The Reserve Bank of India (RBI) vide a Notification announced the issue of 7.75 % Savings (Taxable) Bonds, 2018 with effect from 10th January 2018.

Also Read: Guide to Non-Convertible Debentures (NCDs)

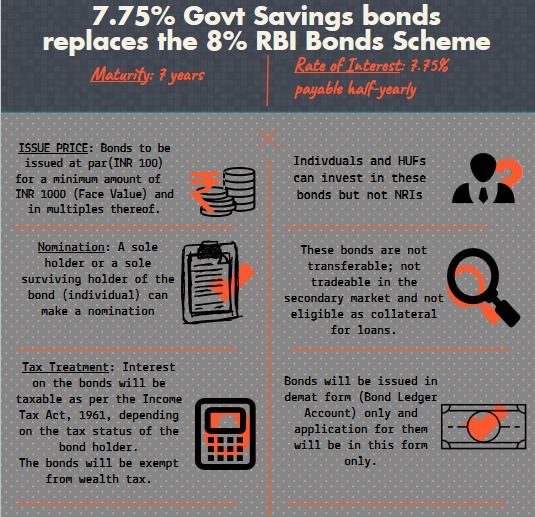

These bonds carry an interest rate of 7.75% with tenure of seven years as compared to the previous issue carrying the interest rate of 8% with tenure of six years.

This rate cut is to bring the interest rate of these bonds at parity with the interest rate offered by the National Savings Scheme (NSC).

Know More: National Savings Certificate

Now having reduced the interest rate and also simultaneously increasing the bond maturity period raises a question as to whether this is a good investment option or not.

Salient Features of the Bond:

Now let first know the salient features of the bonds:

| Minimum Investment | Rs 1000 (Issue price Rs 100) |

| Maximum Investment | No upper limit |

| Mode of subscription | Cash/ Drafts/ Cheques or any electronic mode acceptable to the receiving office. |

| Form of issue | Only in demat form |

| Transferability | Non-Transferable |

Apart from being nontransferable, these “bonds shall not be tradable in the secondary market and shall not be eligible as collateral for availing loans from banks, financial Institutions, and Non-Banking Financial Companies.”

Taxation perspective:

The bonds give no relief in terms of taxation.

As per the provisions of the Income Tax Act, 1961 this interest received on these bonds are subject to taxation in the hands of the bondholder.

Also, there is no tax deduction benefit in this case.

Want to learn Financial Markets from scratch? Enroll in: Online NSE Academy Certificate in Research, Trading & Advisory course on Elearnmarkets.

Relief to Senior Citizens:

Basis the age bracket of the individual, they will be allowed to encash the amount prior to maturity period of the bonds.

The individuals will be allowed to encash based on the age after the following minimum lock-in period from the date of issue:

| Age | Lock-in period |

| 60-70 years | 6 years from the date of issue |

| 70-80 years | 5 years from the date of issue |

| 80 years above | 4 years from the date of issue |

Bottomline:

Overall the investment may look a good option for the lower tax bracket group due to the interest rate propositions.

However, these interest rates are also subject to other factors which are to vary with time

Moreover, the investor should better compare all the available options of investment or hold on till the budget dates to consider the current scenario and the variations in the budget allocations.