Investors use hedging as a risk management technique to reduce or balance the impact of unfavourable price changes in financial markets, hence reducing the possibility of suffering losses. To guard against uncertainty, one can use financial instruments or take strategic positions. Let us discuss Hedging Strategies with options-

In stock investment, hedging in options trading is essential since it offers protection against market volatility. It contributes to a more stable and regulated investing environment by assisting investors in safeguarding their portfolios against negative risks.

Popular hedging tools options provide investors with the option—but not the duty—to purchase (call) or sell (put) an underlying asset at a predefined price within a given window of time.

Option hedging are useful instruments in risk management for stock investors because they offer flexibility and strategic possibilities for hedging against unfavourable market moves.

Before we dive into hedging strategies with options, let us discuss the basics of options trading-

Basics of Options Trading

Let us discuss some basics about options trading-

Call and Put Options

Financial derivatives, known as options, provide the buyer the right, but not the responsibility, to purchase (call) or sell (put) an underlying asset at a given price within a given window of time. Put options are used to profit from price decreases, whereas call options are used to anticipate price gains.

Option Premiums

An option’s premium is the amount that it costs. The price of the underlying asset, its volatility, the amount of time till expiration, and the state of the market all have an impact on option premiums. In order to acquire the rights offered by options, traders must pay premiums.

Strike Price and Expiry Date

When exercising an option, the predetermined price at which the underlying asset can be purchased or sold is known as the striking price. The deadline by which an option must be exercised is called the expiry date, sometimes referred to as the expiration date. Depending on their approach and market forecast, investors must choose the right strike prices and expiration dates.

In-the-Money, At-the-Money, and Out-of-the-Money Options

The way that options relate to the underlying asset’s current market price determines which categories they fall into. At-the-money (ATM) options have a striking price equal to the current market price, out-of-the-money (OTM) options have no intrinsic value, and in-the-money (ITM) options have a positive exercise value. These differences have an effect on the cost and risk-reward characteristics of options, assisting traders in making financial choices.

Explore how gamma scalping can be used in options trading strategies.

Understanding Risk in Stock Investing

Before understanding how options can be used as an option hedging strategy, let us understand what is meant by risk in stock investing-

1. Systematic and Unsystematic Risk

Market risk, or systematic risk, is a natural part of any market, whether it is a whole or a particular component. It is impacted by variables including interest rate changes, economic downturns, and geopolitical events that have an impact on the financial markets or the economy as a whole. Diversification cannot completely eliminate systematic risk, therefore investors must always keep it in mind.

Unsystematic Risk: Often referred to as special risk, unsystematic risk concerns certain stocks or industries. It results from elements specific to a given business, sector, or resource. Product failures, regulatory challenges, and changes in firm management are a few examples. Diversification among different industries or asset classes can aid in reducing unsystematic risk.

2. Common Risks Faced by Stock Investors

Here are some common risks faced by the stock investors:

Market Risk

Market risk, sometimes referred to as systemic risk, is the chance that the market as a whole or a particular sector may see a decline.

Factors: Global market trends, interest rate fluctuations, geopolitical crises, and economic recessions can all affect market risk.

Impact: A portfolio of stocks may lose value overall as a result of market risk.

Company Specific Risks

Known also as unsystematic risk, this type of risk relates to industry- or company-specific risks.

Factors: Company-specific risk can be influenced by subpar management choices, product recalls, legal problems, or shifts in the demand for a company’s goods or services in the market.

Effect: Although they might not have an effect on the overall market, these risks might have a big effect on specific equities.

What is the Concept of Hedging?

Investors use hedging, a risk management technique, to offset possible losses on one investment by holding a contrary position in a different financial instrument or investment. Hedging is primarily used to safeguard against unfavorable changes in market pricing. Hedging is a strategy used by investors to reduce the overall impact of market volatility and uncertainty on their portfolios. It enables them to preserve a more stable financial situation and protect their investments.

