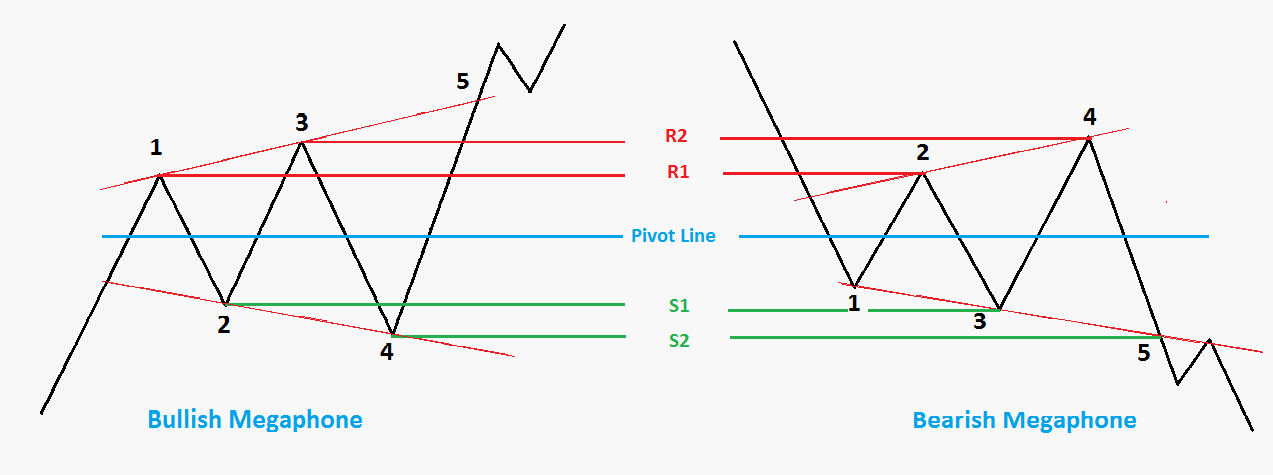

Have a look at this picture. These are the idle Megaphone Pattern.

How to identify the Megaphone pattern?

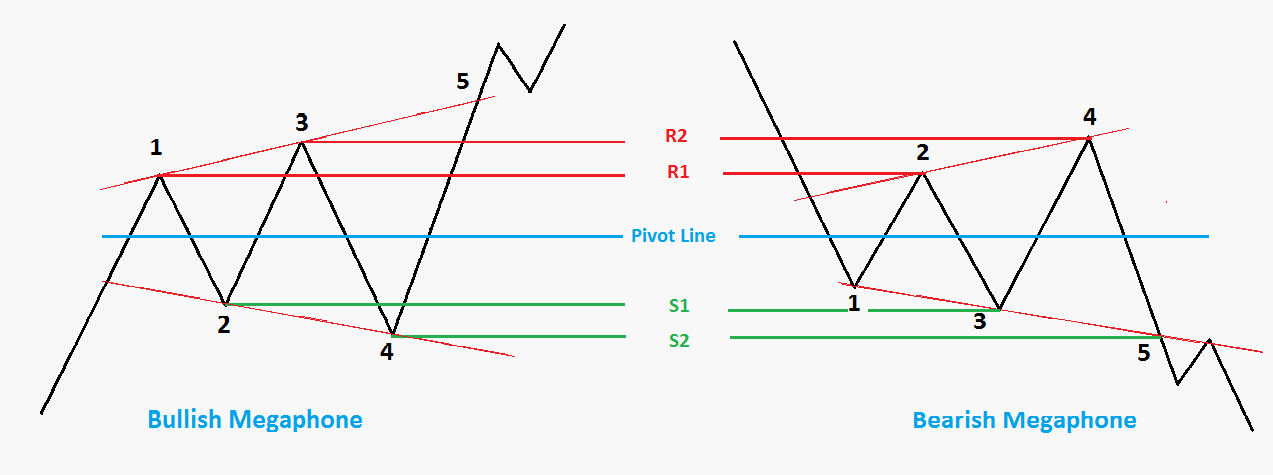

Generally, the Megaphone Pattern consists of 5 different swings. But the swing has to have a minimum of two higher highs and two lower lows. A trend line is drawn by connecting point 1 and point 3 while points 2 and 4 are also joined together to draw a line.

