Being financially independent and financial independence is something we all celebrate.

Financial Independence is when you don’t have to work to live a comfortable life.

How convenient would it be to have a source of fixed income without having to do any work?

Is this even possible?

Well, yes, it is, through savings and investments. Though we are always asked to save early, we must always remember that it is never too late as well.

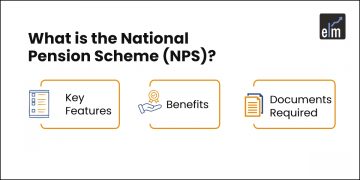

| Table of Contents |

|---|

| Investing in Mutual Funds |

| Investing in the Equity Markets |

| Securing money in Term Plans |

| Saving through Fixed Deposits |

| Depositing in Public Provident Funds (PPFs) |

So, let us help you get started by discussing about 5 ways to attain financial independence.

1. Investing in Mutual Funds:

There are two reasons for which mutual funds are really popular as investment instruments. These are:

- Diversification

- Amount of Investment.

With an investment amount as low as Rs 500, one can invest in a diverse basket of securities through mutual funds.

Mutual funds are suitable for risk-taking as well as risk-averse investors. For instance, an investor who can take moderate-to-high risk can opt for equity funds and those who prefer lower risk can invest in debt funds. However, equity funds give significantly higher returns than debt funds.

Investing in mutual funds helps an investor to meet his short-term goals, such as planning a vacation, to long term goals, such as child’s education.

This investment class makes an investor financially independent by engaging his savings in a diverse range of securities with good returns. Thus, Mutual funds is one of the best ways for achieving financial independence.

2. Investing in the Equity Markets:

Investing directly in the stocks or shares of companies has historically been one of the best ways to invest your money when compared to other asset classes. They have given considerable returns when compared to other asset classes such as Cash, Gold and Real Estate.

When you buy a stock, you own a piece of the company too. So, if the company does well, the stock does well too.

The key is to pick the right company at the right time. Stocks, better known as Equity, have the capacity to not just give you decent returns, but multiply your wealth as well.

For instance, an investment of Rs. 10,000 in Infosys in 1993 would be worth more than Rs. 2 Crores today. So, nothing comes close to an Asset class like equity.

Equities are a very high-risk asset class. However, they offer higher returns than any other asset class.

Equity markets are suitable for those investors who are mentally strong enough to gain the best way and the lose the worst way.

Attain Financial Independence with Financial Planning Made Easy course by Market Experts

People invest or trade in the stock market for wealth creation.

Now, the above two options were directly related to the market volatility, and more or less had some element of risk attached.

However, those who want a secured mode of investment with zero or no risk, can opt for the following three options:

3. Securing money in Term Plans:

A term plan is basically a Life Insurance. It safeguards your family members from any sudden financial shocks which could arise in the case of the death of the sole earner of the family. It is not a scheme which could make you achieve financial independence, but protect your family members if they are dependent on you.

These plans are very affordable and have a lot of tax benefits too.

So, for example a 25-year-old male can get a cover of up to Rs. 1 Crore for the next 30 years. He will need to pay a premium of around Rs 550 per month for such a cover.

4. Saving through Fixed Deposits:

No matter whichever kind of investment or savings mode you opt for, fixed Deposits will always be India’s favorite asset class.

Though the interest received from Fixed Deposits has been coming down to as low as around 6% % p.a., you will find the majority of households opt for fixed deposits as a substantial part of their savings.

The only reason is financial security, no risk, and a guarantee, that in times of any needs, you will be able to withdraw the amount when needed.

5. Depositing in Public Provident Funds (PPFs):

PPF is basically a tax saving mode of investment offered by the government of India.

Under this scheme, a citizen can invest up to Rs. 1.5 Lakh every year, and get assured returns from the government. As the returns are guaranteed by the government of India, they are one of the safest financial instruments to invest in.

However, these investments have a lock in period of 15 years. So, they are only suitable for long term investments.

The returns are determined by the government and can be changed every quarter. The current PPF interest rate is 7.1%.

Analysts worldwide talk about how the next century belongs to India. With a burgeoning younger population, high GDP growth rate, and resources amassed, investing in India’s growth story should lead to Financial independence before we get to our 100th Independence Day celebration.

Of course, the first step in financial independence is learning about the fundamentals of finance, investing and trading.

Happy Independence Day!