Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

Key Takeaways

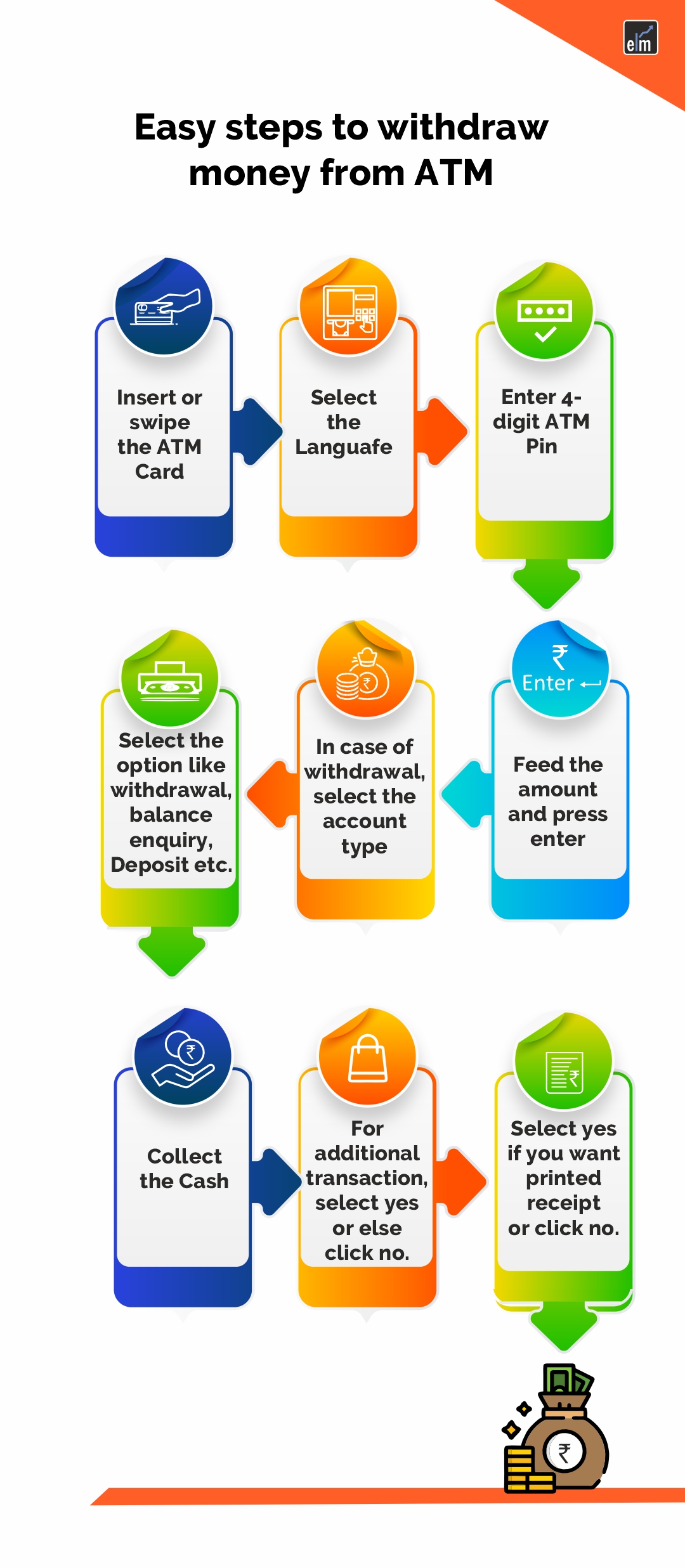

- ATM Working: Insert card → Enter PIN → Choose transaction → Confirm → Collect cash.

- Card Insertion: Insert the side with the chip or magnetic stripe as shown on the ATM.

- Full Form:ATM = Automated Teller Machine.

- Forgot to Collect Cash: ATM pulls money back; amount is usually refunded automatically.

- Withdraw Without Card/PIN: Use mobile app for cardless withdrawal (if your bank supports it). PIN/OTP is required.

When you need cash for daily expenses or an emergency, ATMs (Automated Teller Machines) save the day by eliminating the need to visit a bank branch. There are multiple ways to use an ATM for cash withdrawal; here’s a quick guide to walk you through the basics of how to withdraw money from an ATM.

Table of Contents

What is an ATM?

An ATM is a kiosk-like machine designed to perform basic monetary transactions without any human intervention. Typically, a teller is a bank employee who handles these transactions, like depositing cash and cheques.

However, ATMs have now automated these tasks, making them available 24×7 and speeding up the process without the need to visit a bank or wait in queue for your turn.

While these machines are mainly used for cash withdrawal, they can also perform several other tasks, such as:

- Accepting cash or cheque deposits

- Activation of debit/credit cards

- Requesting a mini-statement

- Changing the PIN of your cards

- Making balance inquiries

- Transferring funds

- Applying for pre-approved loans for selected customers

- Creating a fixed deposit, etc.

However, the availability of these services shall depend on the type of ATM and whether you are a customer of the bank that owns that ATM. For example, you would not be able to use your State Bank of India ATM cum debit card to make cash deposits at a Punjab National Bank ATM.

