In an interesting session as a part of the highly popular Face2Face series, conducted by Elearnmarkets, Mr Vivek Bajaj, Co-founder of Elearnmarkets, invited Mr Vishal Malkan, a successful stock market investor with many years of experience, to decode A 5-Star Relative Strength Index (RSI) Strategy.

In this blog, we will be decoding the basics of the Relative Strength Index indicator and its multiple applications in the stock market for technical analysis. Following this, Mr Malkan will start discussing his strategy – a 5-star strategy.

First, we will discuss how Mr Malkan created his strategy and the basics around RSI and its components, like range shift. We will also talk about how one can decide the ranges for the Relative Strength Index indicator on a chart.

With this, Mr Malkan will then simplify his trading strategy to help traders get the right kind of success with the Relative Strength Index indicator. Finally, he will break down this strategy into different time frames to show its practical application.

Relative Strength Index (RSI) and Range Shift Concept

According to Mr Vishal Malkan, there are two sides to the Relative Strength Index -conventional and unconventional. The conventional form is the most used form by the traders, i.e. considering above 70 levels as an overbought zone and below 30 as an oversold zone and the bullish or bearish divergence.

But the approach has become objective as most stocks have become double or triple after touching Relative Strength Index 70 levels. Thus, this approach is ineffective as the big move comes after 90.

Mr Vishal Malkan uses the unconventional approach of 60-40 RSI and range shift concept in his trading.

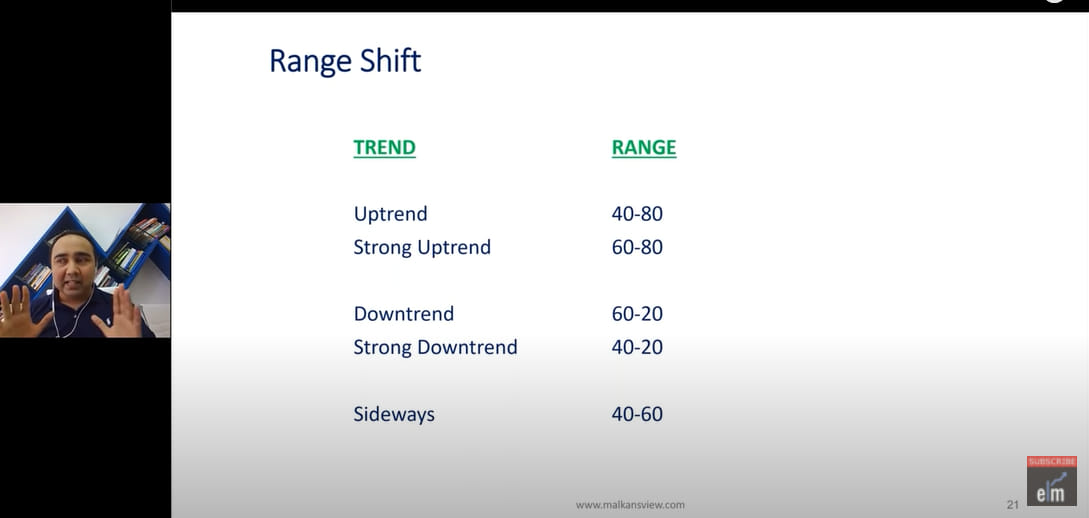

Range Shift is a phenomenon that occurs when the RSI indicator shifts from a predefined range to another predefined range due to the change in the price of the stock.

So, there is a different range for RSI Indicator in a bullish market, and in a bearish market, there is a different Relative Strength Index range.

In this case, the range for the Relative Strength Index indicator is 40-80 for a bullish market and 65-30 for a bearish market.

According to him, whenever the market is bearish, it won’t be able to cross 60, and whenever in a bullish trend, it won’t be able to cross 40.

So, instead of the 70-30 Relative Strength Index, we will use the 60-40 range for the RSI indicator for this strategy. We can see the bullish shift from points A and B when the RSI line is gone after the 40 levels.

Also, this range shift concept can be applied in any timeframe, whether intraday, daily, weekly, etc.

Thus, the range shift concept helps us understand whether the market is bullish, bearish or sideways.

For example, from the above weekly chart of Tata Steel, we can see that 10 is the best buying point as the RSI moves after 60, 11-13 can be considered a sideways market and point 13 is the best-selling point.

