Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

When to take profits and when to cut losses short is one of the toughest decisions that traders have to make.

Some traders will sell their stock as soon as it rises while others continue to hold onto their shares till the trend reverses.

The latter is one of the biggest mistakes they make while trading. Now, how can you prevent from making this mistake?

The trailing stop loss order helps us to trade in the stock market with discipline.

| Table of Contents |

|---|

| What is Trailing Stop-Loss? |

| How does Trailing Stop-Loss work? |

| Techniques for placing Trailing Stop-Loss |

| Advantages | Disadvantages |

Let us discuss what it is all about, how it works, and the advantages & disadvantages of using it.

What is Trailing Stop-Loss?

A trailing stop is a type of stop-loss order which combines both risk management as well as trade management.

Trailing stops are also referred to as profit protecting stops as they help us to lock in profits on our trades.

It also helps us in protecting the amount that will be lost if our trade doesn’t work out.

They are set up to work automatically with most brokers or the trading software provided by them.

It can also be manually implemented by the trader.

How does Trailing Stop Loss work?

A trailing stop loss is firstly placed in the same technique as a regular stop-loss order.

For example, if we want to place a trailing stop for a buy order then we would place it at a price that was below the trade entry.

The main difference between the two is that the trailing stop loss moves as the price moves.

For example, for every 5 points that the price moves, then the trailing stop loss will also move five points.

Suggested Read :- How to place Stop Loss when Trading

Trailing stops move in direction of the trade, so if you have to buy position and the price moves up 10 points, then the stop-loss will also move up 10 points.

But, if the price starts falling, then the stop loss doesn’t move.

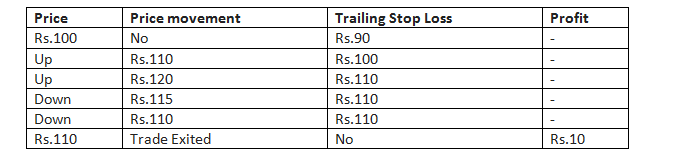

Below is a table that will help you in understanding this:

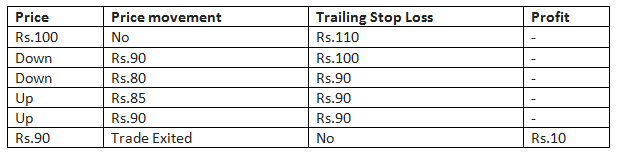

Now let us discuss how trailing stop-loss works when we short:

For example, if we want to place a trailing stop for a sell order then we would place it at a price that was above the trade entry.

Below is a table that will help you in understanding this:

Techniques for placing Trailing Stop Loss

It can be placed with the help of technical indicators:

1. Moving Average:

You can use the Moving Average indicator to set it.

Here are steps to do so:

- Decide whether you want to long or short the trade

- Use the appropriate Moving Average

- Lastly, exit when the price closes beyond it

This means if you want to enter buy position, then you can trail your stop loss with a 20-period Moving Average (MA) and exit your trade when the price closes beyond it.

Example:

2. Average True Range indicator:

You can also use the Average True Range indicator for setting a volatility based trailing stop. Here are steps to do so:

- Decide on the ATR multiple you want to use.

- If you’re long, then minus X ATR from the highs and that will be your trailing stop loss

- If you’re short, then add X ATR from the lows and that will be your stop loss

Advantages:

- This order type will sell your automatically stock when share levels drop.

- This order does not limit your profits. Shares can continue to rise and you will stay invested as long as prices do not fall below your stop loss.

- The order is flexible. You can enter any trailing stop-loss percent for a customized risk management plan and change it as you please.

- There is no extra cost for placing a stop-loss order.

- This order allows investors to take emotions out of their trades.

Disadvantages:

- There is no guarantee that you will receive the price of your stop-loss order. Some brokers do not allow for stop-loss orders for specific stocks or exchange-traded funds (ETFs).

- Volatile stocks are difficult to trade with these orders

- You can lose the ability to make a thoughtful and analytical decision on whether to sell the stock when the price drops.

Key Takeaways:

- The trailing stop loss order helps us to trade in the stock market with discipline.

- It is a type of stop loss order that combines both risk management as well as trade management.

- They are set up to work automatically with most brokers or the trading software provided by them.

- The main difference between stop loss and a trailing stop is that the trailing stop moves as the price moves.

- Trailing stop loss can be placed with the help of technical indicators.

Will you be now able to place it to your trades? Tell us by commenting below.

Happy Learning!

THis will work when we auto mate our stratery.How to do that and back test.

Which trading platform will help in automating and back testing the stratergy.

Does zerodha provide SL based on indicator, as I am using zerodha.

Hi,

Yes, Zerodha also have charts and indicators, from there you can decide your stop loss and place the order.

Thank you for Reading!!

you have given a best info about stop loss.

Hi,

Thank you for reading our blog!!

Keep Reading!

Very informative

Hi,

Thank you for reading our blog!!

Keep Reading!

Informative

Thanks 😊 🙏

Hi,

We really appreciated that you liked our blog.

Keep Reading!