How to withdraw money from ATM?

There are several types of ATM cards: prepaid cards, which are loaded with a predetermined amount of money and can be used until the balance is used up; debit cards, which are directly linked to your bank account for purchases and withdrawals; and credit cards, which let you borrow money up to a certain limit for transactions.

In addition, several banks have a unique feature called Green PIN, which allows a new card to be safely activated by generating a one-time PIN via ATM or mobile banking. To ensure safe and approved transactions, each of these cards needs a PIN for secure access.

Now, let us understand how to withdraw money from ATM. You just need to follow a few simple steps to withdraw cash from ATM:

Step 1: Insert the ATM Card

The first step is to insert your ATM card into the card reader. You can use a debit card or a credit card for the same.

Step 2: Choose a Language

The display screen will ask you to choose a language, which you can select using the keypad or by touching the display screen if the touch interface is supported.

Step 3: Enter Your 4-Digit ATM PIN

Use the keypad or the touch interface to enter your card PIN. Make sure to enter the correct PIN because multiple wrong attempts may block your card.

Step 4: Select the Type of Transaction

The display screen will show multiple transaction options such as ‘Deposit,’ ‘Withdrawal,’ ‘Transfer,’ etc. Choose ‘Withdrawal.’

Step 5: Select Your Account Type

Depending on the card you are using for withdrawal, choose the account type associated with that card. Most individual bankers have savings accounts, as current accounts are for business transactions.

Step 6: Enter Withdrawal Amount

Enter the amount you wish to withdraw and then press “Enter” on the keypad or touch interface. If there is no explicit “Enter” label on the keypad, you can hit the green button.

Make sure the amount entered is a multiple of 100 or 500 (depending on the machine ) and less than your available balance, or the transaction will get cancelled.

Step 7: Collect Cash

If the machine has sufficient balance, the cash dispenser will fetch the cash for you to collect.

Step 8: Get the Receipt if Needed

The display screen will now prompt you with an option to receive a printed receipt. Press ‘Yes’ if you would like a receipt. If you do not want one, the screen will display your balance and complete the transaction.

Step 9: Collect Your Card

The machine will release your card after a brief moment. Don’t forget to collect it. If you wish to perform another transaction, repeat the steps accordingly. However, the sequence of these steps may vary depending on the specific bank or ATM in use.

How to withdraw cash from UPI ATM?

Withdrawing cash from a UPI-enabled ATM is a straightforward process that enhances convenience and security.

Here is a step-by-step guide on how to take money from ATM without card.

- Find an ATM that supports UPI withdrawals and click on “UPI Cash Withdrawal,” “ICCW,” or “Interoperable Cardless Cash Withdrawal.”

- The next step is to enter the amount you want to withdraw.

- Open the UPI app on your phone to scan the QR code that is visible on the screen. You have to scan it just like any other QR code scan for UPI transactions.

- To validate the UPI cash withdrawal, enter your UPI PIN on the phone.

- If you use UPI for multiple bank accounts on the same app, it will ask you to choose the bank from which you want to withdraw.

- Once you confirm the bank, the ATM will dispense the cash. Collect it and you are good to go!

This functionality uses the Unified Payment Interface (UPI) to enable customers to withdraw cash from ATMs without an ATM card. This method is also known as Interoperable Cardless Cash Withdrawal and uses QR codes for transactions.

While more banks are adopting UPI cash withdrawals, the service is not yet available at all ATMs. Also, it is accessible only to users with a UPI-enabled app installed on their phone.

Withdrawal limits at an ATM

The cash withdrawal limit at an ATM is the maximum amount that you can withdraw using ATM transactions in a day. Depending on your account type, card, and bank, this limit may vary from ₹10,000 per day to ₹50,000 per day.

Additionally, some banks also impose limits on the number of times you can make free monthly withdrawals.

Things to Keep in Mind While Withdrawing Money From an ATM

Withdrawing cash from an ATM can sometimes present challenges such as:

- Card Problems: Successful transactions can be hindered by damaged, expired, or blocked cards.

- Network Connectivity: Transaction failures or delays may result from network interruptions or outages.

- ATM Malfunctions: The withdrawal procedure may be hampered by hardware or software problems with the ATM.

- Withdrawal Limits: Banks frequently set daily withdrawal caps, which limit the amount you can withdraw.

- Security Issues: The security of your account may be affected by ATM fraud, which includes card skimming and PIN theft.

With such a rising number of challenges, it is always best to take some safety precautions when it comes to withdraw cash from ATM. Here are some that you can follow:

- The foremost rule is to never share your ATM PIN with others.

- Use an ATM with a security guard or security cameras for added safety.

- If you are stuck anywhere, contact your bank’s helpline number instead of asking strangers for help.

- If you suspect anything wrong, immediately cancel your transaction and inform the bank.

Safety Precautions When Withdrawing Cash from ATM

It is important to follow safety precautions when using ATMs. The key safety precautions when using an ATM are:

- Never share your PIN with anyone.