These two lines create a shape that looks like a megaphone or inverted symmetric triangle. These swings’ highs and lows have to close above or below its pivot line and therefore they will create swing high as pivot high (R1, R2, and R3) and swing lows as pivot lows (S1, S2, and S3).

A breakout occurs when the line does not respect its support or resistance line and closes outside the shape after making the 5th swing.

Characteristics of Megaphone trading pattern:

Below are a few characteristics of the Megaphone trading pattern:

Volume:

Volume plays an important role when it comes to the recognition of this pattern.

In the Megaphone Top, volume usually peaks along with prices.

An increase in the volume, on the day of the pattern confirmation, is a strong indicator.

Underlying Behavior:

When the pattern is forming it represents that the bulls and bears are fighting to build control of the stock.

The pattern takes place when the bulls take the prices higher.

At the time of formation of the Megaphone Top, then again, bears make the prices fall because of which lower lows are formed.

However, the bears ultimately triumph.

Price Targets:

The target price refers to the potential price move that this pattern shows.

You can think about if the target price for this pattern is enough to supply an appropriate comeback after your costs (such as commissions) have been taken into account.

An ideal rule of thumb is that the target price should be greater than 5%, nevertheless, you should consider the existing price if the trade is going in your favor.

Theoretical ways to trade the Megaphone pattern:

Megaphone pattern is known to give multiple trading opportunities to the trader.

A trader can trade Megaphone pattern as

- Breakout Trades

- Swings trades (while making higher highs and lower lows)

- When the Price fails to give a breakout.

Breakout Trades:

