Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

Planning is the best path to achieving success in any endeavor, and the same goes for managing finance.

Financial planning for beginners involves a plan-of-action to help you achieve financial security.

| Table of Contents |

|---|

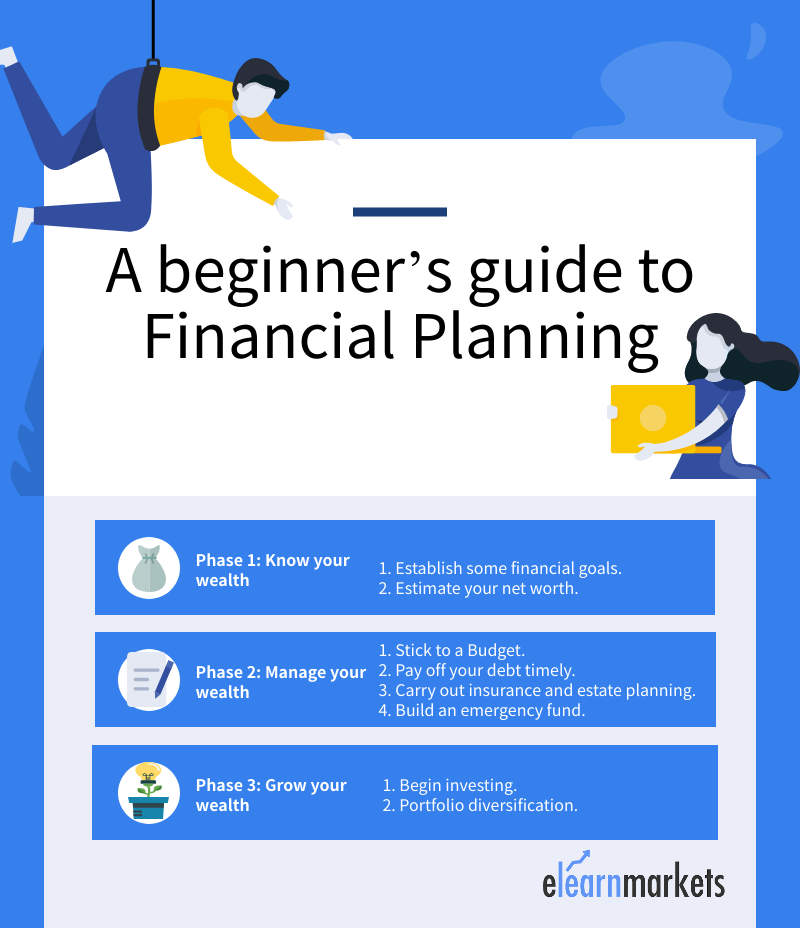

| Phase 1: Know your wealth |

| Phase 2: Manage your wealth |

| Phase 3: Grow your wealth |

As a beginner, you must understand the importance of a plan with a direction.

A plan with direction will help you know, manage and grow your wealth without any planning mistakes.

Simply put, your effective financial plan should be a long-term framework that –

- Is in sync with your financial situation;

- Manages your wealth for your present needs; and

- Grows your wealth to give you a secure future.

Making a plan that follows these phases will help in making a better financial planning for beginners.

Phase 1: Know your wealth:

You can’t plan for something you don’t understand.

It is essential for all of us to understand our financial status and to make sure that our plan is always in sync with it.

Here are some steps for financial planning for beginners : –

1. Establish some financial goals:

When do you want to retire? Are you planning to purchase a house in the following 3-5 years?

These are the kinds of questions your financial objectives should answer for you. Without objectives, your financial plan will seem directionless.

What’s more, your objectives will help you define a path that helps you achieve satisfaction with whatever you do with your money.

2. Estimate your net worth:

If objectives are the direction, net worth is the benchmark through which you will measure the success of your plan.

Every step of your plan should be towards improving your net worth directly or indirectly.

In simple terms, net worth is a sum total of assets minus a sum total of your liabilities. Here’s how you can calculate your net worth –

Step 1: make a list of all your assets – cash and bank balances, investments (at market value), etc.

Step 2: make a list of your debt obligations, including credit card debt.

Step 3: deduct the total liabilities from the total assets; the remaining amount is your net worth.

Every time you plan, ensure that your assets always exceed your liabilities.

Also, make sure that you account for any impact on your net worth before a decision.

Phase 2: Manage your wealth:

Now that you understand your financial status, it’s time to take some active steps to manage your wealth. It acts as phase 2 in the process of financial planning for beginners.

Following are some steps you can take –

1. Stick to a budget:

Using a monthly budget is the most effective way to control your expenses.

Through various thumb-rules, you can save up for various goals and cut down all unnecessary expenses.

Learn to plan your finances with Financial Planning Made Easy course by Market Experts

There are many ways you can maintain a budget.

You can use the old-fashioned pen-and-paper method, or apps which automatically track your expenses.

However, no matter what method, you must remember to make your monthly budget flexible and adaptable, so that you can follow it easily.

2. Pay off your debt timely:

A debt is a financial burden that worsens if you don’t pay it off in a regular manner.

From penalty payments to a fall in credit score, there are many disadvantages of not prioritizing debt.

Therefore, it is essential that you make a detailed financial planning for beginners that focuses on getting you out of debt as soon as possible.

You can also prioritize debt through your budget, or you can use debt repayment techniques as well.

3. Carry out insurance and estate planning:

These elements are often overlooked because they don’t have any immediate benefits.

However, considering the uncertainty of life, both insurance and estate planning contribute to an effective financial plan.

Insurance is protection from the damage caused due to a possible event.

For the best protection, we must consider getting both life and health insurance plans.

On the other hand, estate planning helps with the transfer of your assets to your loved ones after your passing.

This process requires knowledge of the laws involved, so you can take an advisor’s help to guide you instead.

4. Build an emergency fund:

Emergencies like hospital expenses, and job losses, can take a heavy toll on our finances.

To protect ourselves, we must maintain an emergency fund, with at least 3-4 months of our salary in it.

To build an emergency fund, we can either –

- Set aside a sum of money regularly in a savings account; or

- Use investment avenues like short-term liquid funds.

Phase 3: Grow your wealth:

Finally, let us undertake some steps to build a financially secure future with the help of the stock market.

1. Begin investing:

With inflation, we know that things are going to get more expensive as the years pass by.

To grow our wealth and beat inflation, we must start investing as soon as possible.

Investing also helps us gain the benefits of the power of compounding.

This means that, the earlier we begin investing, the lesser money we will have to invest to achieve our goals.

2. Portfolio Diversification:

As an investor, it is essential for you to diversify your assets.

Diversifying means that you should choose different assets to reduce the overall risk in your portfolio.

Moreover, you have to ensure that the assets you choose, help you to achieve your goals timely.

You can also look toward various asset allocation strategies to assist you here.

Key Takeaways:

- Financial planning for beginners involves a plan-of-action, created to achieve our financial goals.

- No financial plan can be effective without direction.

- An effective financial planning for beginners is the one that helps you know, manage and grow your wealth.

A financial plan acts as a life-long support to help you build a secure livelihood.

It might seem complicated for you, as a beginner.

However, through these steps, you can ensure that your plan is effective and easy to follow through.

Happy learning!