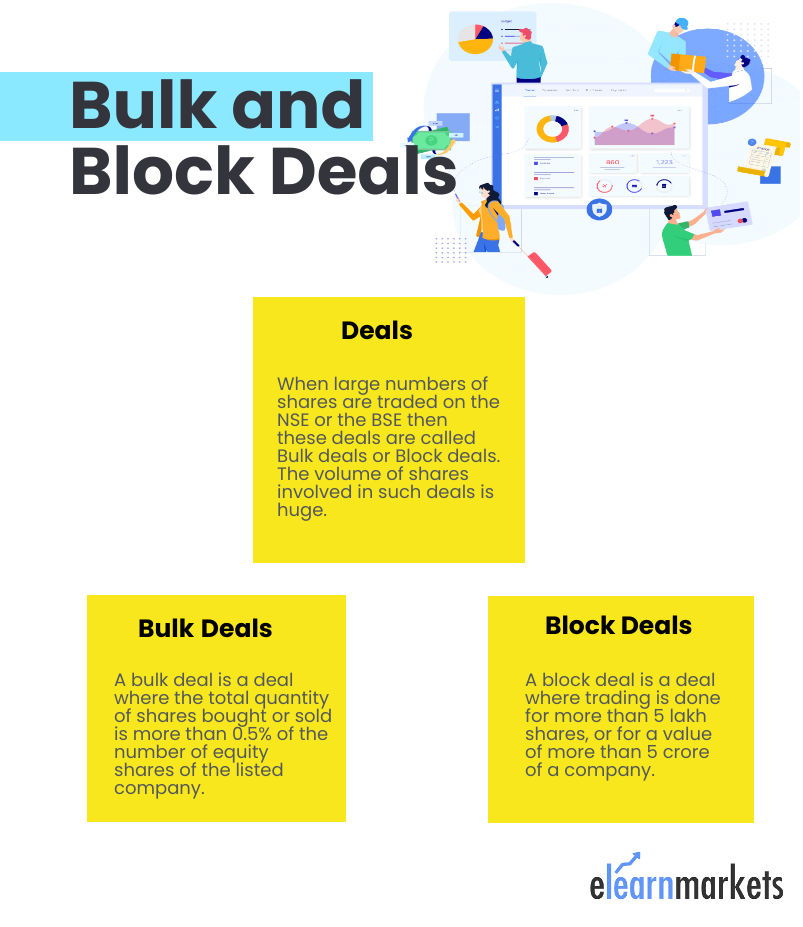

The stock market is driven by two types of participants, Institutional Participants, and Retail Participants. They usually trade in a large number of shares, after careful research and valuation in the market. When large numbers of shares are traded on the NSE or the BSE in one tranche then these deals are called Bulk and Block deals.

The volume of shares involved in such deals is huge.

An active participant of the stock market often comes across these terms, and may even follow such deals for investment or for trading and many among them may take years or months to give returns.

| Table of Contents |

|---|

| What are Bulk Deals? |

| What are Block Deals? |

| Who are the Participants in Bulk and Block Deals? |

| Importance of Deals |

| Example of Deals |

| Impact of Bulk and Block Deals |

| Key Takeaways |

Let us have a brief idea about the bulk and block deals.

What are Bulk Deals?

A bulk deal is a deal where the total quantity of shares bought or sold is more than 0.5% of the number of equity shares of the listed company. Bulk deals happen during the normal trading window provided by the broker. It is a market-driven deal.

This deal is visible to everyone trading on the stock exchange. The broker who manages the bulk deal is required to provide the details of the transaction to the stock exchanges.

If the deal is done through a single transaction then the broker needs to inform the exchange immediately. If the deal has gone through multiple transactions then the broker needs to inform the exchange within an hour from the close of the trading day through DUS (Data Upload Trading Platform).

Once the information is shared with the exchange, they are required to make this information public. This is done after the closure of trading hours but needs to be done on the same day when the trade has occurred.

If 0.5% or more is bought and 0.5% or more is sold during the same trading session, it would be deemed as two separate bulk deals and would require two separate disclosures.

