It is important for the investors and professionals to start investing early. The main reason for doing so is to take the benefit of compounding. By investing for a longer duration, an individual can allow his assets to generate more returns by growing slowly and steadily. To learn, value investing books will be a great help.

“An investment in knowledge pays the best interest.” – Benjamin Franklin

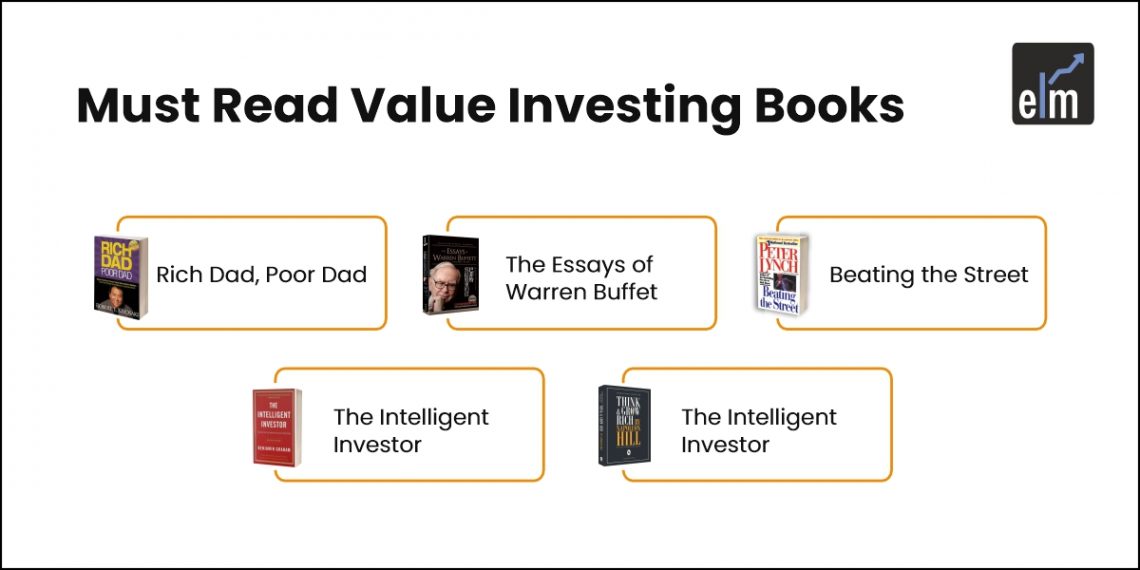

As it is important to start investing early, one should also invest wisely. Here are top 7 value investing books which can provide financial useful insights for the investors::

Value investing Books You Must Read

1. “Rich Dad, Poor Dad” by Robert Kiyosaki

Buy from Amazon: amzn.to/2DDLcCE

This value investing book is a must read book for all investors. The author’s view is that the poor and middle class people work for a living whereas rich people work to learn. In this book, Kiyosaki pressures on the importance of financial literacy and personall finance. He states that financial independence is the ultimate goal.

Kiyosaki states that it is important to learn accounting but sometimes it may also mislead. Banks refers house as an asset, but since it requires payments for maintenance, it should be considered as a liability in terms of cash flow.

The author focuses on those types of investments which produces periodic cash flows while also provides an increase in the value of equity for the investors. According to him investments like real estates and stocks which give regular dividends are favourable. He also highlights the importance of tax planning

Here you can read full summary of “Rich Dad, Poor Dad” by Robert Kiyosaki

The author focuses on those types of investments which produce periodic cash flows while also provides an increase in the value of equity for the investors. According to him investments like real estates and stocks which give regular dividends are favourable. He also highlights the importance of tax planning.

Learn from Experts – Value Investing Strategies

2. “The Essays of Warren Buffet” by Lawrence A. Cunningham

Buy from Amazon: amzn.to/2DDPjyB

Warren Buffet is considered to be the most successful investor in the modern history. In this value investing book the author has provided Warren buffet’s views on a wide range of topics related to the shareholders. Investors can get in-depth connection between the management and the shareholders as well as the process involved in enhancing the enterprise’s value.