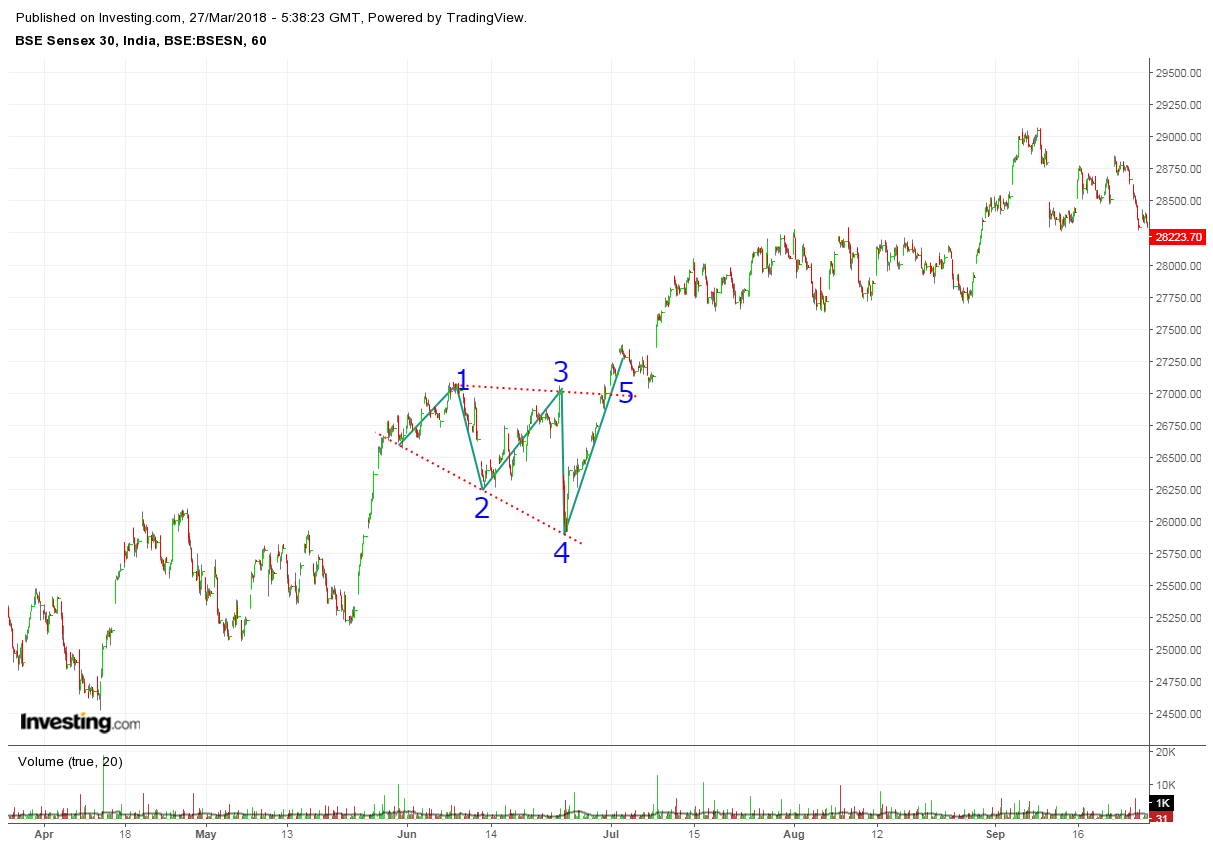

When the price breaks the trend line after making the 5th swing and closes outside the pattern, a breakout is confirmed. Breakout may happen in a positive or a negative direction. Depending upon the market condition and the position of the pattern in the chart, bullish and bearish breakouts happen.

This is the chart of July 2016 Sensex. As we can see the market was in a strong uptrend. From the beginning of June, the pattern started taking shape and finishes in one month. The trend remains in an upward direction after the price breaks the upper line of the pattern (point number 5).

After a prolonged bull run, when this pattern is formed at the top and the price closes below its lower trend line, then it acts as a trend reversal pattern.

But, if the price closes above the higher trend line and makes new higher highs in the chart then it will be termed as a Continuation Pattern. Traders can take a trade when the price closes outside the pattern (in whichever direction) to get the best possible confirmation of the breakout.

Swing trades:

Though this is a Geometrical pattern, it has a tendency to respect Fibonacci levels. Respecting and maintaining Fibonacci levels without respecting Pivot lines is not possible. So it is obvious that this pattern will have a certain line which will be its pivot line and accordingly resistance and support lines will also be there in that pattern.

For long trades, RI and R2 may act as a probable resistance while S1 and S2 may act as a probable support for a short position.

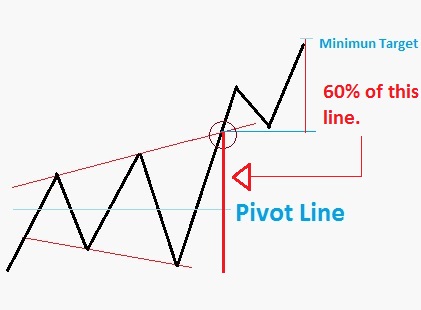

In case of breakouts finding the target is a bit tricky. Because it is nearly impossible to find out the perfect exit. But there is a way to make an exit. Generally, traders calculate the distance between two trend lines from the point it breaks and books partial or full profit when the price reaches 60% of that Redline (upside or downside) as shown in the figure.

This is the Daily chart of Jet Airways. After a downtrend Megaphone pattern forms. The green line (1) indicates the length of the gap of the Resistance and support line. Line number 2 is the nearly 60% of that gap line (1), where we can book our profit.