What are Block Deals?

A block deal is a deal where trading is done for more than 5 lakh shares, or for a value of more than 5 crores of a company.

The deal takes place through a separate trading window and it happens at the beginning of trading hours from 9.15 am to 9.50 am for a duration of 35 minutes.

Securities and Exchange Board of India has set the rule that states that the price of a share ordered at the window should range within +1% to -1% of the current market price or the previous day’s closing price.

Since block deals happen in a separate window they are not visible to the regular market players. Just like bulk deals, block deals also broker needs to Inform the exchange regarding the deals.

Learn to analyze Insider Deals and Make Profits in just 2 hours by Market Experts

Every trade has to result in delivery. A block deal will happen only when the two parties involved will agree to buy or sell shares at an agreed-upon price. If you want to trade the block deal then the quantity and the rate of the shares should be exactly the same as that of the opposite block order deal.

Block deal needs to be traded fully otherwise it will get canceled. With the advancement in technology, through online share trading, the block deal remains in the system only for a period of 90seconds, post which it gets canceled and is not executed.

Regulatory Requirements:

Following details to the exchanges needs to be disclosed by the broker:

- Details of the Security

- Name of the Client

- Volume/Quantity of shares bought/sold

- Trade price

It is mandatory for both bulk and block deals to result in delivery and cannot be squared off or reversed.

STT (Securities Transaction Taxes) are charged on similar lines as being charged on delivery-based transactions.

Who are the Participants in Bulk and Block Deals?

Since percentages of shares and money involved in Block Deals and Bulk Deals are quite high, retail investors do not participate in such transactions.

It is Institutional investors like the foreign institutional investors, super HNIs (high net worth individuals), mutual fund houses, insurance companies, banks, venture capitalists, and other financial institutions are the major participants in these types of deals.

Sometimes, even promoters participate in bulk and block deals, especially to arrange the issues related to cross-holdings.

We can find the details about the regular bulk and block deals in both the BSE and NSE India exchanges

Importance of Deals:

Bulk and block deals were introduced by the Securities & Exchange Board of India(SEBI) to provide greater transparency and to clarify and explain the reason for the increase in the volumes in a particular stock. The disclosures help the investors to know the reason for the increase in the stock price.

The disclosures often indicate which sectors are gaining momentum and where buying interest is falling. Such deals usually attract small retail investors as they get the direction of the markets for future investment cues based on bulk and block deals.

Thus, buying by institutional investors in block or bulk deals attracts a large number of buyers, moving the prices upwards or downwards.

Example:

On 4th November 2019 Rakesh Jhunjhunwala bought 1.30 crore shares or 0.51% stake in private lender Yes Bank Limited via open market transactions. The shares were bought at a price of Rs 67.1, taking the transaction to Rs 86.89 crore.

This led the stock price to increase nearly 9% on the following day, after 2 days of consecutive fall. This led to reinstating the retail investors’ faith in the lender.

Thus since we as Investors don’t have any idea about the period of holding by these investors and liquidity present with them thus it would not be intelligent to replicate their investment style.

Impact of Bulk and Block Deals:

This transaction led to increasing in concentration of interest in such stock, resulting in price appreciation in the near future. The reverse holds true in the case of constant selling.

Studying these transactions over time gives the investor a clear idea about how the stock prices get influenced when such types of deals occur. Apart from this investors also get an idea of the quality of the institutional investors who have participated in the deals.

In regards to Bulk Deals, investors should study separately the intraday trade data and short term trade data as they mostly do not have any investment implications. Rather they should focus on bulk transfers among institutions and promoters which provides a long-term perspective on the stock.

Key Takeaways

- Bulk and block deals helps investors to know who is getting interested in which company.

- As during bull markets there are many deals are conducted and during bear markets they are very few.

- Bulk and block deals by HNI’S or FII’S raise the interest of the investor for the company

- Bulk and Block deals provide a clear picture on the strength of the hands who have invested into the company.

Happy Learning!

Good

Hi,

Thank you for Reading!

Keep Reading!