Pradhan Mantri Suraksha Bima Yojana- The government has created numerous schemes to provide benefits to different parts of society. Insurance is not a new topic in India, but still, its reach is limited to a few people.

Though there are so many insurance companies operating in India, there is still a large number of people, especially in rural areas, who are not covered under any kind of insurance.

This section of society is mostly below the poverty line, and insurance service is unaffordable for them.

Hence, our government has introduced “Pradhan Mantri Suraksha Bima Yojana” after the successful performance of Jan Dhan Yojana, keeping in mind the poor masses.

Table of Contents

What is Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

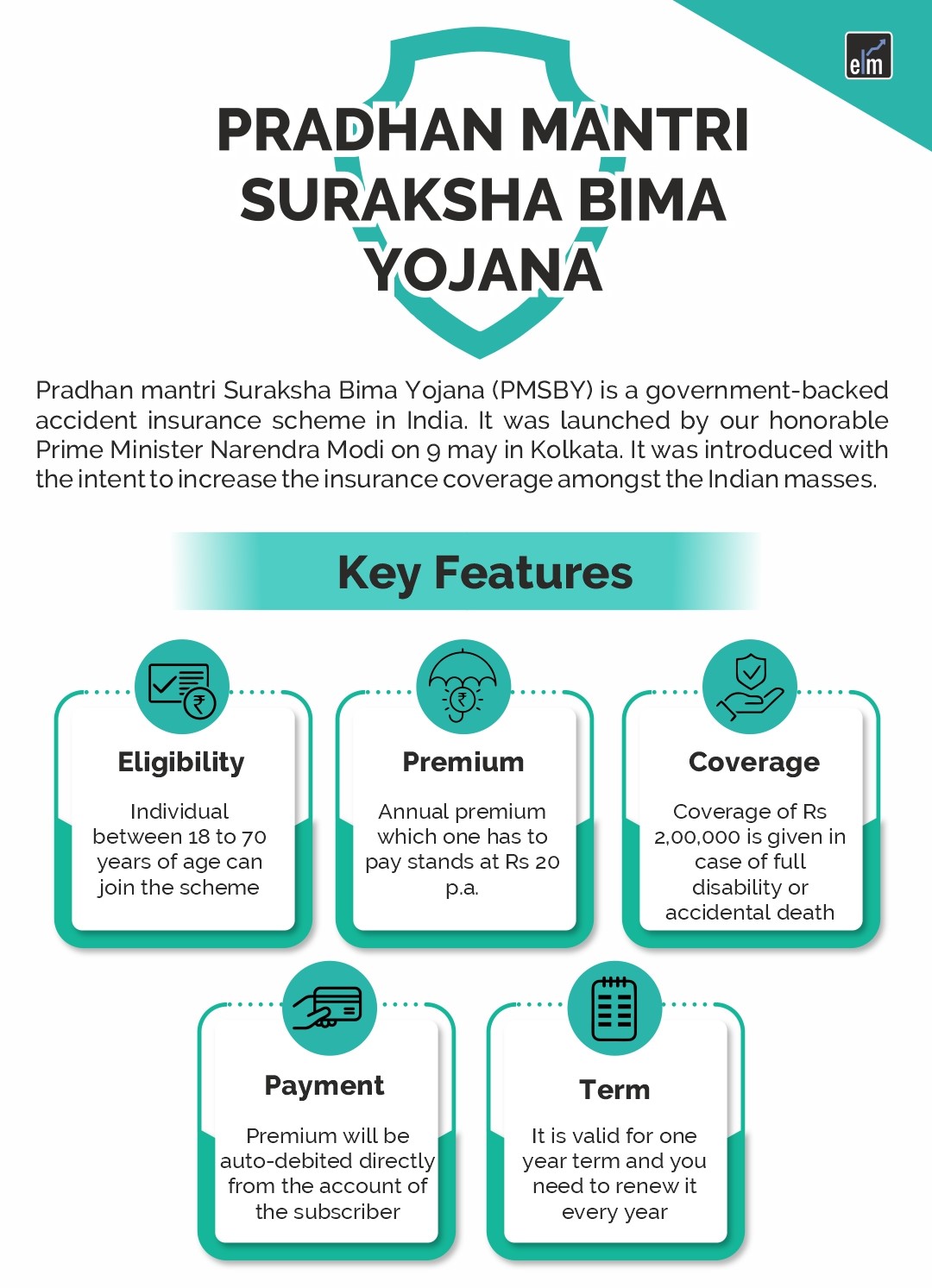

Pradhan Mantri Suraksha Bima Yojana (PMSBY) is a government-backed accident insurance scheme in India. It was launched by our honorable Prime Minister Narendra Modi on 9 May 2015 in Kolkata.

The scheme was launched with the intent to increase insurance coverage amongst the masses. Any individual between 18 and 70 years of age with a bank account can open a Pradhan Mantri Suraksha Bima Yojana account.

The scheme will cover for one year and is renewable from year to year.

Features of Pradhan Mantri Suraksha Bima Yojana

1. Premium

The key highlight of this scheme is its low premium which stands at Rs 20 p.a.

