Have you ever wondered what creates wealth?

What drives prices upward and makes investors wealthier?

Well, Market returns are a function of Investment returns and Speculative return where Investment returns are a direct function of earnings growth (obviously excluding short-term deviations).

Read More: Why Investor Returns are less than Investments Return?

Let us further delve into the speculative return.

It is something which needs to be understood from its very roots.

The market capitalization growth over and above earnings growth determines speculative return.

It is what people will pay for a rupee worth of earnings given their expectations and biases.

The biggest conundrum is to understand the impact and importance of biases.

The painful truth is that biases determine market sentiments and consequently, market movements.

When a person claims to be bullish or bearish on a stock, it may be based on his research but in reality, the epicentre of that research is hounded by individual biases.

The anchoring trap or confirmation bias is the deadliest of the lot.

The first positive news that you hear on a stock makes you research further on it.

No investor will take out the time to research on a stock when his first news has been a negative one.

So every subsequent piece of news that he reads, he will conveniently filter out the portion which does not support his opinion, rather what does not conform to his initial positive outlook on the stock.

To put it simply, there is a wide prevalence of emotional biases overpowering financially optimal decisions in the bourses.

To know more about biases enroll in NSE Academy Certified Equity Research Analysis course on Elearnmarkets.

Example:

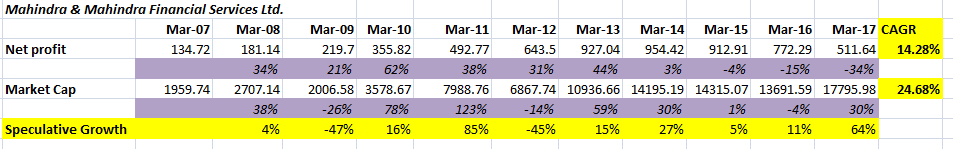

This is exactly what has been happening in the case of Mahindra and Mahindra Financial Services Ltd. Since 2014, the company has consistently been reporting falling Net profits.

A de-growth in earnings should be parallel to decaying market sentiments but this has not been the case for this particular company.

Analyst ratings on the stock have continued to be exuberant, as it can be seen from this chart.

For the last two years, analyst buys recommendations have continuously been going up (with a corresponding rise in prices) despite ordinary financial performance.

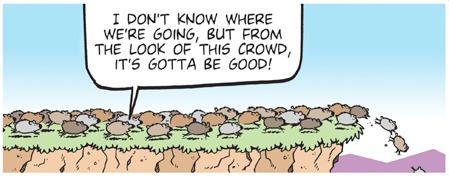

This has created a dichotomy purely based on the prevalence of the herd mentality in financial markets where nobody wants to lose out on the innate momentum of stock prices.

This is a classic definition of momentum investing wherein what is high keeps on going higher and what is low keeps on going lower.

To prove this further, let us have a look at this table.

Market cap of MMFS has grown at 28% whereas its net profits have only compounded at a rate of 14%.

Leon Levy very famously said:

“To ignore the psychological component of the flux of the markets is to miss seeing the elephant in the room. Psychology plays a role in all events in the market, from the actions of the day trader riding the momentum of Internet stocks to the broad shifts that become obvious and undeniable only over time.”

In fact, weren’t all bubbles in history a product of investor psychology? The moods of the market affect not only stock prices but also the fortunes of the business. Markets affect investor psychology but investor psychology also affects markets.

However, even after accounting for these biases, in the long term investor wealth is created primarily on account of company performance, one of which is earnings growth.

Example:

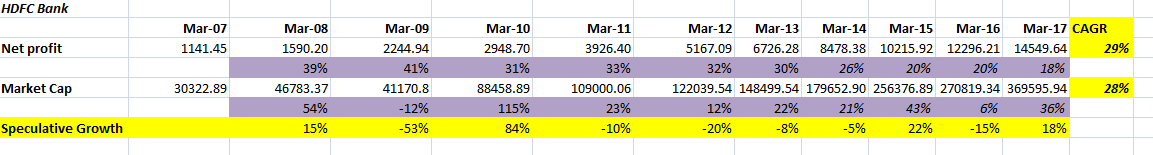

Let us look at one such company: HDFC Bank where market prices have moved in tandem with growth in PAT. Here, investor wealth has predominantly been created because of consistent financial performance.

Look at the CAGR of PAT and Market Cap of HDFC Bank for the last 10 years, as given in the table below.

The growth in market cap mirrors growth in net profits, thereby adding impetus to the fact that, over long periods of time, an investor will earn only as much as his company does.

Bottomline:

We hope that the above write up helped you to get a basic understanding of the determinants of wealth creation.

Happy Learning!!