Bitcoin is a type of digital currency created in the year 2009.

The transaction does not involve any banks but it is created and held electronically.

It is created using software which solves mathematical problems.

It is the first example of cryptocurrency (a growing category of money worldwide).

Why bitcoins?

A Bitcoin is a cheaper alternative to existing currency since it is not subject to any regulation or tied to any country.

It does not involve any kind of credit card fees hence the small businesses or start-ups may like them.

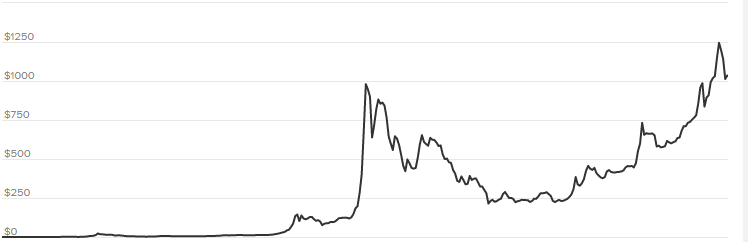

Many people even look upon it as a good investment since they are expecting a significant increase in its future price.

Characteristics of Bitcoin:

Bitcoins have several important characteristics which distinguish it from conventional currencies-

1. Its decentralized

Unlike conventional currency, the bitcoin network is not in a control of one central authority.

Every machine that mines bitcoin and processes transactions becomes the part of the network and work together.

It implies that no single authority can have influence over it.

Even if some part of the network is not operative or goes offline for any reason, the money will still be flowing.

2. Transaction fees are very minimal

The banks may charge you a hefty transaction fee for making international transfers, though bitcoin doesn’t.

Know more about Bitcoins in our free course: Get introduced to Bitcoins

3. It very fast

By the time, the bitcoin network processes the payment, the money will be transferred anywhere within no time.

4. It’s totally transparent

The full detail of every single transaction that ever took place gets stored in a general ledger known as blockchain so one can get the full detail there.

Say if you have a publicly used bitcoin address, it’s very easier to track that how many bitcoins are stored there.

5. It’s anonymous

The users will be able to hold multiple bitcoin addresses and they are not linked to addresses, names or other personal information.

How is it different from normal currencies?

1. Who created Bitcoin?

Bitcoin was proposed by a software developer named Satoshi Nakamoto.

It’s basically an electronic payment system based on mathematical proof.

The main idea was to create a device which is not dependant on any central authority, with a very minimal transaction fee and can be transferred electronically.

2. Who prints Bitcoin?

The normal currency is printed by Central Banks, which usually makes its own rules and are unaccountable to the masses.

The banks can print more money so as to cover the national debt leading to devaluation of country’s currency.

On the other hand, Bitcoin is digitally created by a community of people which can be joined by anyone. These are mined using computing power in a distributed network.

This network also allows transactions to be processed using virtual currency thus making bitcoin its own payment network.

3. What is the basis of bitcoins?

Conventional currencies are based on silver or gold, so theoretically you would get back the gold once you hand over the currency (though this doesn’t work in practice).

While cryptocurrency like bitcoins are not based on gold but based on mathematics.

People all over the globe are using software programs which use a mathematical formula to produce bitcoins.

So anyone can easily check it as the formula is freely available.

How to acquire bitcoins?

1. Buying on the exchange

People can buy or sell bitcoins at several marketplaces called bitcoin exchange using different currencies. The largest bitcoin exchange is Mt. Gox.

2. Transfer

One can transfer or send bitcoin to others using computers or mobile application.

It’s as simple as transferring cash digitally.

3. Bitcoin mining

These days’ people are competing with each other to mine bitcoins by solving complex mathematical puzzles.

Presently within a time span of around 10 minutes, a winner will be rewarded with 25 bitcoins.

4. Owning Bitcoins

The bitcoins can be stored in a digital wallet which can be present in the computers users or in the cloud.

The wallet will act as a virtual bank account where the bitcoins will be easily received or send, save money or pay for the goods.

Bottomline

You can purchase any things electronically using bitcoin like any other normal currency.

The best thing about bitcoin is that it is decentralized which separates it from conventional money.

Moreover, its network is not controlled by any single institution.

However many countries have not granted legal status to Bitcoins due to their use in facilitating illegal activities.

Thus, Bitcoins have a long way to go before they can be used in tandem with conventional currency.

In this newly growing age, learning is very important. You need to master skills like MS Excel to keep up with the growing competition. But dont worry, we have courses meant just for this.

You can join our full excel course in hindi and enhance your knowledge now!

Keep Learning!!