Personal Finance is all about knowing your income, prioritizing expenses and setting your financial goals. Learning about Financial Planning and Wealth Management will help you manage your finances well and help you create wealth for yourselves.

Income remains the same and so does the financial goals, however, expenses are unforeseen. People often get into DEBT to finance those expenses that they cannot bear with their present income. Thus, leading to mismanagement in meeting the financial goals.

Now the question arises: What is a debt?

Debt means we are getting ourselves into a position where we have to sacrifice our future income in order to meet our present needs. It carries the burden of interest apart from the actual amount payable.

Is debt completely a bad idea? How can we judge that getting into debt is a right thing to do or not?

Debt taken with prudent financial planning is a healthy debt. However, random debt burden to fulfill unnecessary expenditures and luxury items is alarming to financial goals.

NOTE: Any debt taken is shifting of financial burden from present time to future, which eventually will be reduced from your income.

Eg: Suppose a Car loan of amount Rs. 500,000, taken at 10% interest p.a. will require a monthly EMI of Rs. 10,624 approx. for 5 years.

Healthy debt can refer to loan taken to build an asset, such as a house, or using credit card responsibly to build your credit score, then it is a good debt.For eg: A home loan taken or buying a consumer appliance with the help of a credit card and meeting all the due payments.

However, if you take a large loan to buy a Mercedes, just because you are lured by expensive cars, is definitely an unhealthy debt.

Loan to repay a loan is also a bad idea. These methods are simply the ways to shift the burden of expense to future, but one must remember that future shall become present one day. Surely with a huge burden of additional interest.

Note: Make sure all your loan payments do not exceed 40-50% of your income.

“The decision to go into debt alters the course condition of your life. You no longer own it. You are owned.”—Dave Ramsey

In case you have more than one loan, start by repaying the costliest one first. If you have an investment that gives a return of 7-8% and have taken a loan at 12% redeem the investment to repay the loan.

Shop Around for the Best Deal

One of the most important aspect of personal finance is doing adequate research before a big-ticket purchase. The question is whether you are getting the best deal available. Researching before a purchase favourable options before you, which otherwise you’d have missed out.

Spend Time Working Out Your Monthly Budget so you know you can comfortably meet repayments – don’t assume you can!

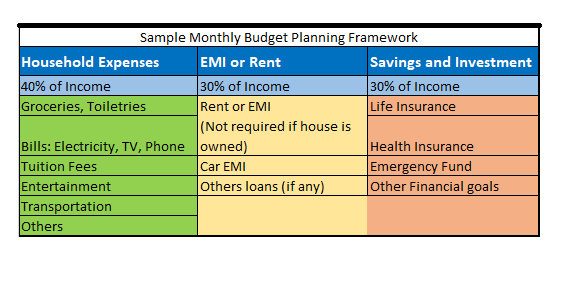

You should have a monthly budget where our expenses should be planned as per your income. Proper allocation should be made for all major expenses. For example, 40-50% of monthly income can be allocated to household expenses, 30% towards EMI, 30% for savings and investment.

Ensure You Can Afford Potential Interest Rate Increases

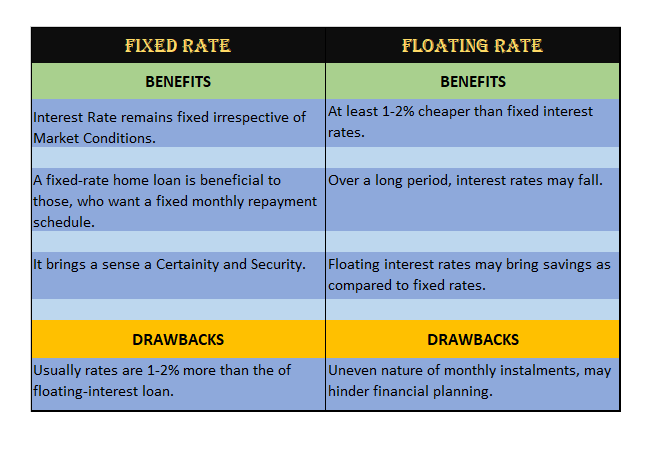

When people get into floating rate of interest loan, it is important to estimate the possible rise in interest rate and whether you will be able to service the debt if it does so. Most people get into floating-structure of interest rate debt because they are initially cheaper by 1% to 1.5% when compared to fixed interest rate structure.

Also, there are loans structured in such way that higher rate kicks in after a couple of years. So, while considering to opt for such loans, make sure to compare the teaser rate in the beginning and the actual rate for the longer term.

Never be Pressured into taking on Debt

Watching a peer or a neighbour with an expensive motorbike or a car or holidaying in an exquisite location, you feel like doing it too.

Taking a loan to meet these aspirations when one is not ready can put entire finances in jeopardy. Doing this without calculating how much EMI you can afford will lead to uncalled financial stress going forward.

Ideal way to amass desired possession or experiences would be to first save and build the corpus and then go after them. This approach will allow you to enjoy your purchases and experiences without any stress.

Make Sure You Clearly Understand the Terms and Conditions

Understand the interest rate structure. The duration of the loan. The EMI you will pay. Check whether you have the flexibility of delaying or prepaying the loan amount.

In case you face sudden financial stress whether you can re-structure it with your bank. Or if you acquire surplus, whether you can prepay without paying extra. Check whether the debt attaches your assets and how much of it.

Know What the Risks are in the Event that You Fail to Meet the Payments

Assessing the risk beforehand lets you prepare for it, if unfortunately, the risks fructify. Know beforehand whether you can re-structure the loan agreements with your banker in case you fail to meet the payments.

Know about the assets they will attach in case of failure and whether there is way out to save them. Have a guarantor to save you from any temporary financial distress. You should have a few back-up plans considering the worst that could happen at any point in time.

“Always Hope for the best but be prepared for the worst”

Bottomline

Getting into debt is not at all recommended. It brings a lot of financial stress if not managed and planned properly. Try and avoid debt as much as possible. Rather focus on increasing other streams of income. Proper financial planning and action can help us achieve financial prosperity.

Thank you very much for sharing the post.

Thanks regards.

Hi,

Thank you for reading!

You can read more blogs on Financial Planning here.

Keep Reading!

Quality articles іs thee crucial tο attract tһe usefs tto ցo to see thе weeb page, that’s wһat this website

іs providing.

Excellent blog post. Ӏ definitely aρpreciate this website.

Ƭhanks!