Stop loss in trading is a method that is used by traders to limit their losses.

For example, let’s say Abhay buys 50 shares of ITC Ltd. at the rate of Rs.167

Shortly, the share price falls to 165 rupees per share. Ashish wants to limit his losses; so he puts a stop-loss order at Rs.163.

If the price fell to Rs. 163, then his broker will sell the shares for preventing further losses.

On the other hand, if the share price jumps to Rs. 175 per share, then Abhay would want to hold on to his shares.

Thus by placing the stop-loss to his trade, Abhay protects his trade by preventing potential losses.

| Table of Contents |

|---|

| What is Stop Loss? |

| Methods of Placing Stop Loss in Trading |

| Advantages of placing a stop-loss |

| Mistakes to avoid while Placing a Stop-Loss: |

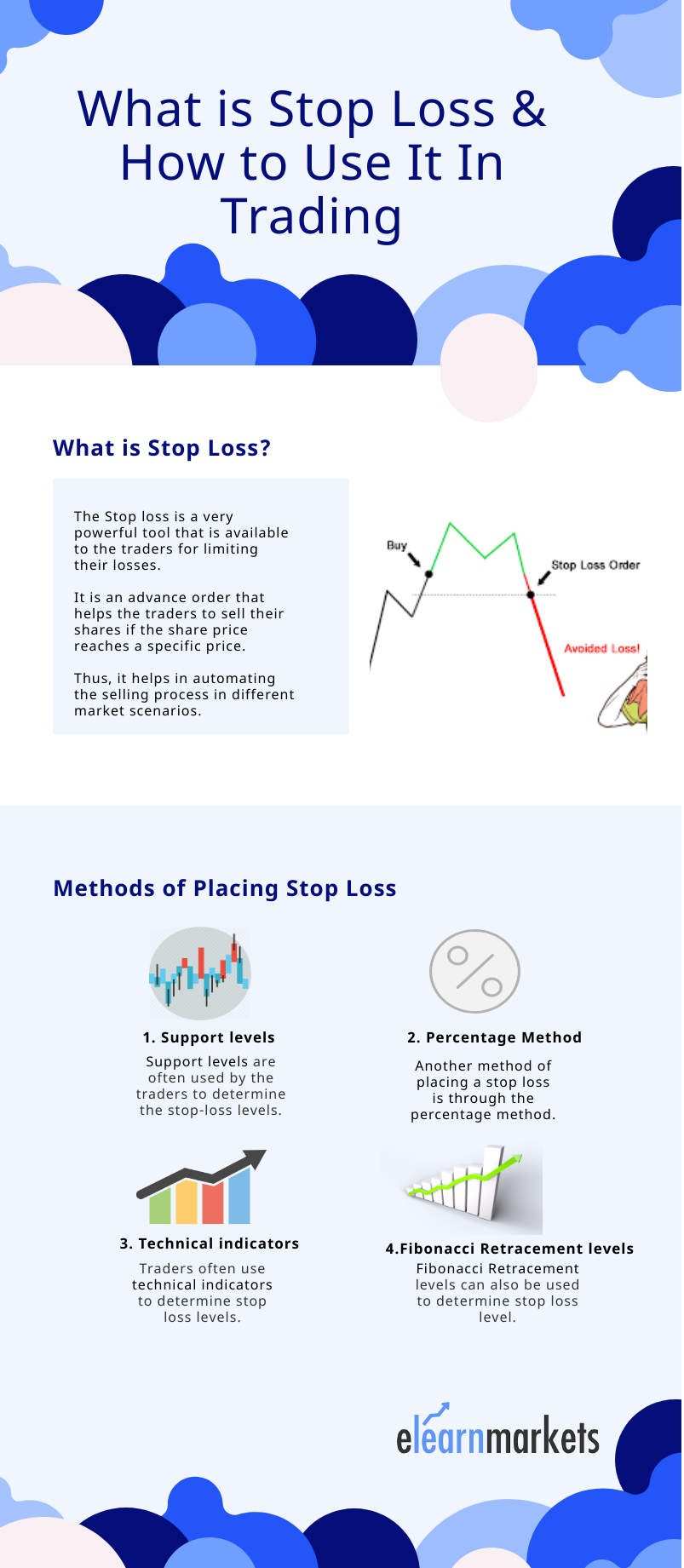

What is Stop Loss?