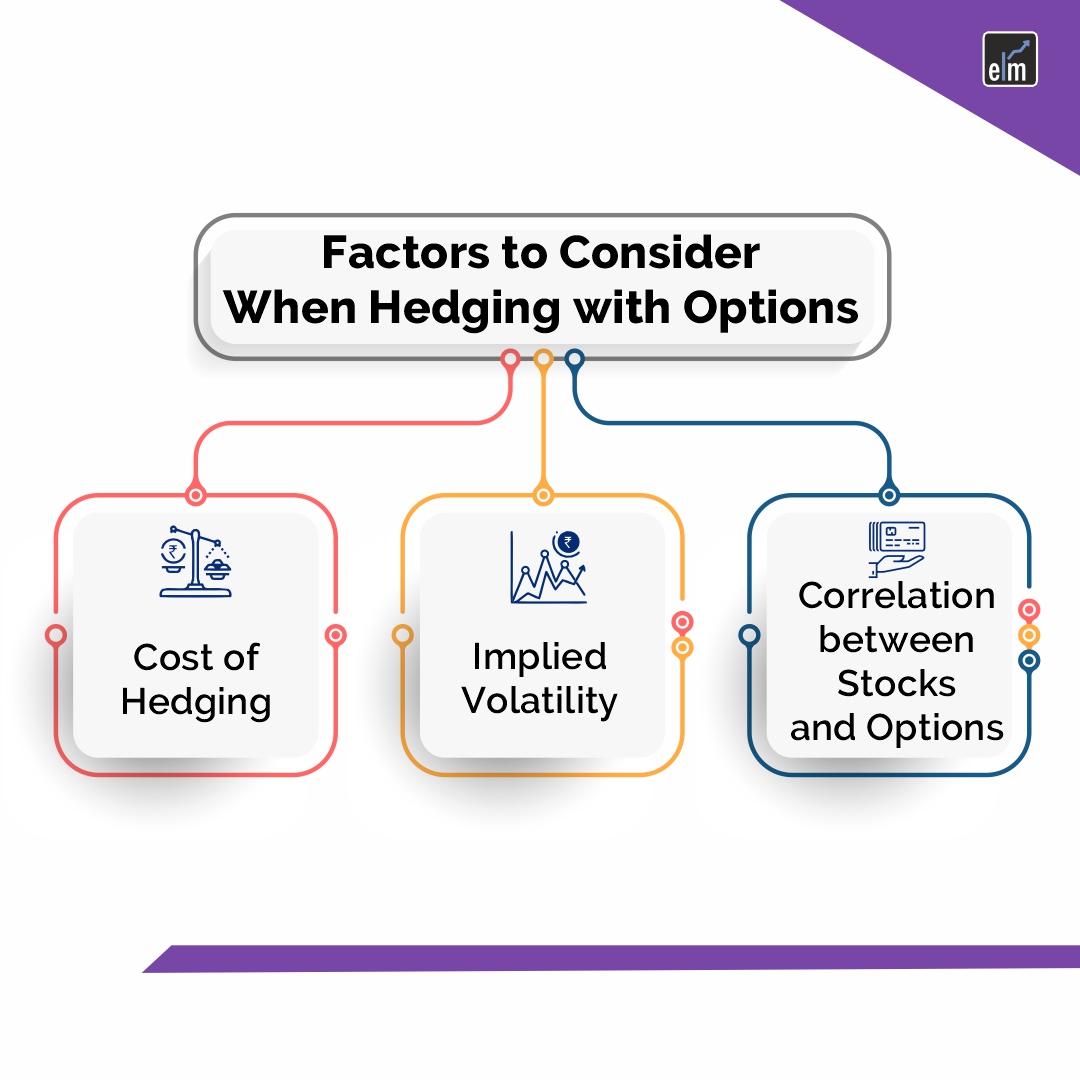

When holding assets that are vulnerable to different risks, such price volatility, interest rate changes, or currency fluctuations, hedging is very important. Investors seek to mitigate potential downside risk through hedging, accepting the associated costs as a kind of insurance against unfavorable market conditions.

Why Hedge Using Options is important?

Because of its special qualities, options, which are financial derivatives, are frequently employed in hedging strategies with options. The following explains why options are good hedges:

Options hedging provide a great deal of flexibility to investors. They can be used as a hedge using options, against a variety of risks, including as shifts in interest rates, price volatility, and currency movements.