2. Risk Coverage

The coverage of Rs 2,00,000 will be provided in case of full disability or accidental death and Rs 1,00,000 in case of partial disability.

3. Payment mode

The premium will be auto-debited directly from the account of the subscriber, and this is the only mode available.

4. Eligibility

An account holder between 18 and 70 years of age, who has given their approval to join the PMBSY scheme or enable the auto debit feature, can enroll in this scheme.

5. Terms of Risk Coverage

A person needs to renew this scheme every year. Moreover, he/she can also choose the long-term option where his account will be debited every year by the bank.

Pradhan Mantri Suraksha Bima Yojana (PMSBY) Benefits

a. Tax benefits

The proceeds received under this scheme will get tax exemption u/s 10(10D). But in case the proceeds from the policy is over Rs 1,00,000, TDS will be applied @ 2% of the overall proceeds if no Form 15G or Form 15H is submitted to the insurer.

Moreover, the premium paid will also be tax-free under section 80C of the Income Tax Act.

b. Low premium

The main attraction of this scheme is its low premium of Rs 20 p.a., which makes it possible for even the poorest of the poor to avail of the scheme.

How to apply for this scheme?

You are required to link your Aadhar card to your bank account. Then fill up the application form and submit the same to your bank.

However, the individuals have to submit an application every year to be covered under this scheme. Whenever you fill out the form, you need to mention the name of the nominee along with the relationship.

Exclusion

The major exclusions include suicide or suicidal attempts under the influence of drugs or liquor, intentional self-injury or loss arising from an act due to a breach of law with or without criminal intent.

Termination of Cover

The individual will not be entitled to any benefit, and the accident cover will get terminated in case of any of the following events-

1. In case the individual attains 70 years of age.

2. The account has been closed as there are insufficient funds in the account to keep the insurance active.

3. When a person is covered by more than one account. Insurance cover will be limited to only one account, and the premium on other accounts will be forfeited.

4. When the insurance cover is ceased due to any technical reasons like insufficiency of funds on the due date or any administrative issues, the same can be reinstated on receipt of the full annual premium (subject to conditions that may be laid down).

The risk cover will be suspended during this period, and reinstatement of risk cover will be at the sole discretion of the Insurance Company.

Bottomline

Pradhan Mantri Suraksha Bima Yojana is one of the most important social security programs initiated by our government to help poor and underprivileged people and to cover them with basic social security benefits. As of January 2018, over 13.28 crore enrolments have already been made under this scheme.

Frequently Asked Questions (FAQs)

What is Pradhan Mantri Jeevan Suraksha Bima Yojana?

The policy that benefits the poor and low-income segment of society the most is the one with a minimum premium of Rs 20 per year instead of Rs 12 per year. The Pradhan Mantri Suraksha Bima Yojana offers life insurance coverage of Rs. 1 lakh for permanent partial disability and Rs. 2 lakh for accidental death and permanent disability.

How to get the benefit of Pradhan Mantri Suraksha Bima Yojana?

The Pradhan Mantri Suraksha Bima Yojana requires an annual premium payment of ₹ 12 from the applicant to receive benefits. The nominee receives the insurance sum if the insured person passes away. In addition, insurance money is given in the event of a permanent incapacity.

For Market Research, visit StockEdge

I have joined pmsy and renew this

How do renew it

Hello Vijay,

Thank you for your comment.

Your Bank will automatically debit your account prior to 1st June every year for the renewal of the policy.

If however, you have not given any auto debit instructions you will have to talk with bank, who will be the best person to guide you for the renewal of Pradhan Mantri Suraksha Bima Yojana.

To know about 7 important social schemes of the Government of India you may read: 7 Government of India Schemes to Invest for Social Security.

Happy Reading!!

How do I get hard copy of my PRADHAN Mantri Suraksha Yojna Policy Documents, having been member since inception?

Thank You!!

Hello Satish,

Thank you for your comment.

You can get the hard copy of the Pradhan Mantri Suraksha Bima Yojana Documents from Your Bank.

You can Read 7 Government of India Schemes to Invest for Social Security to know more about some other important social schemes of the government of India.

Happy Reading!!

Hi, My Mom have BOB bank account with DOB 01.12.1960 opened in 2003 I think on the basis of Voter ID Card or Ration Card

but as per Aadhar Card her DOB is 14.08.1941

She had one eye dead before launch of pmsy scheme,

is she eligible for claiming the partial accidental amount of Rs.1 Lacs as her one eye is totally dead

Please confirm

Regards

Goldi Malhotra

9810436520

Hello Kamlesh,

Thank you for your comment.

Your financial advisor or your bank will be the best person to guide you in this situation.

To know about 7 important Government of India Social Security Schemes you can read this blog

Happy Reading!!

Is this insurance is only for accident death?

Hello Pooja,

Thank you for your comment.

Pradhan Mantri Suraksha Bima Yojana provides coverage for death resulting from an accident as well as both permanent and partial disability resulting from accident.

To know more about other important government social schemes you may read: 7 Government of India Schemes to Invest for Social Security

Happy Reading!!