Intraday trading is generally high-risk trading. Many traders believe that intraday trading is only about the right ideas and trades.

However, it is much more about how the traders can manage their risks and stick to their trading discipline.

Some common mistakes that are committed by the intraday traders are averaging your positions, not doing research, overtrading, following too much on recommendations.

These mistakes have caused many day traders to take losses. Around 90% of intraday traders lose money in intraday trading.

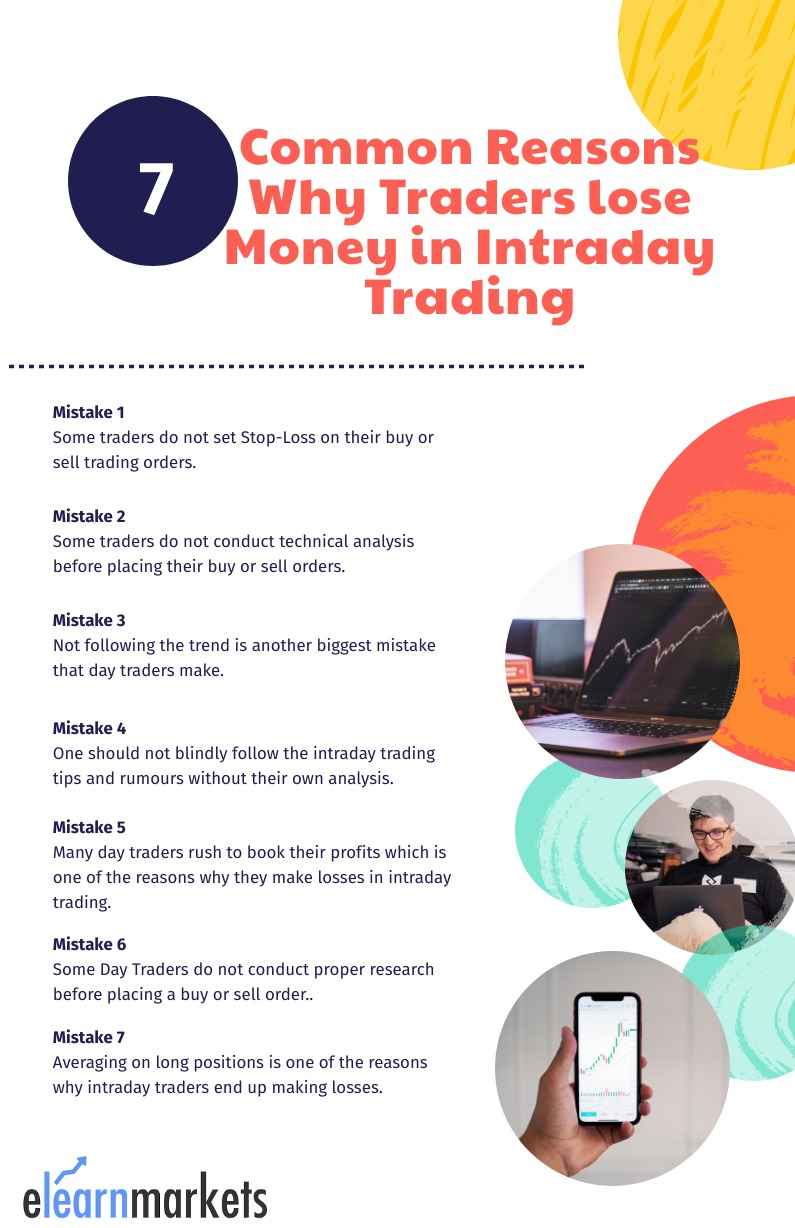

So in this blog, we will discuss 7 common reasons why intraday traders lose money in intraday trading.

But first, let us discuss the basics of intraday trading:

What is Intraday Trading?

Intraday trading refers to the buying and selling of stocks within the same trading day.

It is short-term trading in which the traders take benefits of price fluctuations in the stock market and thus they earn profits.

But to be successful as an intraday trader one need to know how to do technical analysis and understand their risk appetite for making profits in intraday trading.

Intraday trading can be done with stocks, derivatives, currency or commodities.