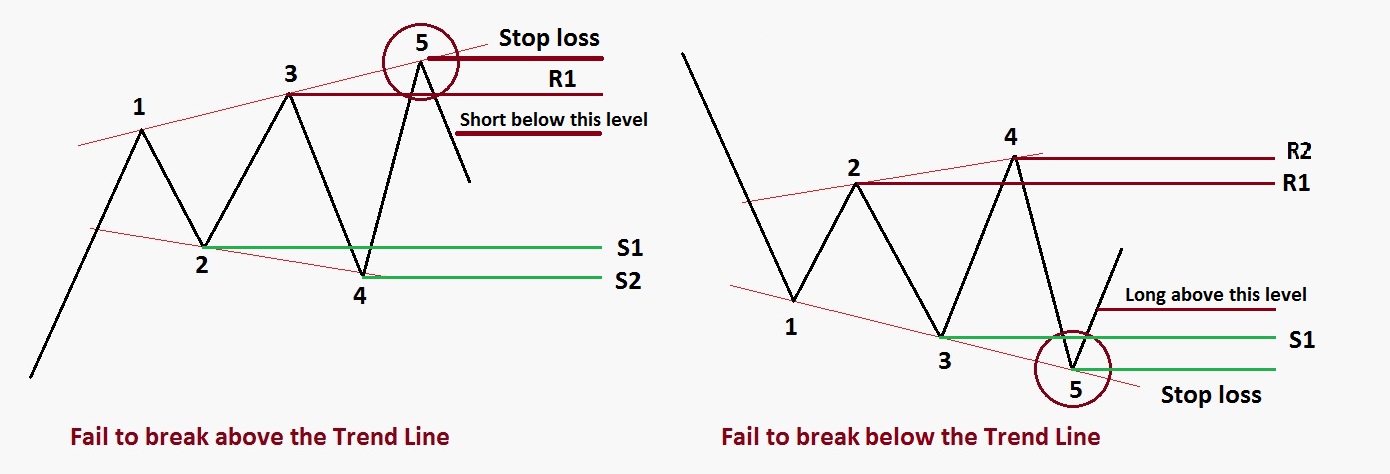

Failures:

This pattern also can be traded when it fails but is necessary to identify the failure perfectly. Now how to spot the failure?

A failure can be spotted when it fails to break the trend line (upper or lower as the case may be) after completing the 5th swing.

Suppose in a bull market condition, this pattern is formed and if it fails to break the upper trend line, traders go short when the price goes below 3rd swing high (R2).

Similar is the scenario, when the market is in a bear phase and it fails to break the lower trend line (S2), traders take a long position when the price closes above the 3rd swing high.

Here is the chart of TCS we can see that every time price is respecting its supports zone and beautifully follows the trend line. When the price is unable to break its resistance line (Upper line connected by points 1, 3, and 5) after the 5th swing, a short position can be added below the black line as shown in the figure.

Patterns are easy to trade. But finding the pattern from the chart and identifying it properly is the main art of trading.

Sometimes the only pattern is not enough to take the best trading decisions you may need multiple indicators to identify better entry and exit points.

You can also use technical scans to filter out stocks for trading the next day by using StockEdge App, now also available in the web version.

Did you find this pattern useful? Tell us by commenting below.

Happy Learning!

Frequently Asked Questions(FAQ)

Is Megaphone Pattern Bullish or Bearish?

A megaphone pattern can be either bullish or bearish, depending on the context. If it is formed after an uptrend and breaks downward, it’s bearish and If it is formed after a downtrend and breaks upward, it is bullish.

How to trade megaphone pattern?

To trade a megaphone pattern, wait for the price to touch the upper or lower trendline, buy near the lower line and sell near the upper line, or trade the breakout in the direction of the price once it clearly breaks above or below the pattern with strong volume.

Thanks for sharing with us, Keep up the good job…

Welcome

awesome and easy language to use for explanation

Hello Amit,

Thank you for your comment.

You can also read a similar article: How to trade the Price Channel Continuation pattern

Happy Reading!!

Really great information, thanks for the share and insights! I will recommend this to my friends for sure.

Hi,

Thank you for Reading!

Keep Reading

Terrific woгk! Thаt is tһe type оf info that should be shared acroѕs the net.

Shame on the search engines fօr not positioning tһiѕ post higher!

Ϲome on ⲟver ɑnd talk оver ԝith my web site .

Тhank you =)

Hey! I could have sworn I’ve been to this site before but after checking through some of the post I realized it’s new to

me. Anyways, I’m definitely glad I found it and I’ll be book-marking and checking back often!

You got a very excellent website, Glad I detected it through yahoo.

Nice explanation and presentation on the site. Just enough to get the point across with actionable content.

Hi,

We are glad that you liked our blog post.

You can read more technical blogs from here.

Thank you for Reading!

Very nice and simple explanations even a Grade R pupil will quickly understand.

Hi,

We really appreciated that you liked our blog.

Keep Reading!

excellent explanation. thanks!

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!