We can conclude the following from the above discussion:

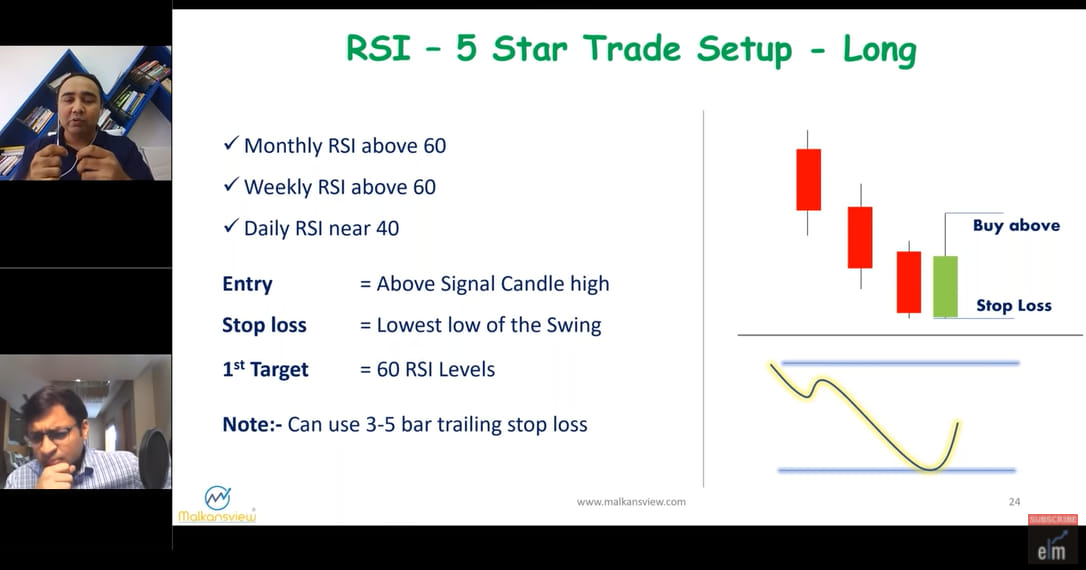

The 5-Star Relative Strength Index (RSI) Strategy–Long

According to Mr Vishal Malkan when the Monthly and Weekly Relative Strength Index is above 60, but when the RSI indicator takes support at 40 (inflection point) in the daily chart, it may bounce back and most probably it will not go below 40.

If a bullish candle is formed at the 40 Relative Strength Index level, the prices may bounce back, and one can enter the stock.

The stoploss can be placed at the low of that bullish candlestick, and the target can be the 60 Relative Strength Index level.

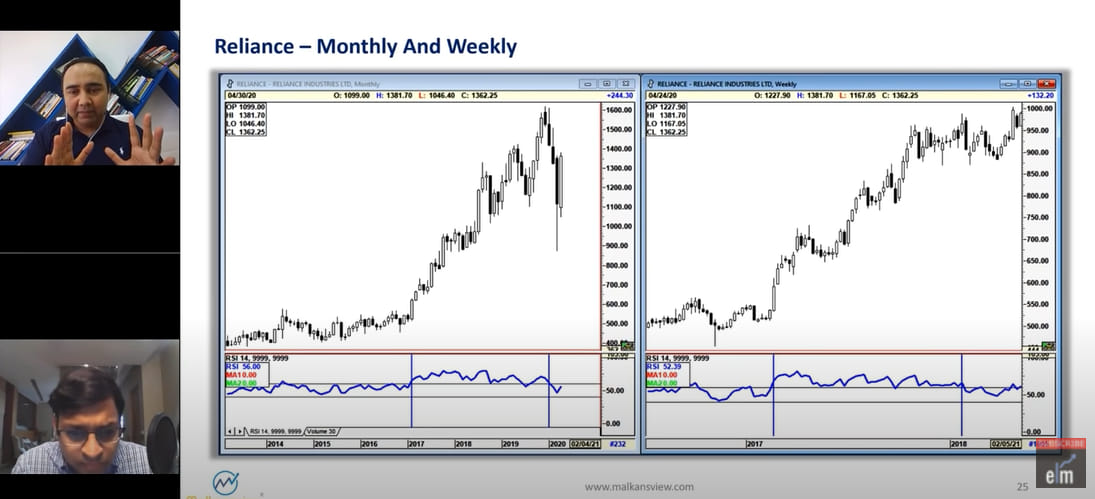

Example-

We have marked the areas in the above Weekly and Monthly chart of Reliance Ltd., and we will see only that period in the daily chart.

So, in that daily chart, we can see that we got many buying opportunities during that period that we had marked in the monthly and weekly charts as shown by the arrows.

