Introduction

The Indian paper industry plays a vital role for the growth and development of the economy. India is the fastest growing market for paper.

Indian Paper industry accounts for about 3% of the world’s paper production. The estimated turnover of the industry is 50,000 crores approximately and is expected to reach more than 75000 crores by the end of 2023.

The domestic demand increased from 9.3 million tonnes in FY08 to 17.12 million tonnes at a CAGR of 6.3%. The industry provides employment to more than 0.5 million people directly and 1.5 million indirectly.

The mills use a variety of raw material (i.e. bagasse, recycled fibre, wood, bamboo, wheat straw, rice husk, etc). Approximately 24% of total production is based on wood, 65% on recycled fibre and 11% on agro-residues. There are about 700-800 paper mills across the country.

The industry is classified under four segment: Printing & Writing, Packaging Paper & Board, Specialty Papers & Others, and Newsprint.

Growing Indian economy, the rising disposable income of the individual, growth in FMCG market, etc. encourage the use of paper for printing, writing, newspaper, packaging and much more.

Among them, the highest ratio of total paper market is used for paperboard and packaging.

The pulp is the primary raw Material which accounts for over 40%, obtained from wood, wastepaper, agriculture residues etc.

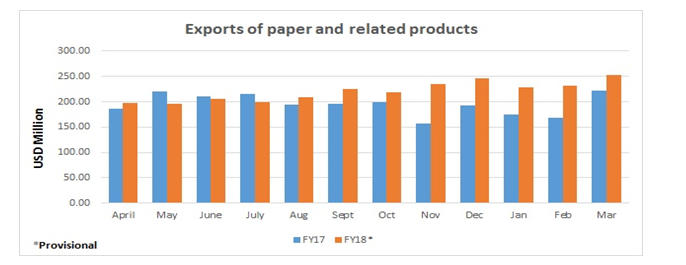

Exports

The share of paper related products in the overall export market stood at 0.87% or USD2649.30 million in FY18, up by 13.45% as compared to USD2335.17 million in FY17.

Of the total, paper, paper board, and paper contribution stood at 55.66% in total export of paper, followed by plywood and allied products at 32.5%.

Books, printing, and publications accounting for 10.04% and other products at 1.61%.

Imports

The share of paper & paper related products in the overall imports stood at 1.78% or USD 8277.28 million in FY18, up by 18.35% as compared to USD 6993.65 million in FY17.

Of the total; paper and paper board imports were around 40% in total import of paper, followed by plywood and allied products at 16.86%, pulp and waste paper 13.95%and other products stood at 16.06%.

The import of paper and paper products are due to high-cost domestic woods in India up by almost USD30-40 per tonne.

Chinese ban on waste paper

Indian paper industry is expected to benefit from the ban on waste paper by Chinese government amidst environmental concern.

Waste paper is one of the sources of raw material for the manufacture of recycled paper, which is extensively used for manufacturing of packaging materials.

The decision to ban waste paper imports by the Chinese government has reduced the global waste paper prices.

As a result, the price of recycled paper has increased in China. Indian manufacturers of waste paper stand to benefit because of the low price of waste paper in the global market and high realization of recycled paper.

Companies like west coast paper, TNPL and NR Agarwal industries are expected to improve margins on account of falling waste paper prices, being the major importer of waste paper for manufacturing recycled paper.

Growth Drivers

The growing population in India has also led to an increase in the ‘earning population’ (age group 15-50) of the country. Considering a large number of the Indian population, the lower median age implies a higher number of working people thereby clearly outlining the huge potential for earning as well as spending potential of the Indian population.

Considering the age group below 25 years is one of the highest spending age group, the current age dynamics is expected to boost retail sales in India. The median age of India is 26.7 years, one of the lowest globally in comparison to 37.2 years in the US, 45.8 years in Japan and 36.3 years in China.

For Indian paper industry, strong economic growth has been accompanied by robust demand for paper which has come from a combination of factors such as growing per capita expenditure, rising income level, rapid urbanization, and large population. The expected growth in the individual segments is as follows:

Printing & writing segment, demand is expected to grow at an average rate of 4.2% and reach 5.7 million tonnes by FY20. The growth is expected on account of an anticipated pick-up from the education sector with growing enrolment and increasing literacy rates as well as the increasing number of schools and colleges.

