Do you have a bank account?

If not, then you must have one as it is a first step which one takes while entering the world of money. With the launch of Pradhan Mantri Jan Dhan Yojana on 28th August 2014, more than 200 million accounts have been added under this financial inclusion campaign to date.

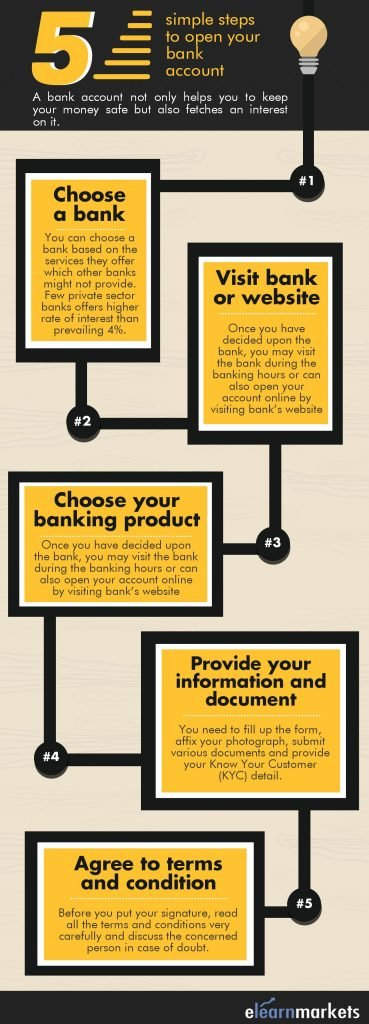

An account in bank not only helps you to keep your money safe but also fetches an interest in it.

| Table of Contents |

|---|

| Choose a bank |

| Visit the bank or its website |

| Choose your banking product |

| Provide your information and documents |

| Agree to terms and conditions |

| Bottomline |

Let me tell you that opening a bank account is a very simple job, provided you have a right set of documents to prove your identity.

Steps for opening a Bank Account:

Here are the steps you need to follow to open your bank account-

1. Choose a bank

You must have already done this before.

If not, then walk around your area and talk to various banks to discuss what exactly you’d get if you open a bank account.

Download Free E-Book : Banking Awareness Book for Beginners

You can choose a bank based on the services they offer which other banks might not provide.

Few private sector banks offer a higher rate of interest than prevailing 4%.

2. Visit the bank or its website

Once you have decided upon the bank, you may visit the bank during the banking hours along with your identification documents and initial deposit, to open the account.

However, you can also open your account online by visiting the bank’s website, which you can do at any time and from anywhere.

Suggested Read: Top 7 Benefits of Bank Account you should know

3. Choose your banking product

A bank account offers various types of accounts and services which you can choose to suit your need.

For instance, you may choose a savings bank account for the basic banking need or a current account in case you have a business.

4. Provide your information and documents

You need to fill up the form, affix your photograph and provide your Know Your Customer (KYC) detail.

You need to submit various documents which include your photo ‘identity proof’ in the form of your PAN card, Passport or Aadhar card and ‘address proof’ in the form of your Passport, Ration card, Voter ID card or Aadhar card.

Moreover, you can use your passport or Aadhar card to serve both your purpose including photo proof and address proof.

5. Agree to terms and conditions

Before you put your signature, it’s very important to read all the terms and conditions very carefully and you can contact the concerned person in case of any doubt.

Most of the bank fill the entire form on your behalf and you just need to submit your documents and put your signature after reading all the terms and conditions.

Bottomline:

Some important points which you should remember while opening your account are as follows:

- Always open a bank account in a joint name which could be with your parents or spouse.

- Fill the nomination details properly since it helps to face unforeseen circumstances

Once you open your account, don’t forget to collect your ATM card and chequebook.

You can also fill a form to apply for internet banking which will give you the option to operate your account online.

Go ahead to open your account today.

Take care and keep learning!!

In order to get the latest updates about Financial markets, visit StockEdge.com