| Table of Contents |

|---|

| What are RBI Monetary Policy Tools? |

| How the movement of Interest Rate impacts us? |

| Impact of interest rate on various sectors |

| Key Takeaways |

Amid the recent pandemic outbreak you must have noticed how the investors, borrowers, bankers were talking about the action that the RBI monetary policy will take in order to bring some relief.

There was a gaga all over the world economies where they were cutting the interest rates to near zero.

But what are these rates? How are these even useful to us?

Let’s find out a few details of the same.

The Central Bank and the Government have their own ways to control and balance the Economy.

Monetary Policy refers to the central bank activities that are directed towards influencing the quantity of money and credit in an economy.

The Fiscal Policy refers to the government’s decisions about taxation and spending in the economy.

What are RBI Monetary Policy Tools?

- Repo Rate: The Repo Rate is the (fixed) interest rate at which the RBI provides funds or overnight liquidity to the commercial bank. Commercial banks often need funds to operate their regular lending business. While there are other sources of funding for a commercial bank, the banks can also borrow from the Central Bank. Let’s say, for example, HDFC Bank has ~15% of the total borrowings and SBI has ~23% of the Total Borrowings from the RBI as of FY19. So, it has a considerable impact on the company’s cost of funds.

Learn from Experts – Financial Policies of Govt of India and RBI

- Reverse Repo Rate: The Reverse Repo rate is the mechanism used by RBI to withdraw funds from the commercial banks in order to draw liquidity from the economy. The RBI borrows money from the commercial banks when there seems to be high liquidity in the market and in return the commercial banks earn interest out of their holdings with the RBI monetary policy.

- Cash Reserve Ratio: The CRR is a certain percentage of total bank deposits that have to be maintained in the form of liquid cash with RBI. This means, that the commercial bank will not have access to that percentage of funds for any economic or commercial activity.The CRR needs to be maintained in order to make sure that the bank has enough liquidity during any distress times and keeping it with RBI makes it safe.

- Statutory Liquidity Ratio: The commercial banks have to also maintain a certain percentage of total deposits with RBI in the form of certain specified securities (mostly central & state government securities). This is also similar to that of CRR which means the commercial banks won’t be able to utilise these funds. This portion of funds allocated with the RBI is called the Statutory Liquidity Ratio.

When and Why the RBI changes the Interest Rates:

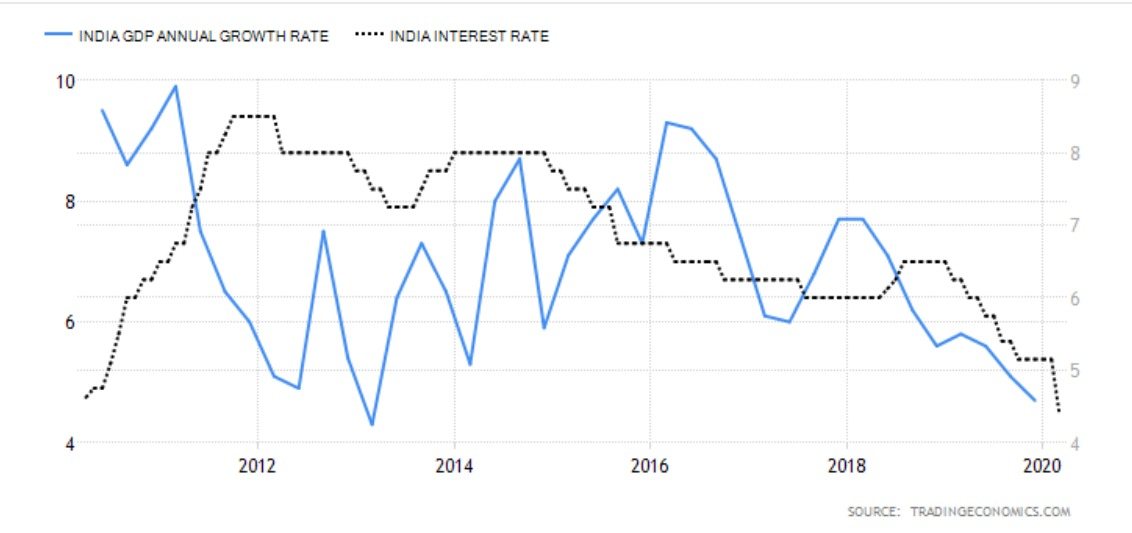

- From the chart, we can infer that when the GDP growth increased from 2013 to mid-2016, the interest rates were mostly the same, but from 2016 to 2020 the GDP growth has fallen and also the interest rates .