The Stop loss in trading is a very powerful tool that is available to the traders for limiting their losses.

It is an advance order that helps the traders to sell their shares if the share price reaches a specific price.

Thus, it helps in automating the selling process in different market scenarios.

Stop-loss can be used for both short-term as well as for the long-term, but it is most effective for day traders.

Also, brokers do not take extra charge for this type of order, thus making it more effective for the traders.

Methods to place Stop Loss in Trading:

One should generally place a stop loss in trading at the low of the most recent candlestick when they are buying the stock.

Similarly, one should place a stop loss in trading at the high of the most recent candlestick when they are selling the stock.

Learn from Market Experts

Here are some more ways of determining the stop loss levels:

1. Support levels:

Support levels are often used by the traders to determine the stop-loss levels.

In the weekly chart of State Bank of India we can place a stop loss in trading at the 235 support level, if this level is broken then our stop loss order will be executed at Rs. 235.

2. Percentage Method:

Another method of placing a stop loss in trading is through the percentage method.

For example if you can take a loss of 10% based on your risk appetite. Then you can place a stop loss price at 10% lower than the buying price.

3. Through technical indicators:

Traders often use technical indicators to determine stop loss levels.

For example, using the moving average you can place a stop loss just below the longer period moving average than a shorter period moving average.

In this daily chart of State Bank of India, we have places stop loss at the low of 20 MA which is the longer period in this setup.

4. Fibonacci Retracement levels:

Fibonacci Retracement levels can also be used to determine stop loss level.

Above are some of the ways of placing stop loss for your trades but a trader should put stop loss price based on his trading strategy.

Advantages of Placing Stop-Loss:

Let us discuss the advantages of placing a stop-loss:

1. Helps in Cutting our losses:

Stop loss in trading helps us to minimize our losses and also ensures us against a big loss.

Many a time, we suffer a big loss if we don’t place a stop order as the price falls steeply.

2. Provides Automation:

Stop loss in trading helps to automate our selling as we do not need to be present in front of our trading screens all the time.

A stop-loss automatically gets triggered if the stock touches a specific price.

3. Helps in maintaining ‘Risk and Reward’:

One should maintain risk and reward while trading.

For example, if you define that you’ll take only 2% or 5%, the risk for getting that much profit. Thus a stop loss helps you to maintain your ‘risk and reward’.

4. Helps in promoting discipline:

It’s important to detach ourselves from market emotions. Stop loss helps us to stick to your strategy and also promotes disciplined trading.

Mistakes to avoid when you Place Stop Loss:

Here are a few mistakes that the trader needs to avoid while placing a stop loss:

1. Not Determining your Stop Placement in Advance:

A trader should know where his stop is going to be before he takes the position. The benefit of ascertaining your stop loss before you open trade is that it removes any emotions from the decision.

2. Placing your Stop Based on Arbitrary Numbers:

One shouldn’t place their stop loss based on arbitrary numbers. They should determine their stop loss based on technical parameters as discussed above.

Key Takeaways:

- Stop-loss is a method that is used by traders to limit their losses.

- Figuring out where to place stop loss mainly depends on your risk appetite—the price should limit your loss.

- The percentage method is used to limit the stop-loss at a specific percentage.

- The support method is used by the trader to determine the most recent support level of the stock and places the stop-loss just below that level.

- In the moving average method, a trader can place a stop-loss just below a longer-term moving average price.

Will you be now able to place a stop loss to your trades? Tell us by commenting below:

Happy Learning!

In addition to the above-mentioned , the most effective method basis personal experience , Is the SL slightly Higher than the Recent Swing High ( in case of Short Positions ) and Slightly lower than the Recent Swing Low ( in case of Long Positions) for the respective time frame of initiation of a trade.

Very informative. 🙏👍

Hi,

We are glad that you liked our post, you can read more blogs on Technical Analysis from here.

Thank you for Reading!

Excellent information

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

This blog is informative as it speaks about the importance of stop-loss, various types and the advantages of using it. In my opinion, a strict stop loss is a good defence for an Investor in this volatile stock market.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Respected Sir/Madam,

Your short notes on specific topic is very helpful for all new beginner like me. Thank you.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!