Regardless of the trading plan, you have to compound your earnings over time; you must, at some point, sell your trades for a profit.

You can’t just take profit whenever or wherever you want; it takes discipline and consistency. Most traders manage their open positions using take-profit orders and stop-loss orders.

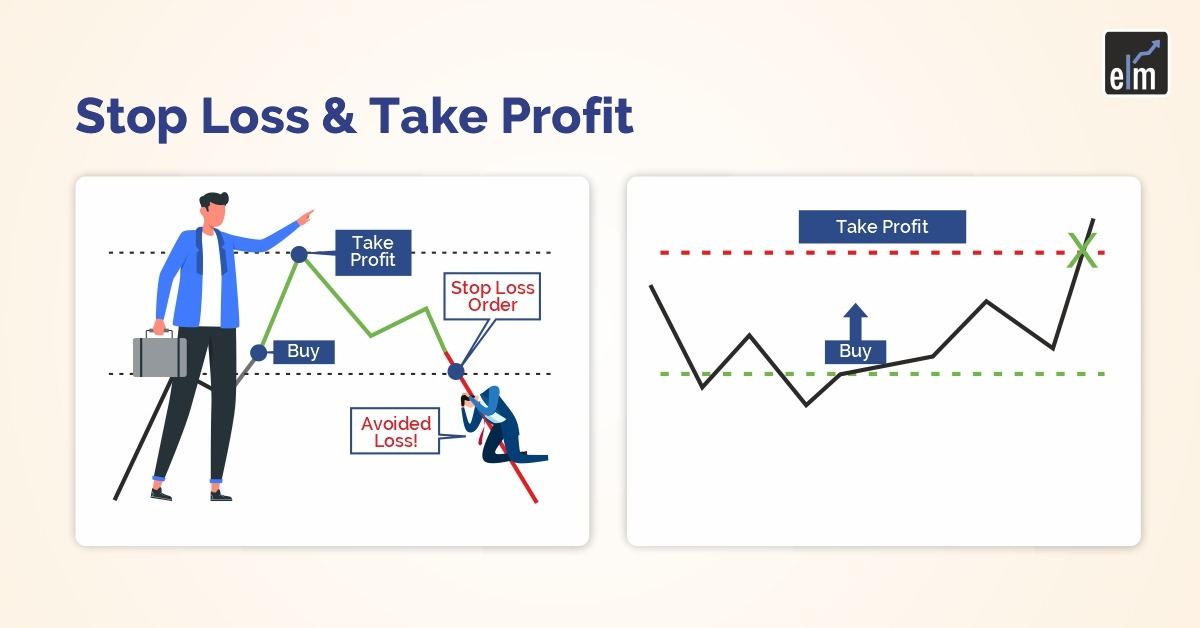

The Take Profit order is carried out, and the position is closed for a profit if the security increases to the take-profit level. The Stop Loss order is carried out if the security reaches the stop-loss level and the position is closed for a loss.

The risk-to-reward ratio of the trade is determined by the distance between these two points and the market price.

The best people to use take-profit orders are short-term traders who want to control their risk. This is because they can exit a trade as soon as their intended profit target is reached and avoid running the risk of a potential market decline. Such orders are disliked by traders who use a long-term strategy because they reduce their profits.

So, in today’s blog, let us discuss take profit orders and how to set take profit orders:

What are Take Profit Orders?

When the current price reaches your predetermined price that is advantageous to your trade, a take-profit order is triggered!

This indicates that your trade has closed, and you will now receive its profit. Because of this, it is referred to as a take “profit,” of course!

A stop-loss order closes your open positions at a predetermined price to limit losses if a trade goes against you.

So basically, take profit and stop loss orders are limit orders that you can typically place at the same time as or even after the execution of your trades.

Take-Profit Order Example

Let’s say a trader opens a new long position after spotting the ascending triangle chart pattern. The trader anticipates that the stock will increase by 15% from its current levels if there is a breakout.

The trader wants to quickly exit the position and move on to the next opportunity if the stock doesn’t break out.

To automatically sell when the stock reaches that level, the trader may set up a take-profit order that is 15% higher than the market price. They might also put in a stop-loss order at the same time that is set at 5% below the going rate.

The take-profit and stop-loss orders together produce a risk-to-reward ratio of 5:15, which is favourable if the probabilities of each outcome are equal or if they are biased in favour of the breakout scenario.

The trader doesn’t have to worry about closely monitoring the stock throughout the day or second-guessing themselves about how high the stock may go after the breakout by placing the take-profit order. The risk-to-reward ratio is clearly defined, and the trader knows what to anticipate before the trade even closes.

How to use Take Profit Orders Efficiently?

Some day traders take profit orders in more ways than just to collect profits. Some people, for instance, use these orders to start new limit orders.

You can place a take-profit order at Rs. 25 if the stock is trading at Rs. 20. When it reaches this level, the position will automatically close. You can also set up other limit orders near this position at the same time.

For instance, you can place a sell-limit order at Rs. 23 if you anticipate that the asset’s price will drop significantly after reaching Rs. 25. According to the theory if the price falls, it will confirm the bearish pattern and reach Rs. 23 at that point.

You can also place a buy-stop order at Rs. 27 at the same time. Bulls will start aiming for $30 if the price doesn’t stop at Rs. 25, according to the theory. And if it reaches Rs. 27, this order will be confirmed.

All kinds of traders use these order types. However, part-time traders are the ones who gain the most from them. For instance, you could easily set up these orders and report to work if you have a 9 to 5 job. When you’re not around, they’ll start.

How to Set a Take Profit Order?

The best places to place a take-profit order are frequently asked questions among traders. Although there is no official rule regarding this, many traders employ various strategies.

1. Utilise your risk-to-reward ratio.

Using your risk-to-reward ratio to determine your take profit is one of the best strategies. If you only want to risk 5% of your money, for instance, you can set your take profit 5% above the going rate. If the stock is currently trading at Rs. 20, you could set the price at Rs. 21.

Although this may seem like a small amount, remember that it represents a 5% return on your investment.

You can also join our course NSE Academy Certified Capital Market Professional (E-NCCMP)

2. Fibonacci Retracement Levels

Utilising the Fibonacci retracement levels is a different strategy. When a price reaches Rs. 20, the 23.6% retracement level, you can add a take profit at Rs. 24, which corresponds to the 38.2% level. Ideally, a price move above the 23.6% retracement should increase the likelihood that it will test the 38.6% level. Consequently, that is where you can set the take profit.

3. Psychological conditions

Additionally, you can employ the crucial psychological level. The next logical level of resistance, for instance, would be at Rs. 70 if the price of crude oil, which is currently trading at Rs. 63 and manages to rise above Rs. 65. Round numbers are crucial because most day traders set their take profits and stop losses there.

Bottomline

In the financial market, taking profit orders is crucial because they enable you to manage your risk. When you have a busy schedule, they also assist you in setting up your trades. We advise you to spend some time learning about these orders and experimenting with them if you are new to trading. You can also learn from our a2z of stock market for beginners course.

We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us spread financial literacy.

Happy Investing!

In order to get the latest updates about Financial Markets visit StockEdge