How to save taxes, or rather, how to plan your investments, is a question that we all have. While tax planning is important, so are tax-saving strategies. With the best tax saving schemes in India, you can save money while also earning money.

The beginning of the fiscal year is the best time to plan for tax-saving investments. This ensures that you do not pay more taxes and save taxes in India, as well as year-long returns on tax-saving investments.

Why do only a few of us succeed in saving taxes in India? The answer could be a lack of knowledge or difficulty incorporating the best-suited option into your investment planning. We have listed each of the best tax saving investment options in India in this article to help you compare and make an informed investment decision.

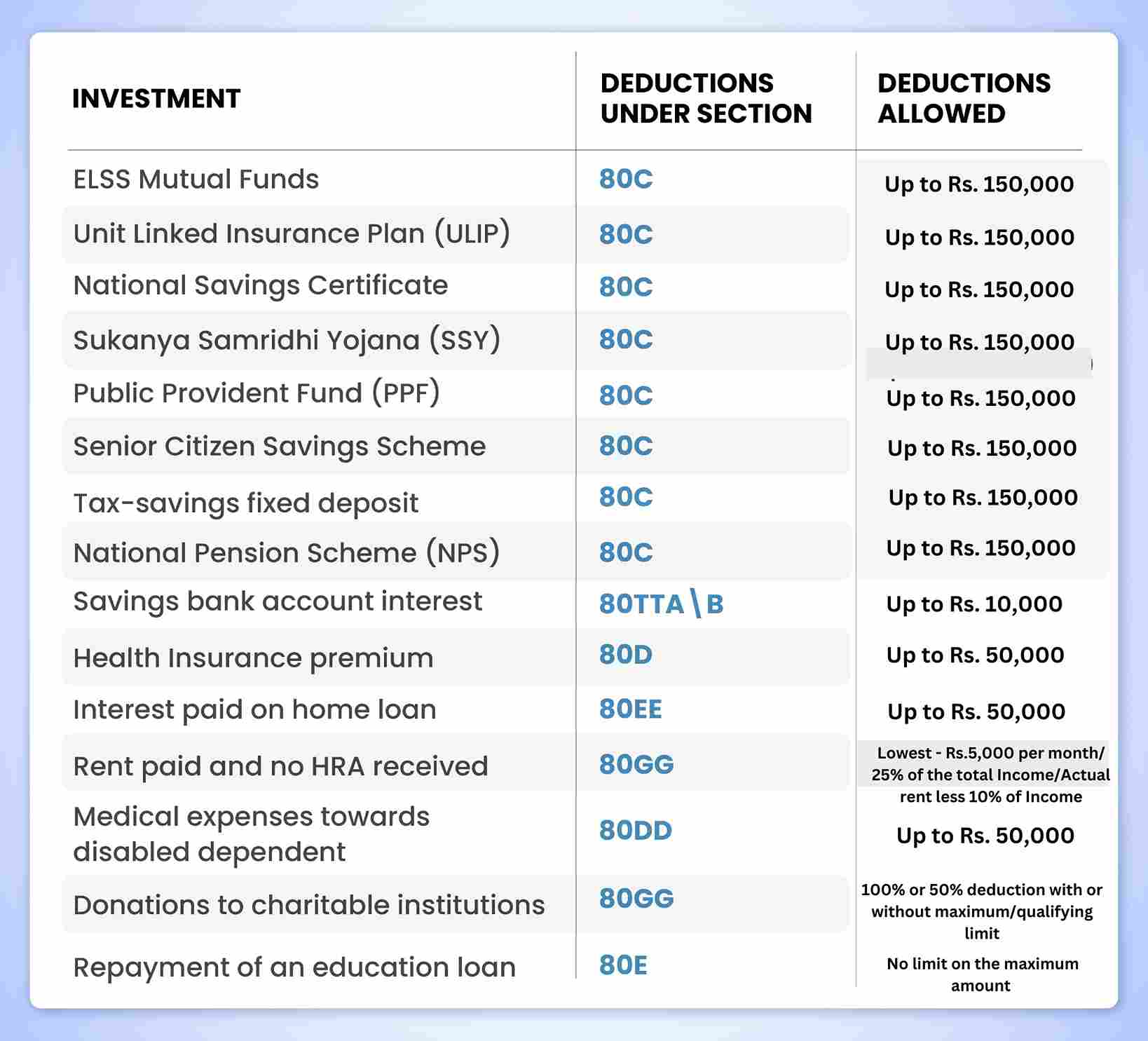

When considering how to save tax in India, remember that your goal should be more than just tax savings. The goal must be to invest in the best-suited investment option while also saving money on taxes. In this article, we have listed the best tax saving schemes for 2022-23-

- 15 Best Tax Saving Schemes in India

- 1. ELSS Mutual Funds

- 2. Unit Linked Insurance Plan (ULIP)

- 3. National Savings Certificate

- 4. Sukanya Samridhi Yojana (SSY)

- 5. Public Provident Fund (PPF)

- 6. Senior Citizen Savings Scheme

- 7. Tax-savings fixed deposit

- 8. National Pension Scheme ( NPS )

- 9. Savings bank account interest

- 10. Health Insurance premium under section 80D

- 11. Interest paid on home loan

- 12. Rent paid and no HRA received

- 13. Medical expenses toward disabled dependent

- 14. Donations made to charitable institutions

- 15. Repayment of an education loan

- How can one plan for tax-saving investments for the year?

- Watch our video on the Impact of Income Tax on your Investments

- Frequently Asked Questions (FAQs)

- Bottomline

15 Best Tax Saving Schemes in India

Here are the 15 best tax saving schemes in India:

1. ELSS Mutual Funds

Equity Linked Savings Schemes are mutual funds that invest a significant portion of their portfolio in equity. Furthermore, the fund has a three-year mandatory lock-in period, which is the shortest of any investment product and one of the best tax saving schemes in India