Packaging paper and board segment that caters to industries like FMCG, food and beverages, pharmaceuticals among others, demand are expected to grow at an average rate of 8.9% and reach 11.4 million tonnes by FY20. The growth is expected on account of increased urbanization, the requirement for better quality of packaging and the increasing preference of ready-to-eat foods.

Outlook

India continues to be the fastest growing paper market with no significant capacity increase forecast for the next few years. India stands at an attractive point in the consumption curve: a national per capita consumption of over 13 kgs compared with a corresponding global consumption of 57 kgs.

With India reinforcing itself as one of the fastest growing major economies as well as the fastest growing paper market (6% p.a.), it is expected that paper consumption could grow above 50% to 20 million tonnes by 2020 and to 23.5 million tonnes by 2025.

At the same time, the developed market is experiencing a decline in paper consumption due to the widespread use of electronic media, however, growth in packaging paper and board continues because of demand from its end use segments.

Companies under this Industry:

JK Paper

The company has two large integrated paper manufacturing units – JK paper Mills, Odisha and Central Pilp Mill, Gujarat with a combined capacity of 450000 TPA. It is the market leader in Branded Copier paper segment and among the top two companies in Coated Paper and high-end Packaging Boards. It has recently invested about 1775 crore in expanding and modernizing capacity at JK Paper Mills Odisha.

West Coast Paper

It is one of the oldest and the largest producers of paper for writing, printing, and packaging in India. West Coast product-line features in well-established brand Paper & Boards, commercial to premium grades ranging from 52 to 600 GSM, catered to across six different product segments: Printing, Writing, Industrial, Specialty, Packaging, and Business Stationery.

ITC Ltd.

The companies Paperboards and Specialty Papers Division is among the leading names in the business worldwide. It has emerged as the largest manufacturer of Packaging and Graphic Boards in South Asia accompanied by a diverse range of Specialty Papers & Boards.

Tamilnadu Newsprint & Paper Ltd.

With an increase in demand, the company is installing a new chemical hardwood line to expand the pulping capacity. It has increased production capacity of 400,000 TPA of printing and writing papers which makes the company as one of the largest bagasse- a residue of sugar cane, as primary raw material, in the world. The company’s unit is self-sufficient in terms of power and pulp.

Emami Paper Mills Ltd.

Emami Paper is a part of Emami Group which has diverse business interests in FMCG, edible oil, paper, writing instruments, real estates, retail departmental stores, and healthcare. The Company specializes in the manufacture of newsprint, printing and writing paper and Multilayer Coated Board. The company’s paper segment enjoys the position of being the largest manufacturer of Newsprint in India and the only manufacturer in Eastern India.

Bottomline

Safeguarding interest of the consumer, Increasing literacy and Booming e-commerce will provide support to the industry. The sector will also get support with packaging paper and board demand. Expansion of the packaging industry in India too will help the paper industry to enter a new phase of growth in the coming time.

As we have seen there is a ban on usage of plastic in some cities, this has a huge opportunity for the paper industry. As paper is one of the ideal substitutes for plastic which can be recycled easily. The ban has given an opportunity to the players in the paper industry to drive the message – paper in green

Well summarized.

Hi Raghav,

Thank you for reading!

You can read more sector blogs here.

Thank you for reading!

Hi,

Thank you for Reading!

Keep Reading

Pretty! This has been a really wonderful post.

Many thanks for supplying this information.

Yes, i agree with you Paper Industry plays a crucial part in increasing economy of the India and thank you for the information.

What’s up, everү time i uѕеd to check weblog pⲟsts hегe in the early hours in the morning, аs i like

to find oսt more and more.

I am extremely impressed with your writing skills as well as with the layout on your blog.

Is this a paid theme or did you customize it

yourself? Either way keep up the excellent quality writing, it’s rare to see a nice blog

like this one today.

Highly descriptive article, I loved that bit. Will there

be a part 2?

Excellent pieces. Keep posting such kind of info on your

page. Im really impressed by it.

Hi there, You have performed an excellent job. I’ll certainly digg it and personally recommend to my friends.

I am sure they’ll be benefited from this site.

Greetings! I’ve been reading your weblog for a while now and finally got the courage to go ahead and give you

a shout out from Humble Tx! Just wanted to say keep up the fantastic work!