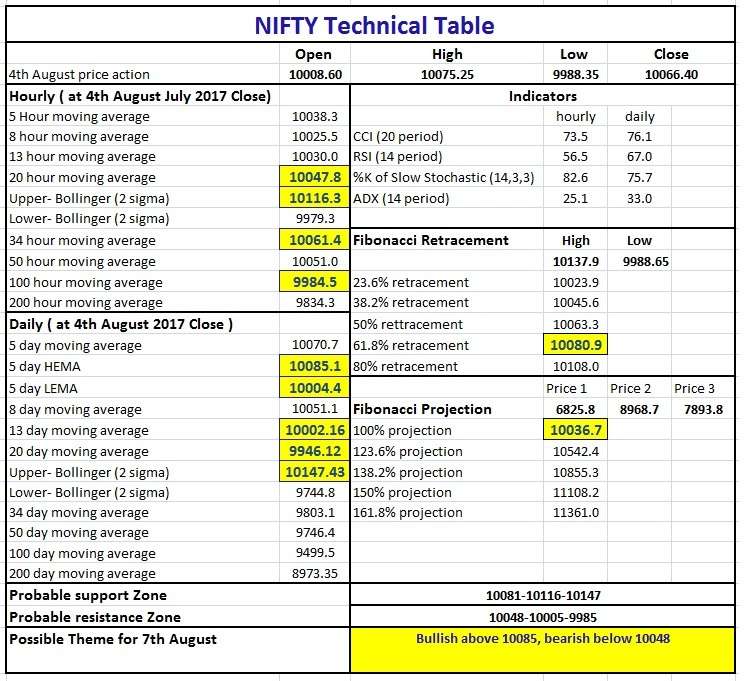

Nifty (weekly close approx. 10066.4):

Nifty moved up during first two days of the week and after Wednesday’s RBI policy it started seeing correction due to some profit booking.

On Friday, in the second half, Nifty turned bullish and moved approx. 80 points from the day’s low.

Hourly Technical:

Nifty is at an important juncture in the hourly chart.

If it keeps on staying above 20 hour moving average (presently at approx. 10048) and 34 moving average (presently at approx. 10061.4), it should resume up move.

Another important level on the upside can be 10081 (61.8% retracement of the last down move, as shown in the hourly chart below).

On the other hand, if Nifty goes below20-hour moving average and 34 hour moving average, it may aim for 100 hour moving average (presently at approx.9984.5) and 200-hour moving average (presently at approx. 9834.3).

The hourly CCI and RSI are in the neutral zone, while hourly slow stochastic is just at the borderline of normal zone, hourly ADX is trending down.

Figure: Nifty Hourly Chart

Daily Technical:

In daily chart, Nifty may find support at 13 DMA (presently at approx. 10002) and 20 DMA (presently at approx. 9946).

On the other hand, if Nifty starts trading above 5 DMA (presently at approx. 10070.7) and 5 day high EMA (presently at approx.10085.3), there is a good chance that Nifty may resume its uptrend.

Daily CCI, RSI and slow stochastic have just entered into the normal zone from the overbought zone and daily ADX is broadly neutral.

Become a Technical Analysis Expert by enrolling in NSE Academy Certified Technical Analysis course on Elearnmarkets.

Figure: Nifty Daily Chart

Weekly Technical:

In the weekly chart, Nifty remains firmly bullish. Weekly CCI, RSI, slow stochastic, ADX are bullish. Weekly close above 10036 (100% projection of the move from approx.6826 to approx. 8969, from Dec 2016 low of approx. 7893) has opened up Nifty for higher Fibonacci projection targets (approx. 10542, 10855, 11108, 11361 etc.) as shown in the following weekly chart.