Investment in ELSS funds is tax-deductible up to Rs. 1.5 lakh under section 80C of the Income Tax Act. The deduction is available for lump sum investments and investments made through a systematic investment plan (SIP). Because ELSS funds invest heavily in equity, there is always some risk.

ELSS funds provide both capital appreciation and tax savings. As a result, it is one of the most popular tax-saving schemes among investors.

In general, taxpayers who want to claim Section 80C tax deductions of up to Rs 1.5 lakh and are willing to take some risk should consider investing in ELSS. These mutual funds are equity-oriented, with a minimum of 60% of their portfolio invested in equity and equity-related instruments. As a result, it is critical to remain invested in the funds for an extended time to reap the benefits of the returns.

2. Unit Linked Insurance Plan (ULIP)

The ULIP Life Insurance Plan is one of the most important tax saving schemes in India. It ensures that a person’s family is financially secure in the event of death. By purchasing a life insurance policy, the taxpayer can avail of the benefit under the income tax act.

Under section 80C of the income tax act 1961, the premium paid towards purchasing a life insurance policy qualifies for deduction up to Rs. 1.5 lakh. Furthermore, the policy’s maturity income is tax-free under Section 10(10D). If the premium does not exceed 10% of the sum assured, the income is tax-free.

3. National Savings Certificate

A government of India initiative, a national savings certificate is a fixed-income investment scheme that aims at small and middle-income investors to invest and earn handsome returns. It is considered a low-risk investment and as secure as the Provident Fund. Investors can invest based on their income and investment habits.

Investment in NSC qualifies for deduction under section 80C of the income tax act up to Rs. 1.50 lakh. Apart from tax benefits, it also provides the investor with complete capital protection and guaranteed interest and considered one of the best tax saving schemes in India. The following are some of the benefits of the NSC tax-saving option:

- As a guaranteed return, 6.8% annual interest is paid.

- Section 80C allows you to claim a tax deduction of up to Rs. 1.5 lakh.

- You can start with as little as Rs. 1,000. (or multiples of Rs. 100). You can increase the investment amount at your leisure.

