Key Takeaways

- Option selling offers steady income with high success rate

Sellers earn premiums as most options, especially out-of-the-money ones, expire worthless. - Time decay supports sellers

As expiry nears, option value erodes, helping sellers profit even without much price movement. - Risk is high without hedging

Naked selling carries unlimited loss potential. Various hedged strategies reduce this risk:- Covered call: Sell a call on a stock you own to earn a premium and cushion small price drops.

- Spreads: Buy and sell options at different strikes to cap both profit and loss.

- Iron condor: Combine call and put spreads to profit in range bound markets with limited risk.

- Effective risk management is key

Use stop-losses, diversify trades, and manage position sizes to limit losses. - Volatility affects premium and risk

High implied volatility boosts premium income but also increases risk. Sellers often prefer such periods for better potential return.

As Warren Buffett famously said, “Risk comes from not knowing what you’re doing.” In the world of trading, understanding your strategy is key to consistent profitability.

While many traders chase quick gains by buying options, few realize the power of option selling as a way to create a steady income and shift the odds in their favour. In fact, experienced traders often say that option sellers are the ones who win consistently in the long run.

If you’re ready to transition from speculative market plays to a more reliable and strategic approach, this blog will guide you through how options selling can pave the way to profitable trading.

We’ll break down why this strategy works, how you can get started, and the risks you need to manage. Ready to learn how to trade smarter, not harder? Let’s dive in!

What is Option Selling?

Options Selling is a popular strategy among options traders as selling options can help generate premium income.

When the traders sell options, they receive a premium from the buyers for taking the obligation to buy or sell the underlying asset if the buyer chooses to exercise their option.

Sometimes, the options expire worthless as the expiry approaches. So, traders can benefit from time decay and sell options.

The Mechanics of Options Selling

Let us understand how options selling can be done with an example –

Imagine you are bullish on a stock, say Reliance Industries Ltd, which is currently trading at Rs. 3035

Instead of buying a call option, you go in to sell a put.

Since you have a bullish outlook, You need to select a strike price for selling puts that aligns with your strategy.

The strike price determines whether an option is in-the-money, at-the-money, or out-of-the-money. For selling options, it is always better to choose Out-Of-The-Money strike prices as there is a higher probability of profit. However, the premium is lower.

The level with the highest number of put contracts is often considered a strong support level. This is because traders expect the price to stay above this level, reflecting confidence that the asset won’t fall below it.

In the case of Reliance Industries Ltd., the 3000 strike price has the maximum put contracts, indicating strong support at this level. Therefore, selling a 3000 strike put capitalizes on this support. Thus, the probability of profit increases.

With this logic., we will sell a 3000 put, which is currently trading at Rs. 40, 1 lot- 250 shares.

If the stock price remains above Rs. 3000 at expiration, the put options expire worthless.

Your profit is the net premium received by you, i.e., Rs. 10,000 (Rs 40 x 250)

However, if Reliance’s price drops significantly below Rs. 3000, then the losses will be undefined, but you will still keep the premium you received earlier.

Suppose If it drops, say to Rs. 2800, your loss increases to Rs. 200 per share.

The losses can continue to grow as the stock price declines, and because there is no limit to how low the price can fall, the potential losses are theoretically unlimited.

However, the only benefit you retain in such a scenario is the premium you received when you initially sold the put.

In this example, if you sold the put for Rs. 40 per option (with a lot size of 250 shares), you would keep the Rs. 10,000 premium (40 * 250). This premium slightly offsets your losses, but it’s minimal compared to the potential downside if the stock price falls sharply below Rs. 3000.

Hence, while selling put options can be profitable in a bullish or sideways market, it carries significant risk, especially if the price falls drastically below the strike price.

Key Strategies for Options Selling

When it comes to options selling, there are two approaches: naked options selling and hedged options selling.

Naked options selling involves selling calls or puts, which carries significant risk, especially if the market moves against your position. While premiums are higher, potential losses can be unlimited.

Hedged options selling includes strategies that involve offsetting positions, such as covered calls or selling puts while holding short positions. This approach limits risk but also caps potential rewards.

Let us discuss some hedged options selling strategies–

1. Covered Call

The covered call strategy involves selling call options for the stock you are holding. Thus, it is a hedging strategy – protecting any downside movement in the stock you are holding.

Suppose you are holding 500 Reliance stocks; then you can hedge it by selling calls – 2 lots simultaneously.

