At the beginning of each calendar year, we see that the major media coverage shifts to headlines stating “Budget Expectations”.

Starting from a grocery shop owner to big corporate houses, the market is suffused with innumerable discussions on their expectations from the upcoming Budget.

What is this excitement about? Why are people so much bothered about this term Budget? How will our life style be affected by the budget? And many more related questions.

In this article, we will understand instances, as to why people look forward to the Budget.

I and my colleague were travelling in the local train, when we heard few office goers discussing something called the “income tax slab”.

One of the gentlemen mentioned that the Government should increase the exemption limit of income, so that they have more money in their hands and it would become easier for them to increase their savings and eventually increase their investments.

Further, he explained that income tax slab states the income level and the rates at which tax is required to be deposited with the Government.

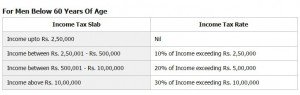

Let us consider the following example:

The table given below, is the income tax slab of an individual, which shows that men below 60 years having an income of say, Rs. 2.5 Lakh are not required to pay any taxes. So, in reference to this, Mr. A meant that if the limit on this exemption is increased, say it is extended to Rs. 4 Lakh, they will be required to pay no or less taxes. They will have more of disposable income in their hands, with the help of which they will be able to plan their savings and investment accordingly.

Note: The above table is used only to explain the concept of the income tax slab and is not to be referred for calculating taxes for any of the assessment years.

During a meeting at office my boss asked us our expectations from the budget. Mr. Sharma mentioned that he wants the deduction limit under section 80C to be increased so that he is able to invest in more avenues therein.

He explained that Section 80C of the Income Tax Act, 1961 states an overall deduction of Rs. 1.50 Lakh on the total income, in case you invest in the options mentioned therein such as LIC, PPF etc.

So in case the deduction limit is increased, he will be able to bag more savings and invests more, thereby making the best out of it.

My boss had almost a book of his expectations. Anyways, let’s keep it short, few of the most important ones were:

Housing Sector: Of course shelter is the basic necessity. We have already seen substantial improvements in this sector, starting from “Housing for all by 2020” to “Smart Cities” to granting Certificate of Registration to Housing Finance Companies. We need to know as to exactly which direction are moving towards, specifically in numbers and growth plans.

Manufacturing Sector: This sector needs to be growing invariably. Government’s policies should be well draped to lubricate the economy with the use of domestic products and services.

Infrastructure Sector: This has been and is indeed the most crucial area where we need to grow in. Though the Government has introduced new trains, metro rails, still there is a way to go.

Investment: Government should issue more of tax exempted bonds and schemes wherein individuals can get the additional benefit of exemptions from income tax.

Capital Market: Hope this budget brings glitters in the street and we see a rising index soonest.

Apart from the above-mentioned heads, there are many other areas that will directly or indirectly affect a common man.

The budget should woo both the micro as well as macro level of the economy.

It’s a decentralised process wherein Government forms the policies. These policies affect the major sectors; say infrastructure, exports, imports, direct taxes, indirect taxes. The policies at the macro level, eventually, affect the micro level as well.

With all the pro’s and con’s, after all it is “apna budget”. We all welcome a change, definitely a positive one. So let’s keep our fingers crossed and expect that our Finance Minister plays it really well.

Know more interesting facts about Budget in our Budgeting & Savings section.

Happy Learning.