- On maturity, the investor will receive the entire maturity value, which will be taxed by the taxpayer.

- There is no way to leave early. You can use the same as collateral security for bank or NBFC loans.

4. Sukanya Samridhi Yojana (SSY)

One of the most important tax saving schemes is the Sukanya Samriddhi Yojana. The government of India launched it in 2015 as part of the Beti Bachao Beti Padhao campaign. It had a major impact on the general public.

The scheme allows for a fixed-income investment in which the taxpayer can make regular deposits while earning interest. Investing in Sukanya Samriddhi Yojana also qualifies as an eligible deduction under section 80C of the income tax act.

The Sukanya Samriddhi is a government of India scheme one of the best saving schemes in India that allows depositors to earn tax-free and prepare for their future. The government determines the interest rate on this scheme which is payable on maturity. The scheme comes with a lock-in period of 21 years, and you need to pay a minimum amount in a year for 15 years before the account will be disconnected. To re-activate the account, you need to pay a penalty of Rs 50 and an original deposit of Rs 250, which will be deducted from your balance.

Only girlchild can claim the benefits of this scheme. It allows you one year time to invest your money and claim tax benefits.

5. Public Provident Fund (PPF)

The Public Provident Fund has always been one of the popular tax saving schemes amongst taxpayers. One of the major reasons for this popularity is the fact that PPF falls under the category of exempt–exempt–exempt tax status. You can open your PPF accounts with a bank or post office.

The PPF account comes with a lock-in period of 15 years, and it allows the investors the below options at the end of the maturity period: Withdrawal of proceeds from the account or continuing for the next five years.

6. Senior Citizen Savings Scheme

A senior citizen savings scheme is one of the income tax saving schemes available to senior citizens in India. The scheme is available for investment through banks and post offices and offers one of the highest rates amongst the various savings schemes.

A deposit made into the Senior Citizens Savings Scheme by an individual is a qualifying deposit under section 80C up to Rs. 1.5 lakhs from the taxable income. The interest on such deposits is fully taxable and liable for a tax deduction if the interest is above Rs. 50,000.

7. Tax-savings fixed deposit

Tax-saver fixed deposits are considered one of the safest tax saving schemes. They are safer than equity investments in terms of risk and returns. The banks decide the interest rates, and it depends on several factors. Below are some of the features of a tax-saving fixed deposit:

Investments in tax saver fixed deposits are eligible for deduction under section 80C while calculating your taxable income. The interest rate you receive is guaranteed by the government of India. With a minimum lock-in period of 5 years, you can save on your taxes.

8. National Pension Scheme ( NPS )

National Pension Scheme or NPS, one of the best tax saving schemes, allows you to build a corpus for your future with a regular income. A Tier-1 account has a lock-in period until the subscriber reaches the age of 60 years. The maximum contribution under a tier-1 account is Rs. 15,000 per annum, tax-deductible under section 80C of the Income Tax Act.

To make contributions tax deductible, make your deposits using either online or offline mode methods using valid crediting cards such as KYC digital, credit card (Visa & MasterCard), or debit cards issued by any Indian bank or other financial institution approved by RBI.

As per Section 80CCD, individuals are allowed to claim deductions up to Rs. 1.5 lakh by investing in NPS. Additionally, a new sub-section 1B was also introduced, which offered an additional deduction of up to Rs. 50,000/-for contributions made by individual taxpayers towards the NPS

9. Savings bank account interest

A savings account or current account is a basic type of bank account service that allows you to deposit money and keep it safe. It’s a liquid instrument, as individuals can withdraw money anytime at their convenience without restrictions.

In the case of senior citizens, a tax deduction is payable for interest earned on fixed and post office deposits under Section 80TTB. This deduction is applicable to taxpayers other than those who are senior citizens.

The maximum deduction under section 80TTA is Rs. 10,000. The limit of Rs. 10,000 applies to the total interest earned from the savings bank account that the assesses has. Any interest over and above Rs. 10,000 is taxable under “Income from Other Sources”. The rate of tax will be as per the applicable tax slab rate.

