The difference between EBITDA and EBIT is that Depreciation and Amortization have been added back to Earnings in EBITDA, while they are not backed out of EBIT. This guide on EBITDA and EBIT will explain everything you need to know!

A company while running its business needs to make some operating profits after meeting all its expenses. Operating profits are the ones which are left over after paying for the cost of making a product.

For example the raw material cost, the employee cost, the power and fuel cost, the new purchases and the other expenses. Thus these are known as operating costs. So whatever is left after subtracting these costs from Sales is known as EBITDA.

Thus EBITDA means Earnings before Interest, Tax, Depreciation and Amortization.

EBIT on the other hand takes into account the Depreciation and amortization and hence is also known as operating profits as it removes noncash items from its books which actually remains in the Balance Sheet. Thus the operating profits do not look inflated due to high depreciation or amortization.

EBIT means Earnings before Interest and Tax.

How is EBITDA and EBIT calculated?

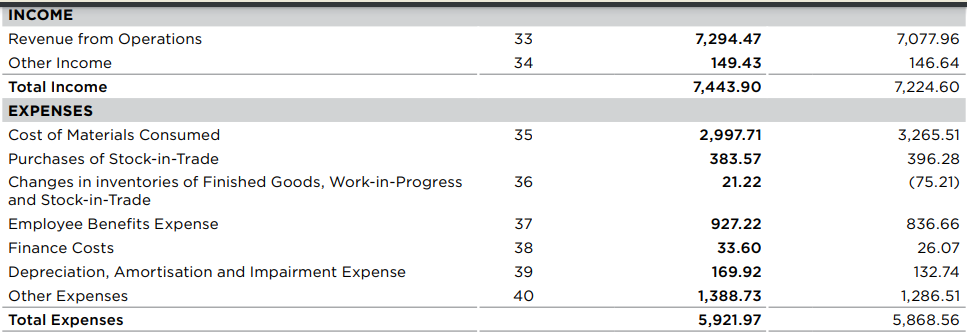

In this case the EBIDTA calculation goes like this

Revenue from Operations – Total Expenses + Finance Cost + Depreciation & Amortization + Taxes

Similarly EBIT calculation means

Revenue from Operations – Total Expenses + Finance Cost + Taxes

Even Income – operating expenses + Finance costs + Taxes gives us EBIT

Thus any company to be an Investment bet should have rising EBIT and EBITDA annually.

What affects EBITDA and EBIT?

Any increase in raw material costs Employee costs or other expenses or power and fuel expenses affect these metrics. Now any rise in these costs will affect EBITDA and EBIT adversely. EBIT means Earnings before Interest and Tax.

Power and fuel expenses increase either due to increase in coal prices or the crude oil prices. Similarly raw material price increase affects the products market price and makes it difficult for some companies to pass it on to their consumers or to other businesses.

There are some other expenses which my rise due to advertisement or logistics cost increase or due to some increase in recurring expenses for the company. For example due to Covid there were major expenses related to hygiene and sanitation which was mandatory for the companies to follow to avert spread of Pandemic.

How can EBITDA and EBIT rise?

An increase in Sales and control on operating expenses through efficient management of the operating Business can drive EBITDA and EBIT growth. Other expenses should be carefully managed and monitored so that it does not increase in absurd percentages. In case of EBIT the depreciation and amortisation should be of lesser value. Depreciation of Infrastructure, Oil and Gas and Mining companies are very high thus they are valued using EBIT.

Pros and cons of EBITDA

EBITDA does not take into account any Capex by the company such as expansion or any purchase of Plant and Equipment. This is taken care of by Cash Flow. It also does not take into account high debt burden or Tax nor does it take into account any depreciation or amortization which is higher in case of Infra and Telecom stocks thus profits might not be correctly represented.

For example Future Retail had EBITDA growth but its depreciation and debt burden being high left it with no profits or cash flow.

EBITDA is normally used to interpret a firm’s solvency and its operating profits to undermine whether its business will be able to service its debt and Interest burden or not.

You can also read our latest article on Understanding Sector Funds and their Benefits to our Portfolio

Pros and cons of EBIT

EBIT is earnings before deduction of Interest or taxes. Thus companies having high interest burden like realty and Infra will show lower operating profits if valued using EBIT. Similarly companies having higher tax expenses like export oriented companies will show higher taxes compared to domestic companies operating in the same sector.

EBIT removes all non cash expenses which are incurred on property plant and equipment as depreciation and under Intangible assets as amortization. Thus it takes into account a portion of Capex.

Key Takeaways

- A healthy EBIT should always be higher than net profits.

- Both EBIT and EBITDA are the key ratios in determining the operational efficiency of a Business.

- EBIT and EBIDTA margin decides the longevity of the operational efficiency of any business. Higher and growing margins depict strong business.

- EBIT does not take into account non cash expenses whereas EBITDA takes into account noncash expenses.

- Better cost synergies and higher revenues will always propel the growth in both EBIT and EBITDA.

- Higher operating profits can only be driven if the business has a pricing power among its consumers.

- If EBIT is lower than net profits than it means that the business is not being managed efficiently.

- Both EBIT and EBITDA can be used to value the companies under same sector business.

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.