- The RBI reduces the interest rates mostly when there is a slowdown in the economy and it pushes up the interest rates when the economy is growing at a higher rate along with the Inflation.

- By increasing the interest rates the RBI tends to stop or slow down the flow of money into the economy by increasing the cost of borrowings. Higher borrowings cost will lead to less borrowings by the companies or the consumers.

- By lowering the interest rates, the RBI tries to increase the flow of money into the economy as the lower Interest rate will aid the companies and consumers to borrow more and consume more. This would help the companies do their Capex activities and help to grow the revenues as well as the profits.

How the movement of Interest Rate impacts us?

1. As a Borrower:

I. Lowering the Interest rates:

Lower Interest Rates would lead to lower interest costs and will attract more borrowers. This is because the borrowers would have to pay low interests against the loans. When RBI reduces the interest rates (Just like the current scenario), it is trying to push liquidity into the economy (retail and corporate). Higher liquidity will help in keeping the economy running without any liquidity crunch.

II. Increasing the Interest Rates:

Higher Interest rates are just vice versa wherein the RBI tries to reduce the flow of money into the economy. Higher interest rates mean higher borrowings costs. In this scenario, businesses and consumers would tend to borrow less due to high costs.

2. As an Investor:

I. Lowering the Interest rates:

The investors closely track the interest rate movements in a country as it determines the long-term growth of the companies and thus the economy, though there is no direct relation of the interest rate to the stock markets. When the interest rates fall the companies tend to borrow more with low cost of borrowings which is used to Capex and thus the anticipation of higher profits aides the stock markets in the near term itself.

II. Increasing the Interest Rates:

As discussed previously that a rise in the Interest rate will lead to companies cutting down its borrowings and lowering the Capex guidance which would ultimately reduce the growing anticipation from the companies. This lowers the stock prices of the companies as the expected growth won’t be reflected in the current stock prices.

Impact of interest rate on various sectors:

1. Financials:

With low-interest rate levels, the banks have the option to lend at a lower interest rate in sync with the Repo or to lend at the existing levels.

Suppose the cost of funds decrease due to lower repo rate, and it continued to lend at previous lending rates then the margins of the banks tend to expand for a few quarters.

Also, in few banks where it lowers the lending rate, more customers are attracted to borrow from them, thus increasing the Advances or the Loan book. Higher interest rates impact just the opposite way.

2. Real estate:

Real Estate is a capital-intensive sector which means that there is a need for a huge amount of funds if one desires to buy a property.

During times of high-interest rates, being a retail customer, we would definitely tend to avoid Home Loans to buy a property or land. Thus, the demand for the real estate sector would be low during these times.

And suppose, there is a low-interest-rate environment then, we won’t hesitate to buy home loans and pay our EMIs as the installments will below. During the lower interest rate environment, we can expect better growth in the Real Estate sector.

3. Consumer Discretionary:

These are basically the non-essential items, for example, Cars, bikes, etc. Suppose we are in a situation where the interest rate is high then we would want to defer from buying a car at the moment as the EMIs would be high, but a low-interest rate situation would definitely be a positive for this segment.

So, I hope you all have got an idea as to how the RBI uses the monetary policy to control the flow of money into the system.

There are a lot of other things which it takes into consideration while making the decisions. However, that is not the scope of this report.

In this blog, we have known the tools the RBI has and how it uses to control the money in the economy.

Along with it, how does it affect us both as a borrower and as an investor.

Key Takeaways:

- Monetary Policy refers to the central bank activities that are directed towards influencing the quantity of money and credit in an economy.

- Monetary Policy tools that the Central Bank is equipped with in order to control the flow of money in the economy.

- The reasons behind the change in the interest rate by RBI

- The impact of the movement of Interest rates on borrowers and investors.

- The impact of interest rate changes on a few of the Sectors

Happy Learning! Happy Earning!