How does Intraday Trading Works?

Intraday trading is a process of buying stocks when their prices are low and selling them when the prices rise within the trading session of a single day.

Traders use different trading strategies for ascertaining the right time to buy and sell stocks within a trading day.

Before executing trading orders traders research the stock in which they want to trade by not only looking at the financial statements but also studying the technical charts of the stocks for tracking the price movements of stocks.

For placing intraday orders traders need to have a trading account from which they can place the orders.

Intraday traders enter and exit the markets before the close of the trading day.

Thus, there is no change in the ownership of the securities traded as all open positions are squared off before the trading floor closes.

7 Common Reasons Why Traders lose Money in Intraday Trading:

Below are 7 common reasons why traders lose money in intraday trading:

1. Not Setting Stop-Loss:

Stop-Loss helps in saving the traders from incurring a huge loss.

A Stop-loss order is a type of order through which traders can instruct the broker to sell the stocks below their purchasing price to reduce losses.

As this order gets immediately executed, intraday traders can reduce the loss if the price movements go against their expectations.

But some novice traders do not set stop losses in their trades which results in huge losses.

As a trader, one should look for maximizing their profits but they should also look to protect their losses.

2. Not Conducting Technical Analysis:

Some traders just follow the recommendations of others and do not conduct technical analyses of their own.

Traders should review the prices, analyze the volume, check the prior trends and analyze other technical indicators before placing their intraday orders.

Rushing just to place buy or sell orders is one of the biggest mistakes intraday traders make.

One should conduct proper technical analysis and then start trading.

3. Going against the Trends:

The phrase- “Trend is your best friend” always works in the stock market. Not following the trend is another biggest mistake that day traders make.

Unless a trader has many years of experience and understanding of the stock market, traders should try to avoid going against the trend.

If the market is in a strong uptrend, then one should try to trade in the up direction only unless there is any strong resistance or chart pattern breakout.

If the trader wants to trade against the trend, then they should set a stop loss to avoid the losses.

4. Following the Herd:

Some traders follow rumors and recommendations which are spread by the media houses and brokers.

This is another big mistake that intraday traders make. One should not blindly follow the intraday trading tips and rumours without their own analysis.

Going by these recommendations without conducting your own analysis can cause huge losses.

These days there are many websites like StockEdge which helps the traders to conduct their own analysis.

5. Being Impatient:

Many day traders rush to book their profits or make trading decisions in a hurry which is one of the reasons why they make losses in intraday trading.

Many traders book profits before deciding their price targets or stop loss.

Traders should execute their trades in a planned way like deciding their stop loss and profit target level and then only execute their trades.

Also being impatient and changing trading strategies frequently is one of the biggest mistakes that intraday traders make.

Watch our Webinar on INTRADAY TRADING STRATEGY FOR PASSIVE TRADERS

6. Not doing Homework or Research:

Day Traders should do proper research before placing a buy or sell order.

They should do the research and decide which stock to buy or sell before the next trading session.

If they conduct research during the trading session, they can miss profitable opportunities.

7. Averaging on Losing Position:

Averaging for a long position when the prices go against the unexpected direction is good for long-term investors but not for Day Traders.

Traders should take the losses from their bad trade and they should not average their long positions as they have to square off on the same day.

Thus, averaging on long positions is one of the reasons why intraday traders end up making losses.

Read more about Intraday Trading from ELM School.

Advantages of Intraday Trading:

When doing intraday trading, traders do not require large capital. They can also sleep peacefully at night without being worried about how the markets will open the next day.

Due to the dynamic nature of the stock market, they can book huge profits and make money in the short term if they follow the basic principles of day trading.

You can also watch our video on Intraday Trading:

Bottomline:

As we have discussed above traders should conduct proper research before following any recommendations or intraday tips. As we all know that the intraday trading is a mixed bag of losses and gains. Not every trade goes right or is profitable. Thus traders should put a stop loss of their trades when doing intraday trading to protect their capital from losses.

And the most important thing before even starting is learning. You can check out our share market technical analysis course and make your self skilled.

Happy Investing!