This book includes various discussions on investing, finance, accounting, valuation, and corporate governance and tax matters and also outlines the basic principles. As the steward of Berkshire Hathway Inc. Warren Buffet informs the shareholders of the company about their mutual interests. He states that one should purchase the stock of the business whose stocks are trading at discount. This book focus on long term value creation, integrigy and investor’s friendly approach. This is a mst read book for business leaders and investors

3. “Beating the Street” by Peter Lynch

Buy from Amazon: amzn.to/2PO1Arx

Beating the Street is one of the must read value investing books. Peter Lynch is one of the most successful investors and hedge fund managers. He started as an intern at Fidelity Industries and 11 years later he was asked to manage the Magellan fund. During the time the fund gave more than 29% returns per year.

Suggested Read: 5 Mantras of Value Investing

This book helps the investor to peek into the author’s mind and thought process, in terms of whether to buy or sell the stock. The author believes that the investor can make better use of the market opportunities than Wall Street and encourages the investors to invest in what they understand. Peter Lynch shows how you can build a profitable investment portfolio based on your experience and investment approach.

4. “The Intelligent Investor” by Benjamin Graham

Buy from Amazon: amzn.to/2PPVvuE

This is the best book ever written on investing. Benjamin Graham is known as the “father of value investing”. In this book the author takes the investors back to the history of the stock market. He tells the investors to conduct fundamental research on the stock. He also discusses different ways of managing the portfolio by using both positive and defensive approach. He also compares the stocks of various companies to prove his points. In this value investing book author explains the psychological aspects of investing and the impact of market fluctuations on investor behaviour. He also warns about the emotional reactions to market fluctuations and advises investors to adopt a disciplined approach. This book p[rovides a thorough analyses in order to provide safe and secure returns.

Here you can read full summary of “The Intelligent Investor” by Benjamin Graham

5. “Think and Grow Rich” by Napolean Hill

Buy from Amazon: amzn.to/2PRyNT5

The author conducted extensive research based on his association with wealthy people. In this book, he has published 13 principals through his research for success and personal achievement. These principals include faith, desire, organized planning, specialized knowledge, persistence and the “sixth sense”. This book conveys the psychology of success and focuses how willpower is a crucial component of the journey to success.

Here you can read full summary of “Think & Grow Rich” by Napolean Hill

6. “Value Investing and Behavioral Finance” By Parag Parikh

Buy from Amazon: amzn.to/2PPGDwu

This book is written by an Indian author Parag Parikh. It is a well structured book and helps in understanding behavioral traits, contrarian trading; sector investing, public sector investing, initial public offerings, bubble trap and index investing. This value investing book quiet compelling for investors and also explains fundamental concepts. This value investing book provides practical knowledge how a investors can avoid any difficulties by understanding to the principles of value investing. If someone wants to get a good insight into the Indian stock market then this is the best book to read.

7. “The Little Book of Value Investing” by Christopher H. Brow

Buy from Amazon: amzn.to/2PPVEyc

In this book, Christopher has used example of supermarket shopping in order to explain the concept of buying stocks. At a supermarket both expensive and cheap stocks are available. It totally depends on the behaviour of the buyer whether he will buy an expensive product or buy a cheap product which will anyhow fulfil his needs. Only a value investor can do a thorough research about the product and buy undervalued products.

There are a number of topics on value investing in this book like: shareholding, margin of safety, choosing value over growth, diversification of stocks, insider’s buying pattern, etc. From this book you can learn a lot about value investing strategies.

This book is brief but there are number of investment strategies an investor can learn.

Bottomline

In conclusion, these top 7 value investing books provide invaluable insights into the principles of successful investing. If you are a new or a experienced investors, each books offers unique investing principles on long term wealth creation and focuses on analyzing fundamentals. By studying these books you can learn different investment strategies and can also develop a patient mindset which is essential for making sound investment decisions that align with value investing principles.

Happy Reading!

Note: Amazon Affiliate link mentioned above

Also Read: Top 7 Must Read Technical Analysis Books

Frequent Ask Questions (FAQ)

What is value investing?

Value investing is a strategy where you buy stocks that are undervalued by the market. The goal is to invest in companies whose true worth is higher than their current stock price.

What is the #1 rule of value investing?

The #1 rule is to buy stocks with a margin of safety, meaning the stock is priced significantly below its intrinsic value, reducing the risk of loss.

Why to read value investing book?

Reading value investing books helps you understand the principles, strategies, and mindset of successful investors, enabling you to make informed investment decisions.

You have noted very interesting details! ps nice web site.

Great list! Value investing is very hard to master, but reading these books is simply the best way to learn value investing. There are many books about value investing but these 7 are simply the best. BTW you didn’t list my favorite one: One Up On Wall Street by Peter Lynch.