To understand Strategic Asset Allocation, let us know what is Asset Allocation, first. In simple words, it is a process of distributing the investor’s savings among the various asset classes.

So, by definition Asset Allocation is allocating funds to different asset classes based on the risk appetite of an investor.

Now, Strategic Asset Allocation is one of the important concepts in portfolio management theory.

The two main principles are :

- Diversification of portfolio

- Reduced Risk with good returns

What is Strategic Asset Allocation?

It is a traditional approach to building a long term portfolio which is purely based on the needs and preferences of the individual’s long and short term goals.

This type of allocation is done with a goal to generate maximum returns while keeping the risks in control which is acceptable to the investor.

Now, talking about strategic asset allocation, portfolio re-balancing is also an important concept. As the market is dynamic there is a constant need for periodic re-balancing of the portfolio.

Lets understand this concept with an example:

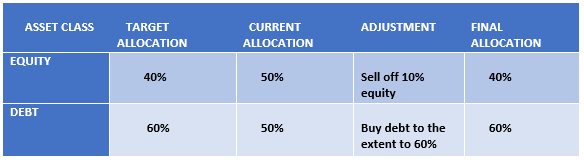

Suppose a portfolio has been constructed with 60% debt and 40% equity in the beginning. But at the end of the year when the portfolio was reviewed, it was found out that equity now represents 50% of the portfolio as the equity market had performed well during the year. So how do we re-balance it to its original?

The equity portion will be sold to bring it to 40% and with that proceeds debt will be bought in order to bring it up to 60%, as shown in the table below:

Learn basics of finance with Invest in Yourself course by Market Experts

When this strategy need to be applied?

- Risk Averse Investors – This type of allocation helps the risk averse investor based on its investment profile. This allocation is generally for the risk averse investors. A group of asset classes are made taking into consideration the investor profile in order to mitigate the concentrated security risk and subsequently generate average returns.

- Novice Investor – The Newbie Investors who wants to generate returns from the markets.

- Long term investors – The Long term investors who do not want to time the market or get involved in the complex process of stock picking and wants to invest for long term.

Advantages of Strategic Asset Allocation

- It is a fixed investment portfolio for a risk averse investor.

- This type of portfolio is relatively easier to maintain due to the simple approach of the passive form of portfolio diversification management.

- Only when the allocation is dis-proportioned then re-balancing is done in order to bring the portfolio into its original form.

- These are made based on the profile of the particular investor which helps the investor to get appropriate returns as per his preferences.

- This strategy is for amateur investors who wants to invest in the markets with calculated risks.

How does strategic allocation process work?

Strategic Asset Allocation vs Tactical Asset Allocation

| STRATEGIC ASSET ALLOCATION | TACTICAL ASSET ALLOCATION |

| Need based approach of portfolio management. | View based approach of portfolio management. |

| Passive form of investment. | Basically active form of managing the protfolio. |

| Goal oriented approach which means that the portfolio is constructed keeping in mind the risk appetitie of the investor and short term as well as long term goals. | Return oriented approach wherein the sole motive is to out perform the underlying benchmarks and generate higher returns. |

| This allocation strategy are mostly for the conservative investors. | This strategy are mostly for the aggressive investors. |

Key takeaways:

- Strategic Asset Allocation is a traditional approach of managing investments which takes the investor’s profile into account and targets to meet the desired goal keeping the risks at bay.

- Re-balancing of the portfolio needs to be done periodically in order to maintain the proportion of the assets allocated in the beginning.

- This allocation process starts by assessing the types of risk, investment horizon, allocating the assets accordingly to finally monitoring and re-balancing the portfolio as per requirement.

- Strategic allocation uses diversification to invest the funds of the long term investors so as to generate returns as well as keep controlled risks on the investments.

- The most important difference between the Strategic and Tactical Asset allocation is that strategic is need-based and tactical is a view based asset allocation approach. For distributing you saving across various asset classes, you can take assistance of Kredent Money App.