If Reliance prices go down, this benefits you because the options may expire worthless, allowing you to keep the premium you received without any obligation to sell your shares.

This premium helps offset the loss in value of your Reliance shares as the price declines, providing a cushion against the downside.

2. Covered Put

A covered put strategy involves selling the underlying stock short and simultaneously selling a put option.

This strategy is typically used when a trader is bearish and expects the stock price to decline.

You believe Reliance’s stock price, currently trading at Rs. 3100, will fall in the near term. So you decide to short 500 shares of Reliance.

Simultaneously, you sell 5 put option lots (since 1 lot = 250 shares, 2 lots = 500 shares) at the Rs. 3000 strike price, collecting a premium.

If Reliance’s price rises above Rs. 3100, then your short position will start incurring losses, as you’ll have to buy the stock back at a higher price.

However, the premium you received from selling the puts provides some protection by partially offsetting these losses.

3. Spreads

Spreads involve buying and selling options of the same type (either calls or puts) but with different strike prices or expiration dates.

These strategies can reduce risk by capping both potential gains and losses.

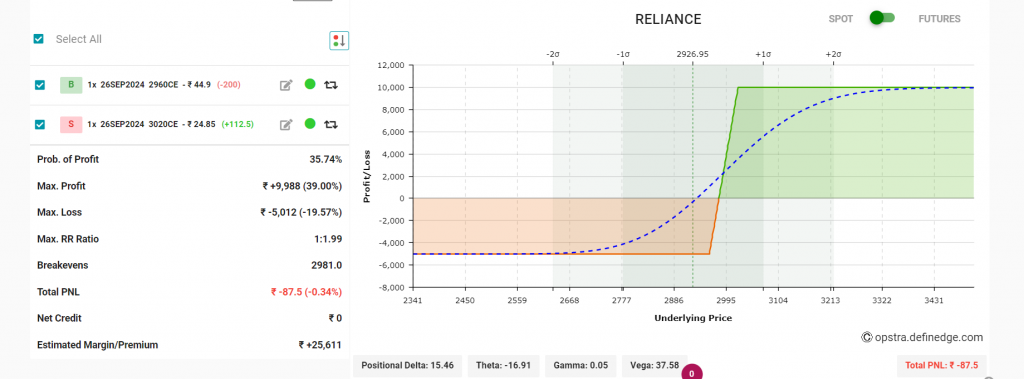

Let us take an example of Bull Call Spread. This strategy is implemented when you are slightly bullish on a stock.

We will buy a lower strike call-2960 and sell a higher price-3040 call simultaneously with the same expiration date as shown below.

We can see from the above payoff diagram that profit and loss are limited to Rs 13,275 and Rs. 6,725, respectively.

4. Strangles

Strangles involve selling calls and putting out-of-the-money options. This strategy is implemented when you have a neutral outlook on a stock/index.

Let us continue with the example of Reliance Ltd.

You sell an OTM call at the 3200 strike price and an OTM put at the 3000 strike price.

If Reliance stays between Rs. 3000 and Rs. 3200, Both options expire worthless, and you keep the premiums.

If Reliance breaks out of this range, You incur losses on one side (either call or put), though the premium provides some cushion.

This strategy carries limited profit (the collected premiums) but exposes you to potentially large losses if Reliance’s price moves significantly in either direction. Therefore, it works best in low-volatility environments or when you expect minimal movement.

5. Iron Condors

It is a strategy that combines a bear call spread and a bull put spread. This strategy is less profitable. Although less risky than short strangles and straddles.

Let us discuss an example of Reliance, where we try creating a Bullish Condor.

Below is an example of a Reliance Bullish Condor-

Positions:

- Sold 3080 CE for Rs. 14.75

- Bought 3160 CE for Rs. 6.75

- Bought 2920 PE for Rs. 38.75

- Sold 3000 PE for Rs. 80.05

Max Profit: Achieved if the price remains between the two inner strikes – Rs. 12,325 (16.50%)

Max Loss: Occurs if the price breaks beyond the outer strikes – Rs. 7,675 (10.27%)

Breakeven: Rs. 2951 – Rs. 3129

Probability of Profit: 35.05%

This allows you to limit potential losses while taking advantage of range-bound price movement with a slightly bullish expectation.

Why Option Selling Can Be Profitable?

Here are some of the reasons why option selling can be profitable-

Time Decay

Time decay refers to the gradual reduction in the value of an options contract as it approaches its expiration date.