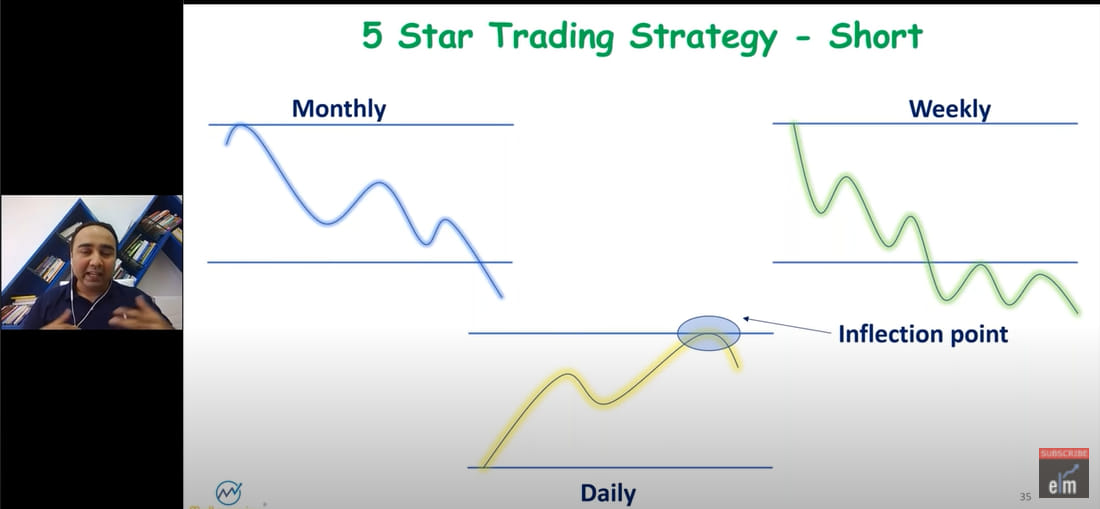

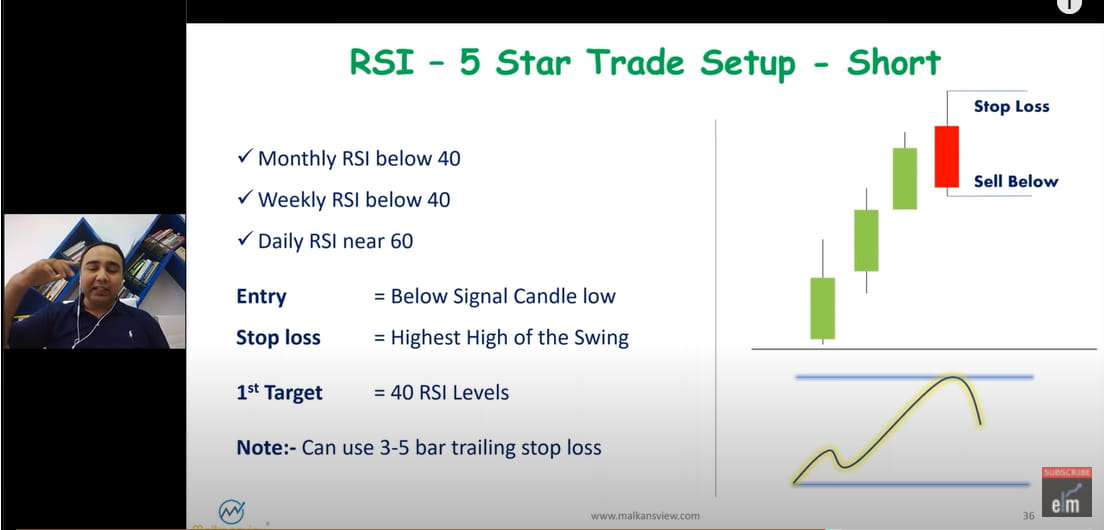

The 5-Star Relative Strength Index (RSI) Strategy-Short

According to Mr Vishal Malkan when the Monthly and Weekly RSI is below 40, but when the Relative Strength Index indicator takes support at 60 (inflection point) in the daily chart, it may bounce back and doesn’t go above 40.

You can also watch the webinar on Relative Strength Index / Bollinger Bands – The Deadly Duo

If a bearish candle is formed at the 60 RSI level, the prices may bounce back from there, and one can enter the stock for shorting.

The stoploss can be placed at the high of that bearish candlestick, and the target can be the 40 Relative Strength Index levels.

You can also do our course on RSI Made Easy

Bottomline

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.