In an interesting session as a part of the highly popular Face2Face series, conducted by Elearnmarkets, Mr Vivek Bajaj, Co-founder of Elearnmarkets, invited Mr Ronak Bhalala, a successful stock market options seller, to decode his options strategy.

Mr Ronal Bhalala has more than 10 years of experience in Trading. He is currently trading on multiple strategies in Options, religiously driven by Option Greeks and automated execution. His core competency lies in fine-tuning strategies with the help of data points and common sense. His journey of trading started with Option Buying. Learned arbitrage strategies execution through manual trading as well learn Option Selling.

In today’s blog, let us discuss his options selling strategy:

Table of Contents

What is Options Selling?

Selling options is a positive theta trade, which means that as time decays faster, the position will gain more money.

In an option trade, the buyer anticipates a certain direction of movement in the stock and wants to profit from it. To profit from the trade, this person must pay both intrinsic and extrinsic value (time value) and make up the difference.

The buyer of the option may lose money if the stock remains unchanged or, even more annoyingly, if the stock moves slowly in the right direction but the movement is countered by time decay since theta is negative.

Time decay, however, benefits the option seller because it continues to work on weekends and holidays in addition to slowly eroding each business day. It’s a gradual source of income for vendors who are patient.

Recall that on the first day of the deal, the option seller received payment for the premium. Consequently, a decrease in the value of an option contract benefits option sellers. The option seller can close out their position with an offset trade by buying back the option at a significantly lower premium when the option’s premium decreases.

Options Selling Strategy–Options Seller

According to Mr Ronak Bhalala, before entering his strategy there is no need to check any news, chart, VIX or IV. You can just execute the strategy.

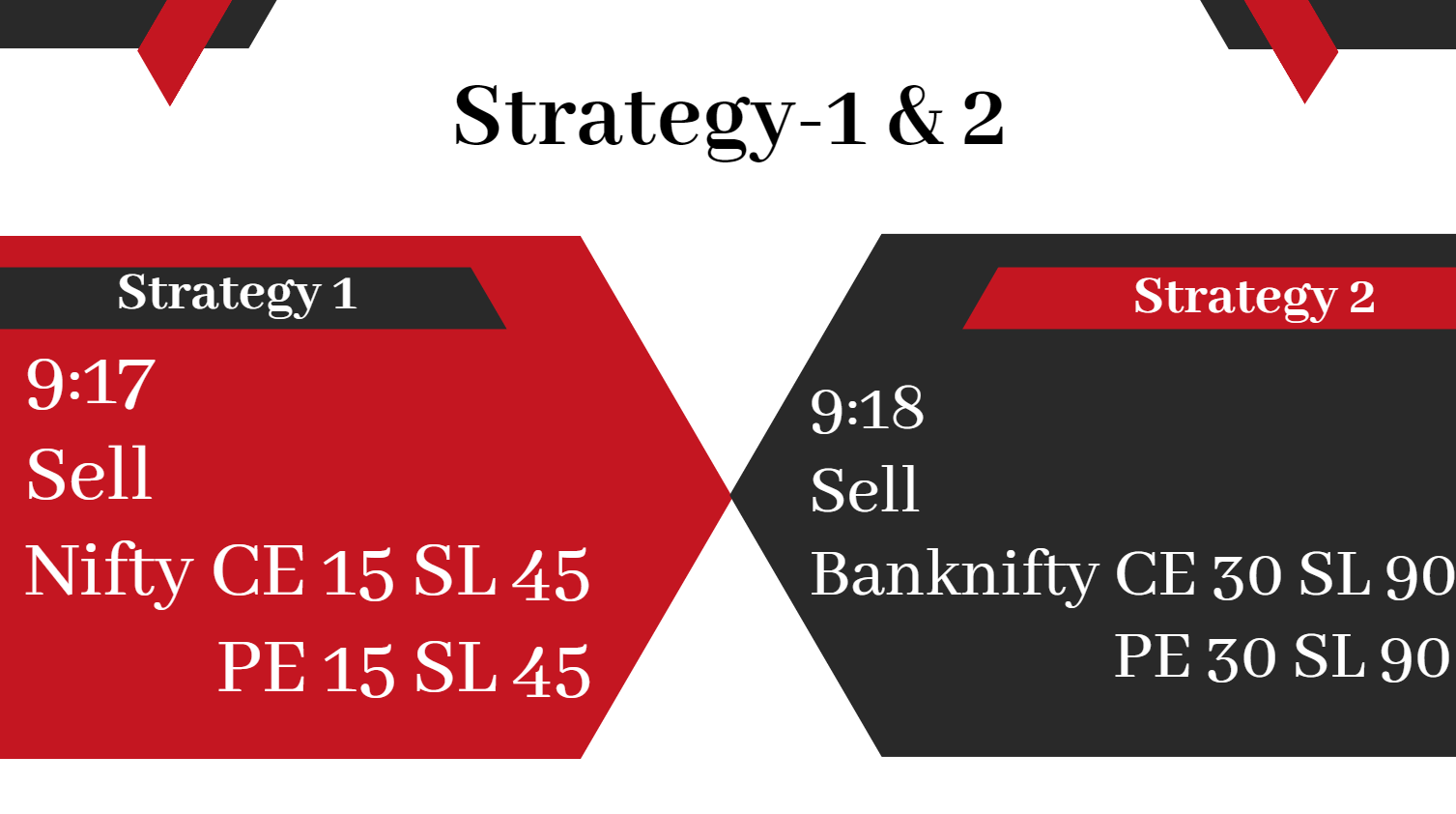

The are four legs to this strategy as follows-

1. Leg 1

At 9:17, one needs to sell a Nifty call of 15 with the stop-loss being 45 and a put of 15 being a stop-loss of 45.

2. Leg 2

At 9:18, one needs to sell a Bank Nifty call of 30 with the stop-loss being 90 and a put of 30 being a stop-loss of 90.

3. Leg 3

At 9:19, one needs to sell a Bank Nifty Call of 40 with a stop-loss of 9 points and a Put Option of 40 with a stop-loss of 9 points.

In this strategy one can exit once the stop-loss gets hit and re-enter when the price comes to 40 but only one time.

4. Leg 4

At 9:25, one needs to sell a Nifty Call of 20 with a stop-loss of 5 points and a Put of 20 with a stop-loss of 5 points.

In this strategy one can exit once the stop-loss gets hit and re-enter when the price comes to 20 but only once.

If the market remains sideways, you will get profits from all the legs. If the market goes in one direction- suppose bullish then you will profit from selling puts. If the market turns bearish then you will profit from selling calls.

In this strategy monthly return on investment is 3-4 % and Yearly Roi is 36-48 %.

One should note that this strategy can be only employed in the equity market using options.

You can watch the full Face2Face Video here-

Bottomline

According to Mr Ronak Bhalala, traders do mistake by never think ahead after deploying a strategy, lack of patience, overtrading and over diversify. Also he says patience is your weapon. One should use it. Learners do not stop. the path to success is never a straight line and failure is stepping stone to success.