When opposed to buying or short-selling the underlying asset, options frequently demand a lower upfront commitment, making them a more affordable method of hedging. Option Hedging enables investors to get security without having to make a big financial commitment.

4 Popular Hedging Strategies with Options

Here are some popular hedging strategies with options-

Protective Put Strategy

Investors can use the Protective Put Strategy, for hedging strategies with options, sometimes referred to as a “married put,” as a risk management tool to guard against any downside risk on a long position in a stock. An investor uses this approach to buy a put option and hold the equivalent amount of underlying stock at the same time.

It involves:

- Purchasing Put Options: When an investor buys put options, they have the right—but not the responsibility—to sell the underlying stock at a striking price and within a predetermined window of time—the expiration date.

- Long Stock Position: The stock that the investor is trying to safeguard is already owned by them.

The put option’s value rises in the event that the stock price drops, acting as a hedge against possible stock losses. In order to reduce their downside risk, the investor might exercise the put option and sell the stock at the fixed strike price.

Covered Call Strategy

An investor uses the covered call technique, a type of options trading, to sell call options on stocks they already hold. Using this tactic, one can keep ownership of the underlying stock and profit from the premiums earned from selling the call options.

It Involves:

- Long Stock Position: A portion of the underlying stock is held by the investor.

- Selling Call Options: The investor offers to sell the same stock as the stock in call options, committing to sell it at the strike price before or on the expiration date.

The premium, which might generate revenue, is given to the investor when the call options are sold.

The call options expire worthless and the investor keeps the premium if the stock price stays below the strike price.

The investor may lose out on potential future gains if the stock price climbs above the striking price and they are forced to sell the stock at the agreed-upon price.

Collar Strategy

The Collar Strategy, sometimes referred to as a “collar trade” or just “collar,” is an options trading technique that establishes a price range for the possible price movement of a stock by combining a covered call and a protected put.

- Protective Put: To reduce downside risk, the investor purchases a put option.

- Covered Call: In order to generate money and partially defray the cost of the put option, the investor simultaneously sells a call option.

By offering a floor, the protective put reduces the amount of possible losses.Although it caps potential gains, the covered call creates revenue.

The result of the combination is a range that the price of the stock is predicted to move inside.

Married Put Strategy

Purchasing a put option to safeguard a long stock position is the goal of the Married Put Strategy, which is comparable to the Protective Put Strategy. The main distinction is that with a Married Put, the stock and the put option are usually bought together.

- Purchasing Put Options: The investor buys put options equal to the quantity of shares of the underlying stock that they currently own.

- Long Stock Position: The investor is trying to safeguard the underlying stock, which they currently own.

The put option serves as insurance in the event that the stock price drops, enabling the investor to sell the stock at the predefined strike price and reducing any losses.

The investor is still able to profit if the stock price increases.

Explore the options trading in India with our advanced options trading course in India. Enroll now for expert guidance on hedging strategies with options!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.

Conclusion

The success of option hedging relies, as with any investing strategy, on meticulous planning and a thorough comprehension of the risks involved. It is advised that investors consult a specialist, pursue ongoing education, and remain aware of the shifting dynamics of the market. By doing this, individuals can improve their capacity for risk management and decision-making, which will ultimately help to create an investment portfolio that is more robust and well-protected.

Frequently Asked Questions (FAQs)

What is options hedging, and why is it important?

Using options contracts to shield an investment portfolio from unfavourable price fluctuations is known as options hedging. It is crucial because, in times of market volatility, it aids investors in risk management, reduces the possibility of losses, and improves the overall stability of their portfolios.

What are some common options hedging strategies?

What is options hedging, and why is it important?

Using options contracts to shield an investment portfolio from unfavourable price fluctuations is known as options hedging. It is crucial because, in times of market volatility, it aids investors in risk management, reduces the possibility of losses, and improves the overall stability of their portfolios.

How does the Protective Put Strategy work?

Using the Protective Put Strategy, an investor purchases put options as insurance against future stock losses. By enabling the investor to sell the shares at a fixed price, the put options serve as insurance against downside risk.