Figure: Nifty Weekly Chart

Figure: Nifty Tech Tabl

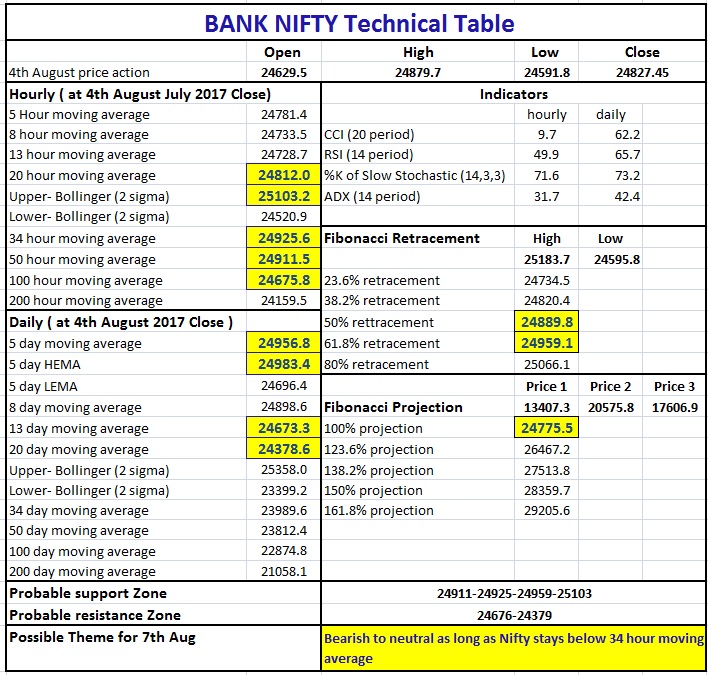

Bank Nifty (weekly close approx. 24827.45):

Bank Nifty had a good bullish day on Monday. But ,the momentum shifted from the day of RBI policy. Even though there was a rate cut, Bank Nifty saw profit booking and the price broke the upward-sloping supportive trend line, and towards the week’s end closed just at the trend line.

Hourly Technical:

In the hourly chart, the Bank Nifty is just situated at 20 hour moving average.

After the break-down below the trend line, it is vulnerable for more weakness if it stays below the trend line and 20 hour moving average (presently approx 24812).

On the downside, 100 hour moving average (presently at 24676) and 200 hour moving average (presently at approx. 24156) may act as important support.

On the up-side, the Bank Nifty may find resistance at 50 hour moving average (presently at approx. 24911) and 34 hours moving average (presently at approx. 24926) and 24959 (61.8% retracement of the last down move). Above these levels, Bank Nifty is likely to change the bearish tone.

The hourly CCI, RSI and slow stochastic are in the normal zone and the ADX is trending down.

Overall, Bank Nifty remains Neutral to Bearish in the hourly time frame.

Figure: Bank Nifty Hourly Chart

Daily technical:

Bank Nifty remains bullish to neutral in daily timeframe. It has taken support close to 13 DMA.

On the downside, 13 DMA (presently approx. 24673) and 20 DMA (presently approx. 24378) are immediate probable supports.

On the upside, 5 day high EMA (presently at approx. 24983) may act as an important barrier.

Once Bank Nifty start closing above 5 day high EMA, it may aim for newer highs.

Daily CCI, RSI and slow stochastic have move from overbought zone to normal zone and ADX is just on the verge of turning down. Overall, the scenario is bullish to neutral.

Figure: Bank Nifty daily chart

Weekly Technical:

In weekly chart, Bank Nifty remains broadly bullish. Weekly CCI, RSI, slow stochastic, ADX are bullish. Weekly close above 24776 (approx. 100% projection of the move from approx. 13407 to approx. 20576, from Dec 2016 low of approx. 17607) has opened up Bank Nifty for higher Fibonacci projection targets (approx. 26467, 27513, 28360, 29206 etc.) as shown in the following weekly chart.

However, the last candle can be classified as a Doji, which implies the possibility of a pause or a reversal. Hence we have to look for price action ahead.

Figure: Bank Nifty Weekly Chart

Figure: Bank Nifty Tech Table

Watch the video below to learn how to interpret the Bank Nifty and Nifty Technical table:

Bottomline:

You can read other Bank Nifty reports here.

Happy Reading!!