An option’s time value is influenced by the remaining time until expiration. As that time decreases, so does the option’s value, which works in favour of the option seller. (theta)

If the underlying stock or index remains relatively stable, then the premium you receive for selling options becomes profitable near the expiration date.

High Probability of Success

Options expire worthless 2 out of 3 times. Let us understand this how by 1st discussing the concept of the Moneyness of an Option.

It refers to the relationship between the option’s strike price and the underlying asset’s current price.

Options can be either –

- In-the-Money (ITM): For calls, when the underlying price is above the strike price; for puts, when it’s below.

- At-the-Money (ATM): When the strike price is equal or almost equal to the underlying price.

- Out-of-the-Money (OTM): For calls, when the underlying price is below the strike; for puts, when it’s above.

Only the ITM options are exercised on the expiry while the other two lapses, resulting in pocketing of premium for the seller.

This creates a high probability of success for option sellers, especially while selling OTM options. By selling these options, you can benefit from the time decay and the low likelihood of the price moving significantly enough to make the option valuable.

This high probability of success is why strategies like selling OTM puts or calls, strangles, and condors appeal to traders seeking consistent returns with controlled risks, as most options tend to expire without being exercised.

Premium Collection

Premium collection from selling options can be a profitable strategy, but it’s essential to understand the potential risks involved.

One of the main fallouts of options selling is the unlimited downside risk. If the underlying asset’s price moves significantly against the option seller, losses can be substantial.

Let us understand this by an example-

Let’s say you own 100 shares of a company and sell a call option against it. You receive a premium of ₹5 per share.

If the stock price rises above the strike price of the option, you’ll be obligated to sell your shares at the strike price, even if the market price is higher. This means you could miss out on potential profits.

Risk Management in Options Selling

Traders can mitigate the risk of selling options by implementing hedging strategies, as we discussed above.

Also, they can mitigate risks through-

- Diversify options portfolio across different underlying assets and expiration dates to reduce concentration risk.

- Use stop-loss orders to limit potential losses if the market moves against your position.

- Carefully manage their position size to avoid excessive risk.

The Role of Implied Volatility

When it comes to options trading, and especially options selling implied volatility plays an important role. Implied volatility represents the market’s expectation of how much an underlying stock will move in the future.

When a trader buys or sells options, then they are not only betting on the price’s direction but also on how much the price can fluctuate before the expiry of options.

When the implied volatility is high, then the options prices are expensive. Traders have to pay more for the uncertainty in the stock’s price movement.

On the other hand, when the implied volatility is low,, then the options prices are lower. Low IV means less expected movement; thus, premiums are cheaper.

IV can be checked through various platforms, such as NSE India Ltd. IV is just one factor to consider when trading options. It’s essential to analyze other factors, such as the underlying asset’s price, time to expiration, and market conditions, to make informed trading decisions.

You can practice Options Strategies from Elearnoptions

Some Practical Tips for Beginners

We have some tips if you are just starting to implement the options selling strategies-

- Before diving into implementation, first understand the basics of options such as calls, puts, and different options trading strategies.

- Always start with taking a position in one lot. As your confidence increases, you can increase your capital.

- Options Selling involves unlimited downside risk. So, setting stop loss levels and maintaining proper risk management are essential!

- Determining the right strike price and choosing the right expiration date which aligns with your outlook.

You can learn more about Options Strategies through our course.

FAQ’s

How do options sell works?

Options selling is a trading strategy in which the options traders sell options according to their view on a stock or index.

How much amount do I need to start selling options?

In India, Options Sellers need a capital of atleast 1-2 lakhs for selling options.

Are options selling really profitable?

Yes, options selling is profitable as traders receive the premium upfront.

Which are the most important factors in Options selling?

Factors that affect the options selling are Interest rates, Time to expiration, Dividends, Strike price, Volatility, Options type, Underlying asset price and Underlying price.

Which are the safest Options selling strategy?

Spread strategies are the safest selling options that help mitigate risks in options trading.

Is Options selling better than Options buying?

Buying options offer the potential for limited loss. However, selling options can generate income, however the loss is unlimited.

The Conclusion

Retail traders may choose to use the same option-selling strategy used by major traders and institutional investors to maximize earnings and minimize risk. But it’s important to keep in mind that you need to accomplish this while keeping in mind the appropriate risk management techniques that are out there.