10. Health Insurance premium under section 80D

Medical insurance is considered the safest investment option and tax saving schemes. This allows the taxpayer to avail of the benefits on two fronts. Firstly, being taken care of by the insurance policy in the case of a medical emergency. Secondly, the tax benefit under the income tax act for investing in an investment product.

11. Interest paid on home loan

For an individual seeking to claim the interest component on a housing loan as a tax deduction, the conditions are: A home loan must be taken for the purchase or construction of a house. Construction of the house must be completed within five years from the end of the financial year in which the loan was taken. This can also be considered as one of the best tax saving schemes in India.

The interest component paid as a part of the loan can be claimed as a deduction under section 24 up to Rs 2 lakh. This is applicable in the case of a self-occupied property. In case of property let out, there is no upper limit for claiming interest.

Read our ELM School Module on Tax Planning

12. Rent paid and no HRA received

Generally, You receive HRA as a part of your salary and treat HRA as a major tax-saving scheme while filing income tax returns. However, there can also be a case wherein it does not form part of the employee’s salary.

In such a case, a standard HRA deduction cannot be claimed, and the taxpayer would not be able to claim the benefit even if they are paying the rent. Further, in such cases, a taxpayer must claim a tax benefit under section 80GG.

13. Medical expenses toward disabled dependent

As per the provisions of section 80DD, taxpayers can claim a deduction if they are looking after disabled dependents. This tax benefit will help in reducing the tax liability of the person who is taking care of someone disabled in the family who is dependent on them.

You can also do our course on CERTIFICATION IN ONLINE FINANCIAL PLANNING & WEALTH MANAGEMENT

14. Donations made to charitable institutions

Under Section 80G, there is a tax deduction allowed on donations made to various organizations. The amount that has been given as a donation should be made by cheque or online transfer. This will allow a 100% deduction of the amount paid to an approved charitable organization.

Any cash transfer above Rs. 2,000 do not qualify for this deduction under this section. It is very important to make sure that you take the stamped receipt from the organization from where the donation has been made in order to claim this deduction.

15. Repayment of an education loan

The income tax act provides a tax benefit on repayment of the loan as a tax deduction under section 80E of the act. You must remember that this tax saving option is available to the person who is repaying the loan.

Once an educational loan is availed, the interest paid on the education loan qualifies for a tax deduction for a maximum of 8 years or the interest is repaid, whichever is earlier. Depending on who pays the EMI for the education loan, the parent or child can claim the deduction

How can one plan for tax-saving investments for the year?

Don’t wait till the last quarter of the year to invest in your chosen tax saving schemes. Instead, plan early and invest according to your goals. This will allow you to beat the rush and make informed choices.

While you may still need to meet your 10 percent annual lock-in limit, this will be easier if you’re able to hold on during a volatile market. Most people do not realize that taxes can be as much as 60 percent of returns! That’s why it’s important for us to talk about tax planning now and avoid any problems later on when we need to sell our portfolios, renew our homes and take care of children’s education expenses.

Watch our video on the Impact of Income Tax on your Investments

Frequently Asked Questions (FAQs)

1. How to save income taxes in India?

You can save tax in a number of ways. The government encourages citizens to invest in the tax-saving investments mentioned under section 80C of the Income Tax Act in order to reduce their tax burden.

In this way, you can make sure you have some sort of investment and stop worrying about spending excessive money on paying taxes. You may also receive a deduction for certain dependents who are eligible, as well as another thing that is related to your tax benefits

2. What are the tax saving options for senior citizens in India?

Fixed deposits (FD) and recurring deposits (RD) are one of the safest and most popular investment choices for senior citizens. The interest rate of FDs and RDs offered by the bank for senior citizens are comparatively higher than that of junior citizens.

3. When is the best time to save taxes in India?

Save taxes and make a year-round return with tax-saving investments. Begin planning for these as early in the financial year as possible, so that you can benefit from the best tax-saving investments before they start giving great returns to you.

Bottomline

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!