Fair Value is a common term used amongst the long term investors.

Being a long term investor, we always try to look for companies that have good future growth potential or which are undervalued as compared to its current market price.

In the first case, when we say we look for a good company with good growth potential, it is called Growth investing.

On the other hand, when an investor looks for a company whose price is below its fair value, we call it Value investing.

| Table of Contents |

|---|

| What is Value Investing? |

| Characteristics of Value Investing |

| Use of Combination Scans in Value Investing |

What is Value Investing?

It is a way of investment where those companies are selected whose value or the market price is less than the intrinsic value.

Value investors usually seek those companies which they believe are undervalued in the market.

It is a common belief among the value investors that the market tends to react to any news resulting in absurd price movements that actually do not correspond with the company’s fundamentals.

This creates an opportunity to profit when the price of the company is much lower than the intrinsic or fair value.

In case you are looking forward to understanding the complete analysis of the companies, you can visit our Fundamental Analysis Course section.

Characteristics of Value Investing:

Value Investing has few aspects which are needed to be followed. Let’s discuss those:

1. Power of Compounding:

Power of Compounding states that when one invests Rs 100 today compounding at 20% pa, this will result in Rs 1540 in 15 years, Rs 3834 in 20 years, and Rs 9540 in 25 years.

Also Read : Understand the Power of Compounding

In basic terms, it means that the more is the number of years, the better will be the result of compounding.

Few big investors like Warren Buffett, Charlie Mungeretc believed and applied the concept of compounding in their long term investment portfolio.

2. The Margin of Safety:

The principle of Margin of Safety states that an investor will purchase security only when the market price is below its intrinsic value.

The margin of safety acts as a cushion to any adverse or unforeseen events regarding the particular stock.

Know more: Why Margin of Safety Matters?

However, we have to note that buying a stock below its intrinsic value does not guarantee a successful investing, as finding the ‘true or intrinsic value’ of a stock is completely a subjective matter and differs from person to person.

3. Invest in a comfortable business:

When we plan to buy a smartphone, we often research and dig deep into the performance and features of the phones along with the brand.

We do this because we want to make sure that the money we are spending on it is a fruitful one.

Similarly, when we want to invest in companies, we must always make sure that we understand the business and its product in detail.

This will ensure that we connect with every negative or positive development around the business. Following this will also help to avoid losing money.

4. Invest in companies having a moat advantage:

Companies having moat are always said to remain in an advantageous position.

Moat is a quality which a company possesses, which gives it a competitive advantage to its peers.

The presence of moat acts as a barrier against any other company seeking to enter into the industry and thus enjoying the supernormal profit.

5. Keep some cash idle:

In value investing, it’s always better to keep aside some idle cash as, during volatile markets, it is often seen that few of the companies are available at a highly discounted price due to market sentiments.

This idle cash helps in investing in those companies.

Inculcating Value investing is not an easy task as we need to have a strong conviction on the company we are investing in.

It is highly risky and time-consuming to find stocks that are trading below their intrinsic value

Having proper knowledge about the company is one of the most critical factors which we need to keep in mind.

To get practical insights on scans, you can use the Stockedge app.

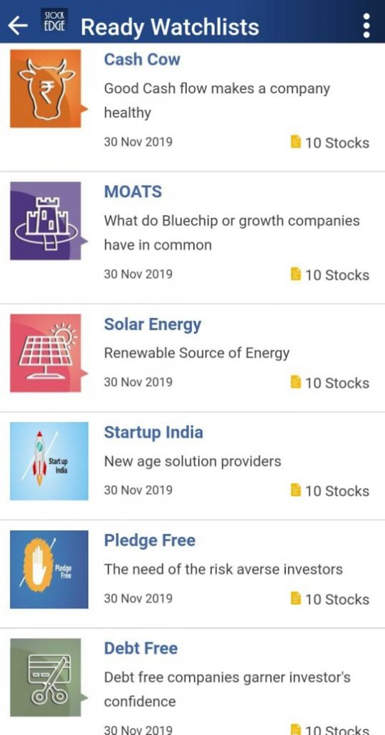

Here, you will find a ready watchlist, as shown in the image in the StockEdge app.

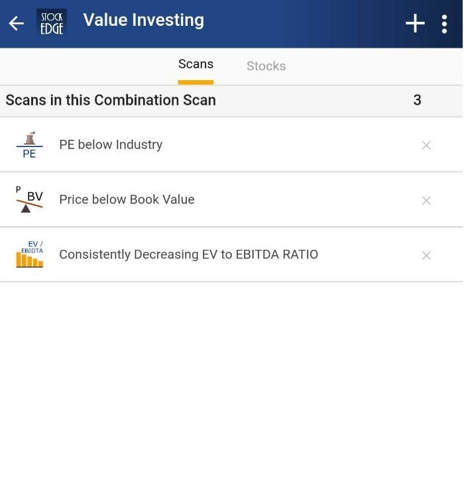

Under Combination Scans, we can prepare our custom scans as per our needs.

For value investing purposes, there is a combination scan using a few of the many criteria from ‘Valuation Scans’.

Use of Combination Scans in Value Investing

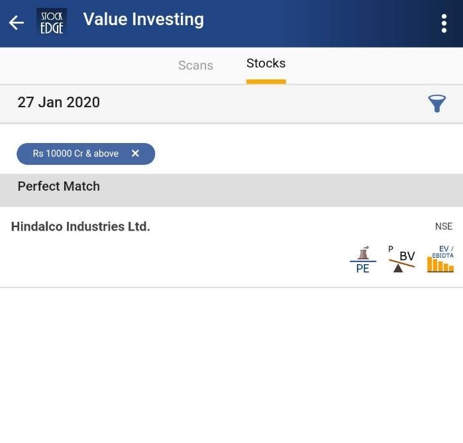

First, you need to select criteria, like here we have used ‘PE below industry’, ‘Price below Book Value’ and ‘consistently decreasing EV to EBITDA ratio’.

These scans will show us the companies which are trading below the industry average and are below its book value.

As in Value Investing, we generally tend to look for companies that are trading at a discount but have a good future potential.

After this step.

You will be required to filter out stocks which have a future potential.

Filtering the stocks is a process which we have explained in our following blogs:

Also Read:

Once you are finished doing both the steps, you are ready for Value Investing to create wealth for yourself.

As Warren Buffet says, “Price is what you pay, and Value is what you get.”

Dear Author,

Thank you for writing this article, it is very informative and useful. As per my experience there is a vital difference between educated and being financial educated. The article written by you will make people financial educated.

Regards,

Abhishek