- Use ATMs with security guards or cameras.

- Contact your bank’s helpline if you’re in any trouble.

- Immediately cancel the transaction and inform the bank if you suspect anything suspicious.

Final Thoughts

The introduction of ATMs was a major step in extending banking services beyond the bank premises and operating hours. Knowing how to take money from ATM can fulfil your emergency needs anytime, anywhere, without the need to carry money with you. They are a quick and secure source of withdrawing or depositing cash at your own convenience, offering a seamless banking experience through a kiosk.

Explore our finance courses for beginners now and learn essential skills to manage your money wisely!

Frequently Asked Questions (FAQs)

1. How ATM machine works step by step?

When you use an ATM, the steps include inserting your card, entering your PIN, selecting the transaction type, entering the amount (if applicable), collecting your cash (if withdrawing), collecting your receipt (if needed), and collecting your card after the transaction is complete.

2. Which side of an ATM card is inserted?

An ATM card should be inserted into the machine with the magnetic strip or chip facing downward and in the direction of the card reader. This guarantees the ATM will read the card correctly.

4. What happens if I forget to collect cash from the ATM?

If you forget to collect cash from an ATM, it will remain in the cash dispenser until retrieved or taken by someone else. It’s crucial to contact your bank immediately to report the issue and check the status of the transaction.

5. How to withdraw money from ATM card without PIN and OTP?

You cannot withdraw money from an ATM without a PIN. However, some banks offer cardless withdrawals through mobile apps, where you can generate a one-time code instead of using a PIN or OTP.

6. What is the New Rule of ATM Withdrawal?

The new ATM rule in India starts from May 1, 2025. If you cross the free transaction limit, you will be charged ₹23 for each extra transaction. The number of free transactions depends on your bank and location. This limit includes both financial and non-financial transactions.

7. How much money can you withdraw from ATM?

The ATM withdrawal limit depends on your bank and the type of debit card you have. Most banks in India allow daily withdrawals between ₹10,000 to ₹2,00,000 per day. Some premium cards may offer higher limits. Always check your card’s specific limit with your bank.

In order to know more visit our website StockEdge.com.

!

in step 5 select your account ???what should i select ???pls response asap thankyou

Hi,

Thanks for reading through. In the fifth step you will find the options of the type of bank account. Select the option of your account type as to whether it is a Savings/ Current account and proceed.

Thank you

Very interesting post. All content is clearly written and thank an author for the explanation.

how can i generate 3d secure code in atm branch .pleas explain me step by stem. i have sbi debit card but how can i activate for 3d secure code. please your suggession help us lot

Hello Chandu,

Thank you for your comment.

We do not have domain expertise to help you with regards to the issue faced by you.

Your Bank: SBI will be the best person to guide you in this situation.

You can read more blogs on banking topics here.

Happy Reading!!

Dear madam,

I am working in a co-op bank, can u give me best practice ATM Reconciliation process.

Hi Vinod,

This is just an informative blog for knowledge.

Thank you for reading!

Keep Reading!

Great information you shared through this post! Thanks for the marvelous posting.

Hi,

Thank you for reading our blog!

Keep Reading!

Informative 4th step may be elobrated

Hi,

Thank you for your feedback.

Keep Reading!

I have a 6 digit pin # when I got the card 3 years ago. Will it still work?

Hi Jim,

If your credit/debit card has not expired then the pin should work.

Thank you for Reading!

Keep Reading!

The information given by you is very useful to me…. thanks !

I like the valuable information you provide in your articles.

I will bookmark your weblog and check again here frequently.

I am quite sure I will learn lots of new stuff right here!

Good luck for the next!

Dear Author,

Thank you for writing this article, it is very informative and useful. As per my experience there is a vital difference between educated and being financial educated. The article written by you will make people financial educated.

Regards,

Abhishek

This is really interesting, You’re a very skilled blogger. I have joined your feed and look ahead to in quest of extra of your fantastic post. Additionally, I have shared your site in my social networks!

Hi there, You have done an incredible job. I’ll certainly digg it and personally suggest to my friends. I am confident they will be benefited from this web site.

Nice information. Thanks for sharing the article in the blog.

Hi,

Thank you for reading our blogs!

Keep Reading!

Thanks but button besides the screen what are they meant for

Hi,

You can chat with our team member if you have any queries related to the courses or blogs by clicking on it.

Thank you for Reading!

This article is very impressive.. Thank you.

Hi,

We are glad that you liked our blog post.

Thank you for Reading!

Thank you, interesting answers, and I have learnt something

Hi,

Thank you for Reading!

Keep Reading!

Hi…great information here..thank u so much.

Hi,

Thank you for Reading!

Keep Reading!

Nice very useful

thanks

Hi,

We really appreciated that you liked our blog.

Keep Reading!

your post is very useful and informative. thanks..

Hi,

We really appreciated that you liked our blog.

Keep Reading!

How can I get the atm card, after I finish the step of withdrawal?

Hi,

Usually, the atm card comes out automatically after the cash comes out of the ATM.

Thank you for Reading!